HANOI: Vietnamese carriers signed $21 billion in aviation deals with US firms on Wednesday as US President Donald Trump met with top leaders in Hanoi ahead of his summit with North Korea’s Kim Jong Un.

Trump has urged Hanoi to narrow its gaping trade gap with Washington as part of his “America First” clarion call, urging Vietnam to buy more made-in-USA goods.

The communist country’s aviation sector has boomed in recent years thanks to a rapidly expanding middle class with growing appetites — and budgets — for air travel.

Three of Vietnam’s top airlines signed several deals for planes, engines and maintenance contracts on Wednesday as Trump met with the country’s top leaders in Hanoi ahead of his much-anticipated second summit with Kim later Wednesday.

Budget carrier Vietjet — famed for its bikini-clad air hostesses — signed an agreement for 100 Boeing 737 jets worth $12.7 billion, along with training and support contracts, the airline said.

“We are pleased to expand our partnership with Vietjet and to support their impressive growth with new, advanced airplanes,” Boeing CEO Kevin McAllister said in a statement from the airline.

A senior White House official said the budget carrier will also buy 215 engines made by CFM, a joint venture between America’s GE Aviation and France’s Safran Aircraft Engines.

Startup Vietnamese carrier Bamboo Airways, which made its inaugural flight only last month, will buy 10 787 Dreamliners from Boeing as it looks to grow its nascent fleet and expand its routes to international destinations.

“Vietnam and the US economic and trade relations have seen rapid expansion. Nonstop air routes between the two countries are of essence accordingly,” said Trinh Van Quyet, the chairman of FLC Group, the airline’s parent company.

Bamboo said Wednesday it wants to start flying to the US later this year or early in 2020.

There are currently no direct flights between Vietnam and the US, though the US Federal Aviation Administration has granted Vietnam a “category 1” ranking, paving the way for nonstop travel between the two countries.

Meanwhile state carrier Vietnam Airlines signed a $100 million maintenance contract with Sabre Corporation.

The bundle of deals was praised by the White House, which under Trump’s direction has also been urging its former wartime foe to buy more military equipment.

“These deals will support more than 83,000 American jobs and provide increased safety and reliability for Vietnamese international travelers,” a senior White House official said after the deals were signed.

Vietnam’s aviation sector has soared in recent years, with passenger numbers jumping from 25 million in 2012 to 62 million last year.

But growth is expected to start tailing off, analysts say, in the face of increasingly squeezed airport capacity and tough competition across the region, in particular from budget airlines such as AirAsia and TigerAir.

Wednesday’s aviation deals came ahead of Trump’s summit with Kim, with the leaders set to meet at the historical Metropole hotel.

Vietnamese carriers sign $21 bn in aviation deals with US firms

Vietnamese carriers sign $21 bn in aviation deals with US firms

- The growing middleclass in Vietnam helped boost the aviation sector in the country

- Three of the top Vietnamese airlines signed deals with Boeing and other US companies

Saudi’s ACWA Power signs several MoUs with Japanese companies

Saudi Arabia’s ACWA Power signed memorandums of understanding with several Japanese companies on the sidelines of the Saudi-Japan Vision 2030 Business Forum that took place on May 21.

ACWA Power signed agreements with Sumitomo Mitsui Banking Corporation, Mizuho Bank, SBI Holdings and Toray Membrane Middle East to encourage collaboration on sustainable energy and water solutions.

According to ACWA Power, the objectives of the MoUs are to promote sustainable energy transition and attracting foreign investment.

The MoUs are important to the Kingdom in terms of water desalination supplies, reducing carbon emissions and economic development.

Saudi plans to decarbonize are ‘important’ for future, says Marubeni CEO

TOKYO: Atsushi Suzuki, president and CEO of Marubeni Middle-East & Africa Power Limited, says Saudi Arabia’s plans for a decarbonized outlook is an important step for the Kingdom.

“I think this is one of the most important steps for Saudi Arabia because, as you know, Saudi Arabia has a Vision 2030 to decarbonize and for the use of sustainable energy in the Kingdom,” Suzuki said in relation to a wind farm project his company is undertaking.

