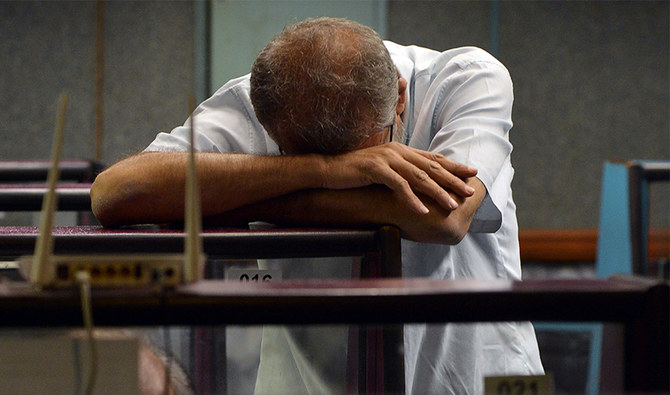

ISLAMABAD: The Pakistani rupee currency fell further against the dollar on Friday and the stock market shed more than 800 points to close off its worst week in seventeen years, less than a week after Pakistan signed a bailout deal with the International Monetary Fund that comes with strict reform conditions.

The rupee has depreciated by almost five percent since the IMF and Pakistani authorities agreed to a bailout package last Sunday. On Friday, The Pakistani rupee, in the open market, closed at 151 against the dollar as compared to Thursday’s close of 147, Exchange Companies Association of Pakistan data said.

Taking a cue from the currency market, the stock market also shed 804 points on Friday, falling due to the devaluation of the rupee for the last two working days, an expected hike in the policy rate in the next monetary policy meeting on Monday and selling pressure from mutual funds (net selling of $14mn in 4 sessions).

Finance adviser Dr. Abdul Hafeez Shaikh flew into Karachi on Thursday and met stockbrokers on Friday who requested setting up a “market support fund” to help rein in the continuous decline on the trade floor, local media reported.

“Rupee free fall against the dollar, falling foreign exchange reserves, likely surge in state bank policy rate announcement on May 20, concerns over IMF conditions and targets for the federal budget for fiscal year 19 played a catalyst role in bearish close,” said Ahsan Mehanti, the Chief Executive at Arif Habib Corporation.

“This movement reflects demand and supply conditions in the foreign exchange market,” the State Bank’s chief spokesman said in an emailed statement on Thursday. “It will help in correcting market imbalances.”

Market participants expect a further policy rate hike in the wake of the IMF agreement as the central bank is scheduled to announce the monetary policy for the next two months on Monday.

“The central bank is expected to increased 100 basis points bps 11.75 percent,” Muhammad Sohail, CEO of Topline Securities, told Arab News.

Pakistani rupee in freefall, stock market ends worst week in 17 years

Pakistani rupee in freefall, stock market ends worst week in 17 years

- Finance adviser Shaikh meets stockbrokers who suggest setting up “market support fund” to rein in continuous decline on trade floor

- Rupee hits 149.50 in interbank market before closing at 147.66 against US dollar, stock market sheds 804 points

Pakistan forms committee to negotiate financial advisory services for Islamabad airport privatization

- Committee to engage Asian Development Bank to negotiate terms of financial advisory services agreement, says privatization ministry

- Inaugurated in 2018, Islamabad airport has faced criticism over construction delays, poor facilities and operational inefficiencies

ISLAMABAD: Pakistan’s Privatization Ministry announced on Wednesday that it has formed a committee to engage the Asian Development Bank (ADB) to negotiate a potential financial advisory services agreement for the privatization of Islamabad International Airport.

The Islamabad International Airport, inaugurated in 2018 at a cost of over $1 billion, has faced criticism over construction delays, poor facilities, and operational inefficiencies.

The Negotiation Committee formed by the Privatization Commission will engage with the ADB to negotiate the terms of a potential Financial Advisory Services Agreement (FASA) for the airport’s privatization, the ministry said.

“The Negotiation Committee has been mandated to undertake negotiations and submit its recommendations to the Board for consideration and approval, in line with the applicable regulatory framework,” the Privatization Ministry said in a statement.

The ministry said Islamabad airport operations will be outsourced under a concession model through an open and competitive process to enhance its operational efficiency and improve service delivery standards.

Pakistan has recently sought to privatize or outsource management of several state-run enterprises under conditions agreed with the International Monetary Fund (IMF) as part of a $7 billion bailout approved in September last year.

Islamabad hopes outsourcing airport operations will bring operational expertise, enhance passenger experience and restore confidence in the aviation sector.

In December 2025, Pakistan’s government successfully privatized its national flag carrier Pakistan International Airlines (PIA), selling 75 percent of its stakes to a consortium led by the Arif Habib Group.

The group secured a 75 percent stake in the PIA for Rs135 billion ($482 million) after several rounds of bidding, valuing the airline at Rs180 billion ($643 million).

Pakistan’s Finance Minister Muhammad Aurangzeb said this week the government has handed over 26 state-owned enterprises to the Privatization Commission.