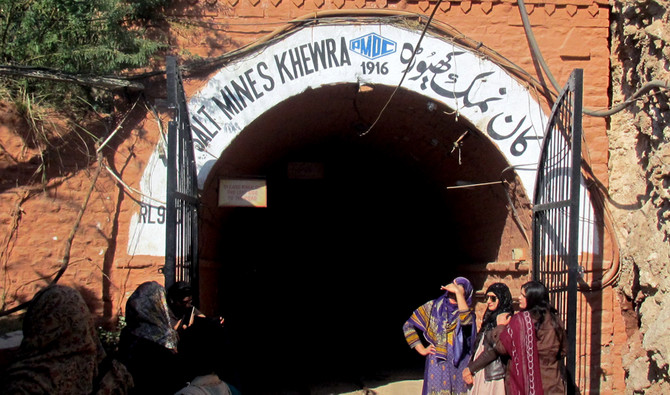

KHEWRA: The Khewra Salt Mines, located about 160 kilometres south of the Pakistani capital of Islamabad, are said to be the second largest salt mine in the world and the largest in Pakistan.

“Nearly one million tourists visit the mine annually,” senior guide Abid Hussain, who has worked at the mines since 1985, told Arab News. The entry fee is just 200 rupees.

“Salt was previously extracted from the mine in three shifts, 24 hours a day, but now due to a shortage of workers it’s been limited to two morning and evening sessions,” Hussain said. The salt, normally used for human and animal consumption, is also exported to foreign countries including Korea, Japan and Malaysia.

The history of the mines dates back to 320 BC when Alexander the Great is said to have discovered them. The colonial British government improved mining practices in 1872.

Shanzay Syed Bokhari, a seventh grade student from Kahuta, had come to Khewra just to see the salt mines. “It was interesting to read about it in our social studies book but seeing it is far better,” Bokhari said, saying she now planned to convince her classmates to pay a visit to the mines also.

“I must say it’s a beautiful gift from God to us,” said Syed Munir Hussain Shah, a school teacher who had brought his students to the mines on a field trip. “We explained the Khewra salt mines chapter to the students and today we brought them to show them. It will clear their minds and they will be able to explore it [the mines] by themselves,” Hussain said.

The mines also have a souvenir store where you can buy models of the Minar-e-Pakistan, canons, and mosque made from salt bricks. There is also a restaurant and a unique dispensary where people with asthma spend 8-10 hours a day undergoing salt therapy.