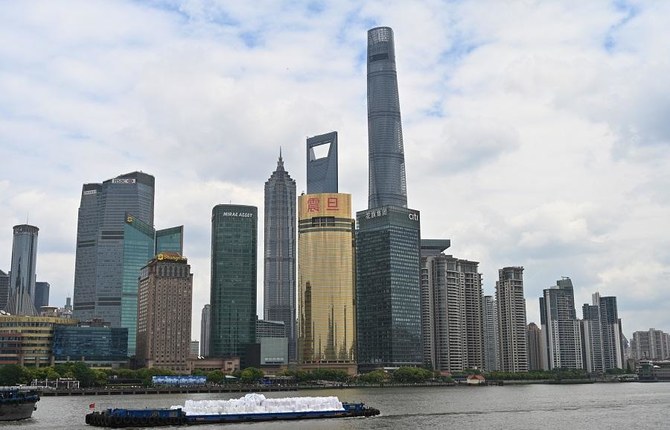

BEIJING: China’s state media has unleashed fresh attacks on the US as the tariff war between world’s two largest economies continues.

The China Daily newspaper on Friday accused Washington of seeking to “colonize global business” by targeting Chinese firms.

The Global Times accused the US of “hegemonic hubris” and launching a “global assault” on free trade.

The Trump administration last week put Huawei on a blacklist that effectively barred US firms from selling the Chinese company computer chips and other components without government approval. The move could cripple Huawei, the world’s largest manufacturer of networking gear and second-biggest smartphone maker.

Washington has called Huawei a threat to national security.

The Trump administration has imposed 25% tariffs on $250 billion in Chinese imports and has plans to hit another $300 billion worth.

China media accuses US of plot to ‘colonize global business’

China media accuses US of plot to ‘colonize global business’

- The China Daily newspaper on Friday accused Washington of seeking to “colonize global business” by targeting Chinese firms

- The Global Times accused the US of “hegemonic hubris” and launching a “global assault” on free trade

Closing Bell: Saudi main index closes in red at 10,947

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Thursday, losing 208.20 points, or 1.87 percent, to close at 10,947.25.

The total trading turnover of the benchmark index was SR4.80 billion ($1.28 billion), as 14 of the listed stocks advanced, while 253 retreated.

The MSCI Tadawul Index decreased, down 25.35 points, or 1.69 percent, to close at 1,477.71.

The Kingdom’s parallel market Nomu lost 217.90 points, or 0.92 percent, to close at 23,404.75. This came as 24 of the listed stocks advanced, while 43 retreated.

The best-performing stock was Musharaka REIT Fund, with its share price up 2.12 percent to SR4.34.

Other top performers included Al Hassan Ghazi Ibrahim Shaker Co., which saw its share price rise by 1.18 percent to SR17.20, and Saudi Industrial Export Co., which saw a 0.8 percent increase to SR2.51.

On the downside, Abdullah Saad Mohammed Abo Moati for Bookstores Co. was among the day’s biggest decliners, with its share price falling 9.3 percent to SR39.

National Medical Care Co. fell 8.98 percent to SR128.80, while National Co. for Learning and Education declined 6.35 percent to SR116.50.

On the announcements front, Red Sea International said its subsidiary, the Fundamental Installation for Electric Work Co., has entered into a framework agreement with King Salman International Airport Development Co.

In a Tadawul statement, the company noted that the agreement establishes the general terms and conditions for the execution of enabling works at the King Salman International Airport project in Riyadh.

Under the 48-month contract, the scope of work includes the supply, installation, testing, and commissioning of all mechanical, electrical, and plumbing systems.

Utilizing a re-measurement model, specific work orders will be issued on a call-off basis, with the final contract value to be determined upon the completion and measurement of actual quantities executed.

The financial impact of this collaboration is expected to begin reflecting on the company’s statements starting in the first quarter of 2026, the statement said.

The company’s share price reached SR23.05, marking a 2.45 percent decrease on the main market.