“As a Japanese company we have provided good capabilities to support Saudi Arabia’s Vision 2030 project of becoming an eco-friendly country,” Suzuki told Arab News Japan. “We believe this is a good step to a partnership between Japan and Saudi Arabia and will also result in Saudi Arabia becoming a big ‘new’ energy exporter not only of oil and gas, but also of new energy, green hydrogen for example.”

Marubeni has partnered with several Saudi companies to expand its presence in the country. “We have already participated in five projects in the power sector in Saudi Arabia, so we will continue to deploy our capacity to make sure that the Saudi government, our client, will be satisfied.”

The Saudi-Japan Vision 2030 Business Forum wrapped up on May 21 with more than 300 industry officials and business leaders from Saudi Arabia and Japan in attendance to promote business and cultural exchanges and to accelerate growth and investment between the two countries.

Saudi participants at the forum spoke of “getting the pulse of what the Japanese markets want from Saudi Arabia,” covering investment, business, sustainability, and the circular economy, as well as soft power fields such as entertainment and gaming.

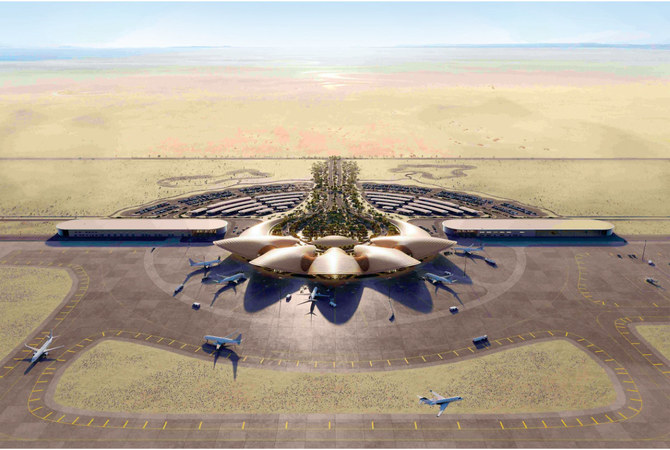

Private aviation soars in Saudi Arabia as more businesses take to the skies

- Sector set to grow at compounded annual growth rate of 8.88 percent between 2025 and 2029

RIYADH: Saudi Arabia’s business aviation sector is experiencing a surge fueled by the Kingdom’s expanding economy, significant government investment on infrastructure, and a growing influx of high-net-worth individuals.

Valued at $1.2 billion in 2023 according to TechSCI research, this segment is projected to grow at a compounded annual growth rate of 8.88 percent between 2025 and 2029.

It was also highlighted in the General Authority of Civil Aviation’s roadmap unveiled at Riyadh’s Future Aviation Forum in May.

The roadmap aims to support the Kingdom’s development as a global high-value business and tourist destination.

Additionally, it targets a tenfold increase in the contribution to gross domestic product by the general aviation sector to $2 billion by 2030, covering the business jet segment, including charter, private, and corporate planes.

Farid Gharzeddine, captain and CEO of Dubai based private jet company SkyMark Executive, told Arab News: “Saudi Arabia’s private aviation and charter business have always been thriving, serving individuals, business executives, government officials, and special missions.”

He added: “In 2023, this sector experienced significant growth driven by the Kingdom’s Vision 2030 and its efforts to diversify away from oil, particularly through the promotion of sectors such as tourism and entertainment. These initiatives had a substantial impact on the private charter industry, influencing both destinations and clientele.”

During this timeframe, he explained that SkyMark Executive, functioning as a private aircraft provider, observed a significant uptick in requests for flights transporting tourists, entertainers, and artists from abroad to emerging destinations such as AlUla, the Red Sea airport, and others.

The Red Sea International Airport, located within three hours’ flying time of 250 million people, launched its first international flights earlier this year.

With a capacity to serve 1 million guests annually, according to the group’s CEO John Pagano, this milestone marks a significant step towards establishing Saudi Arabia as a premier global tourism destination.

