FRANKFURT: German high-end carmaker BMW on Wednesday posted a steep drop in quarterly profit as new EU emissions tests, global trade tensions and costly recalls weighed on the bottom line.

The Munich-based group said net profit between July and September slumped 24 percent year-on-year to €1.4 billion ($1.6 billion), falling short of analyst expectations.

Third-quarter revenues were up 4.7 percent to €24.7 billion, supported by brisk demand for the group’s vehicles which include the compact Mini and luxury Rolls-Royce.

The group had already issued a rare profit warning in September when it was forced to lower its full-year outlook in the face of a series of setbacks.

Chief among them was the introduction of tough new EU pollution tests known as WLTP, which sent rival carmakers scrambling to shift non-compliant models before the September 1 deadline.

This resulted in “unexpectedly intense competition,” BMW said.

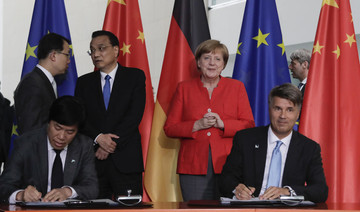

The group has also been unnerved by US President Donald Trump’s festering trade row with China and his threats to slap steep tariffs on auto imports from the European Union.

“The ongoing international trade conflicts had the effect of aggravating the market situation and feeding consumer uncertainty,” said BMW, which owns factories in Europe, the US and China.

The automaker also felt the pinch from a mass recall of diesel-powered cars over a fire risk in the third quarter, and increased spending on electric and self-driving cars.

“Particularly in these volatile times, we are maintaining our focus on the future and taking the decisions that will lead to tomorrow’s success,” said chief executive Harald Krueger.

BMW confirmed its trimmed outlook for 2018, forecasting revenues from its car business “slightly lower” than last year, rather than the slight increase previously expected.

Group-wide profit before tax “is expected to show a moderate decrease” year-on-year, rather than staying around last year’s level of €10.7 billion.

BMW quarterly profit dips in ‘volatile’ times

BMW quarterly profit dips in ‘volatile’ times

- Third-quarter revenues were up 4.7 percent to €24.7 billion

- The group had already issued a rare profit warning in September

Aramco-backed S-Oil expects Q2 refining margins to remain steady then trend upward

SEOUL: South Korea’s S-Oil forecast on Friday that second-quarter refining margins will be steady, supported by regular maintenance in the region, then trend upward in tandem with higher demand as the summer season gets underway, according to Reuters.

Over the January-March period, the refiner said it operated the crude distillation units at its 669,000-barrel-per-day oil refinery in the southeastern city of Ulsan at 91.9 percent of capacity, compared with 94 percent in October-December.

S-Oil, whose main shareholder is Saudi Aramco, plans to shut its No. 1 crude distillation unit sometime this year for maintenance, the company said in an earnings presentation, without specifying the time.

Venture investments spark renaissance of Saudi innovation

RIYADH: In Saudi Arabia, a dynamic transformation is unfolding within the entrepreneurial landscape, powered by the robust growth of venture capital, which achieved an impressive 86 percent compound annual growth rate from 2019 to 2023.

This financial infusion has been a game-changer, propelling the Kingdom past the $1 billion mark in venture capital investment last year and igniting a wave of innovative thinking among Saudi entrepreneurs.

Simply put, VC is a category of private market investment and financing. A VC firm raises capital from investors, referred to as Limited Partners, and uses that capital to fund promising startups they have determined as likely to have high growth potential in an emerging category.

A vibrant scene

“The rise of venture capital in Saudi Arabia is fueling a vibrant entrepreneurial scene,” said the founder of Saudi-based VC firm Nama Ventures.

Offering a unique perspective on this financial phenomenon, Mohammed Al-Zubi shared his insights with Arab News about how venture capital is energizing the entrepreneurial scene in the Kingdom.

Al-Zubi described this financial influx as a vital nutrient, fostering a fertile ground for innovation and growth within the Kingdom.

Ripple effects

“Startups get crucial funding, expert guidance, and exit pathways, attracting and retaining ambitious talent. This creates a ripple effect — successful ventures generate high-quality jobs, attracting more skilled professionals and expertise,” Al-Zubi told Arab News.

However, he explained that challenges like limited seed funding and skill mismatch require more attention.