According to a research by Mortor intelligence, the GCC region is highly promising for business aviation, and is also a lucrative market for the private aviation sector, due to the presence of a large number of high net worth and ultra-high net worth individuals in the region.

The influx of multinational companies establishing regional headquarters in Riyadh, driven by the Kingdom's efforts to increase foreign direct investment, may have boosted demand for private aviation. This stems from the need for efficient, flexible travel options for corporate executives and high-net-worth individuals, fueling growth in private jet and charter services.

Players are investing in technological advancements to enhance aircraft manufacturing, navigation, and maintenance, anticipating growth in demand for new business jet models offering increased cabin space and long-range capabilities.

Manufacturers such as Gulfstream, Bombardier, and Embraer are focusing on luxury, technology, and performance enhancements to appeal to GCC customers, positioning themselves for growth in the forecast period.

Evidence of this is Qatar Executive’s position as the largest operator in the world for two new models from Gulfstream, G500 and G650ER.

Gharzeddine commented that his company’s clients from Saudi Arabia are often one of the most discerning clientele and prioritize state-of-the-art technological advancements when selecting aircraft for their travel needs.

“These clients prioritize excellence in service delivery, emphasizing both technological sophistication and exceptional service standards. They are committed to enhancing their travel experiences to achieve the utmost levels of comfort, safety, and luxury,” he added.

Furthermore, this segment can benefit from Saudi Arabia’s aviation strategy, which aims to expand connectivity to over 250 destinations by 2030. A key component of this plan is privatization, exemplified by the Kingdom's implementation of the first successful public-private partnership model in the Middle East.

GACA also announced during the Future Aviation Forum its targeted investments in six new specialized general aviation airports in the Kingdom, alongside other initiatives.

"These investments are anticipated to enhance infrastructure and service quality within the private aviation sector, making it more appealing to high-net-worth individuals and corporate clients," Gharzeddine commented.

"Improved facilities and services will likely drive increased demand for private jet charters and ownership, boosting the overall efficiency and capacity of the aviation sector. Additionally, these developments will help position Saudi Arabia as a key hub for private aviation in the Gulf region," he added.

Charter business and sustainability

Leading the change in sustainable aviation growth, Saudi Arabia announced its finalization of a comprehensive plan in November to address environmental sustainability within its civil aviation sector, in line with international commitments such as the 2015 Paris Agreement.

Spearheaded by GACA, the Civil Aviation Environmental Sustainability Plan targets the reduction of greenhouse gas releases, with a zero-emissions goal by 2060.

Saudi Arabia’s initiatives extend to hydrogen fuel infrastructure and green projects like the Circular Carbon Economy, while major developments such as AMAALA and the Red Sea project reflect a commitment to net-zero emissions.

Global business and government leaders consider sustainable aviation fuel a key opportunity for significant reductions in air travel emissions, with numerous initiatives underway to make this energy product a reality.

SAF is derived from renewable hydrocarbon sources and can reduce carbon emissions by 75 percent compared to traditional fossil-based jet fuel.

However, the primary challenge is supply and demand, as production needs to increase significantly to meet the set targets by 2030.

According to Gharzeddine, in addition to the limited supply, achieving economies of scale to reduce production costs is also an ongoing issue, as is the high charge of specialized processing required for biofuels.

Maryam Al-Balooshi, the UAE’s lead negotiator for aviation climate change, also emphasized the urgent need for Gulf countries to produce SAF to compete in the Western-dominated market and support greener flights, as reported by the National News in February.

An important aspect to consider is how technology and artificial intelligence can play pivotal roles in driving sustainable aviation. Advanced flight planning systems use AI to optimize flight paths, reducing fuel consumption and minimizing carbon emissions.

“By analyzing weather patterns, air traffic, and aircraft performance in real-time, AI can suggest more efficient routes and altitudes, ensuring flights operate at maximum efficiency,” Gharzeddine explained.

Predictive maintenance powered by AI also enhances sustainability by identifying potential issues before they become significant problems, thereby reducing downtime and extending the lifespan of aircraft components.

Additionally, AI-driven data analytics can help monitor and manage the carbon footprint of each flight, enabling operators to make informed decisions about fuel usage, weight management, and other factors that influence emissions.

By leveraging advanced technology, AI, and SAF, the private aviation sector in Saudi Arabia can meet growing demand while setting a benchmark for sustainability in the global aviation industry.

From tennis to paper, PIF pushes ahead with its diverse investments strategy in 2024

- Sovereign wealth fund continues to drive forward Kingdom’s economic diversification agenda

RIYADH: Tennis, tech and paper production are just some of the areas Saudi Arabia’s Public Investment Fund has reached into so far in 2024, as the body continues to drive forward the Kingdom’s economic diversification agenda.

The sovereign wealth fund has continued with the momentum built up in 2023, which saw it make investments in companies as diverse as London’s Heathrow Airport and Rocco Forte Hotels.

Its activities since the turn of the year saw PIF revise its asset size on its website, reaching $925.2 billion after it climbed to the fifth spot in a ranking of state-owned investment organizations by the Sovereign Wealth Fund Institute.

This monumental rise in the fund’s standing followed its procurement of an additional 8 percent stake in Aramco, boosting its shareholding’s estimated value to $328 billion.

Here are some of the key announcements made by the wealth fund so far in 2024

PIF’s deal with Bahrain Mumtalakat to enhance investments

One of the primary deals signed by PIF in the first quarter was a memorandum of understanding inked with Bahrain’s sovereign wealth fund Mumtalakat in March.

The agreement aims to expand cooperation between the two parties, enable new and promising investment prospects in Bahrain, and create opportunities for private companies in both countries.

Yazeed Al-Humied, deputy governor and head of MENA Investments at PIF, said the deal supports the wealth fund’s objectives of building long-term strategic regional partnerships that bring additional value to local economies.

“It also enables the achievement of sustainable returns that further contribute to maximizing PIF’s assets and diversifying the economy in line with the objectives of Saudi Vision 2030,”

said Al-Humeid.

PIF acquired 40 percent stake in Zamil Offshore

In February, the wealth fund acquired a 40 percent stake in Zamil Offshore Co., a significant move that could boost marine support services in Saudi Arabia.

In a press statement, PIF revealed that this investment is part of the fund’s broader strategy to contribute to the development of the Kingdom’s energy base.

Zamil Offshore Co. is one of the largest Saudi-based offshore support providers, operating over 90 vessels in the Arabian Gulf.

Bakr Al-Muhanna, head of the Transport and Logistics Sector in Middle East and North Africa Investments at PIF, said that this investment will strengthen the offshore support industry, contributing to the fund’s wider efforts to develop Saudi Arabia’s energy ecosystem.

PIF’s efforts to accelerate growth of global tennis sports

In February, the wealth fund signed a multi-year strategic agreement with the Association of Tennis Professionals aimed at accelerating the growth of the sport globally.

“Through our collaboration with ATP, PIF will be a catalyst for the growth of the global tennis landscape, developing talent, fostering inclusivity and driving sustainable innovation. This strategic partnership aligns with our broader vision to enhance quality of life and drive transformation in sport both within Saudi and across the world,” said Mohamed Al-Sayyad, head of corporate brand at PIF.

Under the deal, PIF will leverage ATP’s expertise to develop further opportunities for young Saudis in wtennis, including the development of state-of-the-art facilities and ensuring the availability of necessary coaching in the Kingdom.

The launch of Alat

Another significant development in February was the launch of Alat, a PIF firm aimed at turning Saudi Arabia into a global hub for sustainable technology manufacturing.

The company will prioritize constructing products tailored for local and international markets across seven strategic business units. These include advanced industries and semiconductors, smart appliances and health solutions, as well as smart devices and building technologies.

Alat will also manufacture more than 30 product categories that will serve vital sectors, including robotic and communication systems, advanced computers and digital entertainment, as well as advanced heavy machinery used in construction, building and mining.

Acquisition of Mepco in diversification push

In January, PIF bought a 23.08 percent stake in the Middle East Paper Co. as the fund continued expanding its investments in the Saudi economy’s primary sectors.