“By fostering a diverse ecosystem and addressing these gaps, Saudi Arabia can harness the power of VC to build a thriving and sustainable entrepreneurial powerhouse,” Al-Zubi added.

Echoing Al-Zubi’s remarks, Tariq bin Hendi, senior partner at Global Ventures, told Arab News that the Kingdom’s VC growth reflects its booming economy.

“Saudi Arabia is a large market with compelling macroeconomics and significant funding, which in turn is re-shaping the regional startup landscape,” Hendi said.

“Increased investment has helped start-ups to digitize, scale and accelerate their business operations — with many success stories: Tarabut, Zension, RedSea, Zid and Hakbah being among the most well-known,” Hendi added.

An innovative economy

Hendi emphasizes the crucial role of venture capital in the economic diversification of Saudi Arabia.

He notes that sectors like agritech, fintech, and cleantech are attracting significant investments, aligning with Saudi Arabia’s Vision 2030 goals.

“The increase in investment saw Saudi Arabia secure MENA’s (Middle East and North Africa) highest VC funding in 2023, which is also aligned with the country’s Vision 2030 objectives,” he stated

“Venture capital’s investment in nascent technologies and innovative ventures allows for early-stage experimentation and for new start-ups to respond to analogue-based problems previously difficult to navigate through digitalization,” Hendi added.

According to him, this synergy between venture capital and startups not only drives technological progress but also offers insights into the regulatory landscape, promoting economic diversity and innovation within the region.

He also highlights the broader impact of venture capital, noting how it enables local businesses to scale and address global challenges, creating job opportunities and demonstrating the Kingdom’s potential in leading sustainable startup growth.

Moreover, Hendi points out that venture capital stimulates international collaboration, attracting global investors and reducing investment risks, further bolstering Saudi Arabia’s position as a dynamic hub for economic activity and innovation.

Furthermore, in his article “Venture Capital Fundamentals: Why VC Is A Driving Force Of Innovation,” Mark Flickinger, general partner and chief operating officer at US-based BIP Ventures, describes VC as a critical factor for economic innovation.

“VC is a rewarding form of private market investment that gives innovators a real chance to transform their ideas into businesses. It connects founders and investors, driving progress and successful outcomes for both,” Flickinger said.

“And for everyone who is part of this virtuous cycle of funding, building, and scaling market-changing businesses, VC is a way to support the impact of the innovation economy – which is the economy today,” he added.

The challenge

Hendi underscores the significant transformation underway in Saudi Arabia, driven by the nation’s economic diversification and digitalization, which is fueling a burgeoning demand for talent and innovation.

With a young, tech-savvy population, the Kingdom is ripe for entrepreneurial ventures, evidenced by success stories like Tabby, he explained.

The growing ecosystem, supported by incubators and successful exits, showcases the country’s potential as a hotbed for technology-driven businesses catering to consumers, enterprises, and government sectors.

The challenge now, according to him, is to further enhance this vibrant environment, making Saudi Arabia even more appealing for entrepreneurs.

He advocates for continued deregulation and the creation of conditions that encourage innovation, enabling entrepreneurs to develop products and services that resonate with consumers and drive economic growth.

The goal is to not only maintain the momentum but to elevate Saudi Arabia’s status as a premier destination for starting and scaling innovative ventures.

How to utilize funding

As VC growth continues to expand, startups are pressured to find efficient ways to use their funding to boost the overall ecosystem.

Al-Zubi shares his advice stating: “Imagine your funding as rocket fuel – you have to blast off without burning it all at once, right?”

“To fly long and far, focus on essentials. Build a stellar team, fuel growth with customer love, and lay a strong financial groundwork,” Al-Zubi added.

“Track your rocket’s path with data, experiment with new maneuvers, and stay tuned to the space weather. Be open with your investors, listen to wise advisors, and don’t be afraid to adjust your trajectory if the wind changes. Remember, long-term success is a marathon, not a sprint. Spend smart, learn fast, and keep your eyes on the stars,” he added.

Furthermore, Hendi advocates for meticulous planning in resource allocation, emphasizing the importance of understanding the market, timing for product launches, and strategic deployment of capital.

According to Hendi, startups must have a clear grasp of their financial roadmap, with a detailed understanding of expected expenditures over set timelines, to ensure sustained growth and success in the evolving economic environment.