According to a statement, the body acquired the stakes by increasing capital and subscribing to new shares in Mepco. Muhammad Aldawood, PIF’s head of the industrials and mining sector in the Middle East and North Africa region, said the fund’s investment in Mepco reflects the attractive growth opportunities in promising sectors such as recycling, retail, and building materials.

The fund added that PIF’s investment in Mepco will support the private sector in Saudi Arabia, boost local content, increase exports as well as improve quality and competitiveness.

Sami Al-Safran, CEO of MEPCO, said that PIF’s investment will help the company become a national champion in the recycling industry.

“PIF’s investment further enables the implementation of our expansion strategy and captures significant growth potential, both locally and regionally,” said Al-Safran.

Completion of the acquisition of Dubai-based Kent

In February, Saudi contractor Nesma & Partners, backed by PIF, completed the acquisition of Kent, based in Dubai, after signing an agreement in 2023.

In a statement, Nesma said that the acquisition aligns with the company’s strategic growth strategy and aims to position the firm as a global leader in the construction industry.

“The acquisition of Kent represents a significant milestone for Nesma & Partners, reinforcing our commitment to expanding our capabilities and enhancing our position in the global market,” said Samer Abdul Samad, president and CEO of Nesma & Partners.

According to the acquisition details, Kent and Nesma do not plan to integrate operations, and both firms will continue their existing projects.

PIF aims to strengthen electric motorsports sector

In January, the wealth fund signed a multi-year agreement named Electric 360 with Formula E, Extreme E and E1 to support the growth of electric motorsports and their role in advancing the future of electric mobility.

In a press statement, PIF said the partnership will drive technological innovation and revolutionize sustainable transport and future mobility, ultimately reducing carbon emissions.

“Together with these championship series, Electric 360 will redefine electric sport and supercharge its growth, delivering tangible impact aligned with our broader business strategy as PIF drives new green technological innovation that will be the cornerstone of future electric mobility,” said Mohamed Al-Sayyad, head of corporate brand at PIF.

Saudi Arabia’s open banking strategy a game-changer

- Initiative enables customers to securely share their data with third parties

CAIRO: Saudi Arabia’s embracing of open banking has transformed the region’s financial ecosystem, according to a top fintech CEO.

In an interview with Arab News, Abdulla Al-Moayed, head of Tarabut, praised the Kingdom’s central bank for its inclusive regulatory impact on the financial sector.

In May 2022, the institution, also known as SAMA, went live with its open banking initiative, which has altered the future of financial technology in the Kingdom and the wider region.

Open banking is a technological innovation that enables customers to securely share their data with third parties.

“Open banking changes the very nature of relationships across the financial ecosystem for Saudi Arabia and for the region as a whole. This is only a good thing,” said Al-Moayed.

Echoing those sentiments, CEO of US-based fintech MoneyHash Nader Abdelrazik, told Arab News: “Open banking (in Saudi Arabia) will significantly catalyze the relationship between banks and fintech, and it will open up a multitude of business use-cases.”

He added: “Banking and finance innovation is highly dependent on access and adoption of open data frameworks. Once these frameworks are in place, not only the existing banks and fintechs will collaborate more, but it will also attract more banks and fintechs to expand to the market and embed their solutions.”

Abdelrazik believes this will increase the economy’s digital sophistication and competitiveness, “but the real winner here is the consumer.”

In its Open Banking Policy report, SAMA said its initiatives focus on “nurturing the rise of digital technologies and their impact on the new financial services enabled by them, as well as building the regulatory framework needed to adopt these initiatives.”

The release further stated: “This opens the door to create and offer new financial services. Therefore, SAMA sees open banking as a pivotal role in the further development of the Kingdom’s financial sector.”

Al-Moayed explained that SAMA’s efforts to standardize application programming interfaces or APIs, are enhancing the country’s monetary platforms, which aim to broaden financial inclusion by facilitating secure, seamless, and affordable access to services and advice.

APIs allow different software applications to communicate with each other, facilitating the integration and sharing of data and functions.