Startup Wrap – Egyptian firms secure funding to boost Saudi expansions after battling stagnation

CAIRO: Startups in Egypt have started to gain momentum with several ventures securing funding to boost expansion efforts to the Kingdom.

Following a period of startup funding stagnation, Egyptian founders have made their way back to the regional venture capital space with a flurry of investment deals and expansion strategies already in place.

Egyptian fintech startup Waffarha has secured a seven-figure seed round from Value Makers Studio to expand its footprint.

Founded in 2012 by Tarek Magdy, the platform offers significant discounts, with daily deals ranging from 50 percent to 90 percent.

The new capital will enable Waffarha to enhance its technology, recruit talent, and expand into Saudi Arabia and additional markets.

Moreover, in 2018, Fawry for Banking Technology and Electronic Payments, one of Egypt’s largest financial institutions, acquired a share of 30 percent of the company.

The company claims to boast a network of over 1,000 merchants and over 3,000 stores that cater to more than 5 million customers, without any subscription fees.

Over the last 12 years, Waffarha claims to have emerged as a top-tier lifestyle website and mobile app.

Egyptian HR tech startup Bluworks secures $1m in pre-seed funding

Bluworks, an HR and Software-as-a-Service solutions provider based in Egypt, has raised $1 million in pre-seed funding led by Khawarizmi Ventures and included Camel Ventures, Acasia Ventures, and angel investors.

Founded in 2022 by Farah Osman, Hussein Wahdan, and Nour Ahmadein, Bluworks aims to optimize costs for businesses through data-driven decision-making.

“With so many HR softwares on the market, not one is built to manage blue-collar workers,” Wahdan said.

“Since the process of managing this type of workforce is so manual, errors frequently occur, leading to penalties and deducted salaries with no oversight from the workers, causing them to leave and ultimately contributing to high turnover rates,” he added.

“Currently, companies can spend about 7-10 days just closing their payroll accounts, but with Bluworks, this time can be cut down to one day - all while leveraging data and insights on their workforce,” he stated.

The company aims to utilize the funding to support its product development goals, expand its presence, and grow its team.

Egypt-based fintech Bokra closes $4.6m pre-seed funding round

Bokra, an emerging fintech startup from Egypt, has secured $4.6 million in pre-seed funding, led by DisrupTech Ventures and SS Capital.

Founded in 2023 by Ayman El-Sawy, Bokra offers diversified investment solutions for retail and SME investors.

The funds will support the launch of the Bokra app, expansion of its investment products, and scaling operations across the Middle East and North Africa region.

“We are dedicated to accelerating financial inclusion and elevating investment awareness across MENA,” El-Sawy said.

“In a region where financial needs and aspirations are ever-changing, Bokra is poised to become the preferred investment platform for both individuals and small and medium-sized enterprises looking to diversify their fractional ownership portfolio in a simple, trackable and informed way,” he added.

Egyptian startups win big in Saudi-Egyptian program

Ten Egyptian startups have received awards from the VMS Bridge program, aimed at enhancing connections between Egypt and Saudi Arabia’s entrepreneurial ecosystems.

Winners included Amanleek, Farhy, Sprints, Career180, and Jamaykaa, which will explore investment opportunities during a 4-day visit to the Kingdom.

Other winners, Notchnco and Neqabty, received free company licenses in Saudi Arabia, and AgriCash, ReNile, and ICareer won access to Arweqah’s training programs.

Jordan-based healthtech startup Arab Therapy secures $1m seed funding

Arab Therapy, a Jordan-based mental health platform, has raised $1 million in seed funding, led by Flat6Labs and Vision Health Pioneers, with participation from international angel investors.

Founded in 2021 by Tareq Dalbah, Omar Koudsi, and Hekmat Al-Hasi, Arab Therapy connects users with licensed mental health professionals.

The investment will facilitate the company’s market expansion and the initiation of business to business sales operations.

TVM Capital Healthcare invests $17m in Neurocare Group AG

TVM Capital Healthcare, based in the UAE, has invested $17 million into Neurocare Group AG, a Munich-headquartered healthtech specializing in personalized mental healthcare.

The investment will support Neurocare’s expansion plans in the US and Saudi Arabia and fund the development of new hardware and software innovations, enhancing their clinical solutions.

UAE-based logistics startup Shorages secures $1m for expansion

Shorages, a UAE-based logistics startup, has raised $1 million in a pre-series A funding round led by Joa Capital’s S3 Ventures Fund.

Founded in 2019 by Rayan Osseiran, the company provides fulfillment solutions in the UAE and Saudi Arabia for e-commerce platforms.

The company aims to utilize the funding to help expand its warehouse operations across the Gulf region.

UAE e-commerce startup WEE secures $12m in funding

UAE-based e-commerce startup WEE has concluded a $12 million pre-series A funding round, facilitated by SIG Investment.

Founded in 2021 by Anastasia Kim, Oleg Dashkevich, and Sergey Kolikov, WEE is an online marketplace that offers below 15-minutes delivery services.

The investment will be used to spearhead WEE’s logistics capabilities, accelerate growth, and expand its team.

Turkish fintech app Midas closes $45m funding round to boost MENA expansion

Turkish fintech app Midas closed a $45 million funding round by Portage, a global investment platform, supported by International Finance Corporation, Spark Capital and Earlybird Digital East Fund.

Founded by Egem Eraslan, the company allows users in Turkiye to invest in Turkish and US equities.

The startup is aimed at Turkiye’s retail investor market and claims to have more than 2 million users. The company claims to charge significantly lower transaction and commission fees for Turkish customers who want to invest in US or Turkish stocks.

Midas has plans to expand beyond Turkiye, and aims to target countries in the MENA region, according to a report by TechCrunch.

Midas also plans to use the new funding to roll out three new products in cryptocurrency trading, mutual funds and savings accounts.

UAE’s Maalexi signs agreement with Etihad Credit Insurance

Maalexi, a UAE-based risk management platform focused on SME agri-businesses, has entered into a strategic credit insurance agreement with Etihad Credit Insurance, the UAE’s federal export credit company.

This collaboration will enable Maalexi to utilize ECI’s extensive trade credit solutions and services, enhancing the competitiveness of regional SMEs in the food and agriculture trade sectors, both locally and internationally.

The partnership aims to reduce market entry barriers, support Maalexi’s goal of increasing SME participation in the cross-border trade of agricultural produce, and contribute to food security in the UAE.

Oil Updates – prices on track to snap 2-week losing streak

SINGAPORE: Oil prices rose on Friday, on track to end higher this week after two straight weeks of losses, after a top US official expressed optimism over economic growth and as supply concerns lingered due to conflicts in the Middle East. according to Reuters.

Brent crude futures gained 31 cents, or 0.4 percent, to $89.32 a barrel at 6:47 a.m. Saudi time, and US West Texas Intermediate crude futures rose by 23 cents, or 0.3 percent, to $83.80 a barrel.

For the week, Brent has gained 2.3 percent so far, while WTI is up 0.8 percent.

Treasury Secretary Janet Yellen told Reuters on Thursday US gross domestic product growth for the first quarter could be revised higher, and inflation will ease after a clutch of “peculiar” factors held the economy to its weakest showing in nearly two years.

US economic growth was likely stronger than suggested by weaker-than-expected quarterly data, she said.

Data showed that economic growth slowed in the first quarter, and prior to Yellen’s comments, tremors from an acceleration in inflation had weighed on oil prices as investors calculated that the Federal Reserve would not cut interest rates before September.

Elsewhere, supply concerns as geopolitical tensions continue in the Middle East also buoyed prices early in the session.

Israel stepped up airstrikes on Rafah after saying it would evacuate civilians from the southern Gazan city and launch an all-out assault despite allies’ warnings this could cause mass casualties.

Saudi Arabia’s business landscape witnessing dynamic shift as AI adoption rises

- Companies urged to set their agenda without delay, prepare to adapt to evolution

RIYADH: Saudi Arabia’s business environment has witnessed a drastic shift in recent years as employers consider artificial intelligence a critical tool for their operations.

With the Kingdom hosting major technology events like LEAP, regional business owners and employees have recognized the need to upskill their proficiency in AI-related operations to catalyze growth.

Talking to Arab News, Rami Mourtada, partner and director of Boston Consulting Group, said companies in Saudi Arabia should set their AI agenda imminently and prepare to adapt to this dynamic evolution.