“Standardized APIs enable interoperability between providers, leading to a more cohesive financial ecosystem,” Al-Moayed said.

Open banking changes the very nature of relationships across the financial ecosystem for Saudi Arabia and for the region as a whole.

Abdulla Al-Moayed, Head of Tarabut

“This allows for the development of innovative financial services and products that can cater to a wider range of customer needs. By opening access to financial data, these APIs are fostering an environment of innovation, allowing fintech startups to focus on end-user problems; away from the worries of connectivity and access to data,” he added.

Being one of the region’s leading providers of APIs, Tarabut has set a prime example for others to follow.

“Our mission is to enable the connections necessary to expand financial inclusion for everyone, by building the infrastructure that enables secure, seamless, and inexpensive financial services and advice. As with all financial and personal data, we should be clear that trust, security, and safety are a non-negotiable part of the process,” Al-Moayed stated.

Regarding security, the CEO highlighted: “At Tarabut, we take a series of continuous steps to ensure security, such as ensuring that all transactions and data access requests are authenticated using multiple factors to enhance security, as well as the requirements to also employ state-of-the-art encryption standards to protect data during transmission and storage.”

He further explained: “Data access controls, such as implementing strict controls on who can access specific data and for what purpose, ensure that customer data is not misused.”

Al-Moayed adde: “There are also continuous and regular compliance checks and audits to ensure that all participants in the open banking ecosystem adhere to the highest security standards and regulatory requirements.”

He also underscored the collaborative effort with SAMA during the regulatory sandbox period, which showcased the potential of open banking to transform financial accessibility.

Fostering symbiotic relationships

“Looking at Saudi Arabia, we see a nationwide ambition to promote a symbiotic relationship between banks and fintechs, by enabling data sharing and the adoption of innovative technology solutions,” Al-Moayed said.

“Banks provide fintech companies with access to valuable financial data with customer consent, and the fintechs and the banks can work together to create more personalized and innovative financial products,” he added.

Al-Moayed explained that banks looking to partner with a fintech company could lead to new revenue streams and open up customer segments, enhancing their market reach and product offerings — as well as ensuring adaptability and innovation for the young, digitally-native population

of the Kingdom.

“Together, banks and fintech can reach underserved segments of the population, as well as those who could benefit from improved awareness and access to different services, providing each with the many benefits and impacts that are inaccessible by traditional means,” he said.

Safeguarding consumer data

According to Al-Moayed, SAMA has established a robust legal framework essential for safeguarding consumer data, which mandates explicit consent before sharing financial information with third-party providers.

“SAMA have rightfully identified consumer data protection and privacy as crucial for consumer trust and participation,” stated Al-Moayed.

He elaborated that this approach not only provides consumers control over their personal information but also “gives consumers control over their data, including the right to know how their information is being used and the ability to revoke access at any time, builds trust and encourages participation in the open banking ecosystem,” which is vital for building trust within the banking sector.

“We believe this is a critical part of the trust-building process for banking customers across Saudi Arabia. By making it clear to people that every person is the true owner of their data, they can feel empowered to make the best access decisions for their personal needs,” he added.

A smooth transition

As the Kingdom transitions toward open banking, traditional banks are seizing the opportunity to redefine their roles.

“We have been hugely impressed by the vision and appetite for transformation from banks across the Kingdom,” Al-Moayed expressed.

He explained that financial institutes are transitioning from being mere custodians of customer funds to becoming more integral participants in their customers’ financial lives.

“The banks we partner with truly see open banking as so much more than a new series of regulations to comply with,” he said.

“Recognizing the value of innovation brought by fintech startups, like ours, many banks are forming partnerships and collaborations to leverage the best available technology to enhance their offerings,” Al-Moayed added.

MoneyHash’s Abdelrazik stated that traditional banking will continue to thrive and be active, at least in the short term.

“But with the rise of open banking and numerous opportunities in the fintech sphere, banks implementing a robust digital strategy, and leveraging strategic alliances with fintechs, can be much more competitive and agile to this dynamic market,” he added.