“Transformative AI adoption in the Kingdom cannot happen without proper business adoption, and businesses that haven’t should quickly set their own AI agenda, define a strategic AI roadmap, pilot promising use case, and engage the organization properly for this change,” said Mourtada.

He added: “As business leaders progress this journey, events like LEAP are important for learning from other businesses’ experience, engaging with experts to help refine their agenda, and getting new ideas for use case to pilot.”

Bridging the AI gap between employers and employees

A current report by US-based management consulting firm Oliver Wyman disclosed that Saudi Arabia and the wider Middle East region have invested heavily in national AI strategies in recent years, and the approach is paying off.

The study revealed that the Kingdom’s young population born between 1997 and 2010 has already recognized the benefits of this new technology, with more than half acknowledging the advantages AI will offer in enhancing productivity.

Ana Kreacic, chief knowledge officer at Oliver Wyman, said that bridging the gap between employers and employees is necessary to ensure the smooth adoption of AI in businesses.

“Currently, there is a big disconnect between employers and employees. While CEOs recognize AI’s potential and many already are redesigning work to improve productivity, streamline operations, or gain a competitive advantage, they underestimate many aspects of the technology,” said Kreacic.

She added: “Businesses should create a shared mission around AI’s adoption, not only around improved business productivity but also how the technology will affect workers and their roles. Business leaders right now must prioritize how to motivate younger workers, develop and train them, and allay their anxieties.”

The analysis by Oliver Wyman underscored that about 57 percent of the employees surveyed in Saudi Arabia revealed that the training provided by their companies on AI was insufficient, while 40 percent demanded peer-to-peer mentorship programs to adapt to the change.

“There is a lack of understanding and trust about how AI will affect work and how businesses plan to support their employees through the AI transition. More than ever, businesses need to communicate regularly with their employees about their plans, providing clear guidelines, and also double down on ongoing AI skill-building and training,” noted Kreacic.

She further emphasized that business leaders should prioritize motivating and training young workers, which will ultimately reduce their anxieties surrounding the tech adoption.

“Most AI-enabled tools are continuously improving, which means employees not only need to learn how to use these tools once but that they will continue to learn new things as they engage with the tools over time. This is different from most past technologies we’ve interacted with, and part of the reason why employees ranked AI as their top reskilling priority,” Kreacic told Arab News.

Kreacic further pointed out that businesses also need to focus on digital training for individuals born between the mid-1990s and the mid-2010s, or Gen Zers, who lack the skills required for AI despite their computer training and knowledge.

“Businesses also need to help them develop the soft skills that are becoming even more crucial as AI eliminates repetitive roles. Many Gen Zers were onboarded during the pandemic or spend less time in the office because of remote and hybrid work and haven’t yet acquired the skills that older generations learned while working alongside senior colleagues,” she added.

The vitality of encouraging AI adoption by alleviating fears

Even though adopting AI will increase businesses’ productivity, the majority of workers are worried that this trend will negatively impact their job security.

“There is increasing anxiety from the general workforce about AI’s impact on their job security, especially as its adoption rises — more employees see its capabilities and impact 1st hand. BCG research has shown that the optimal setup — i.e., resulting in the least risk of bias or error — is where humans act as oversight, with key checkpoints, for AI-transformed processes,” said Mourtada.

He added: “Employees should first influence their employers to adopt this hybrid approach and second engage with it to capture the benefits directly.”

The Oliver Wyman study revealed that 69 percent of Saudi Arabia’s young people are worried about the impact AI will have on job security, compared to 59 percent of older adults.

According to the report, senior employees may feel more secure in their careers because they believe AI will have less impact on higher-level employment.

“That fear already is impacting talent retention. 24 percent of Saudi Gen Zers are looking for other jobs that are more secure in the AI transition compared to 14 percent globally,” said Kreacic.

She added: “Business and government can address these fears and discourage workers from fleeing unnecessarily by communicating clearly and regularly about how generative AI will affect work and which activities will be substituted, augmented or transformed — as well as how they plan to support their employees through the transition.”

According to Kreacic, businesses should create a shared mission around the adoption of AI, not only around improved business productivity but also how the technology will affect workers and their roles.

“As companies become increasingly reliant on AI technology, younger workers may feel less and less connected to a company, so nurturing the young workers’ sense of belonging will be critical to allowing them to reach their full potential at work,” she told Arab News.