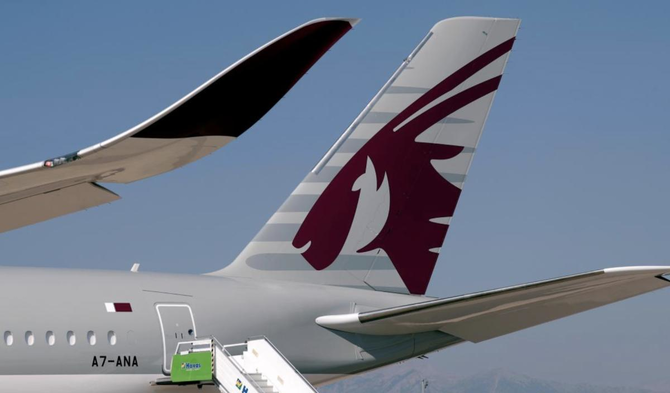

ANTALYA, Turkey: Qatar Airways made a “substantial” loss in its last financial year because of a regional dispute that has banned the airline from four Arab countries, its chief executive said on Wednesday without revealing the extent of the losses.

Qatar Airways has been blocked from flying to 18 cities in Saudi Arabia, the United Arab Emirates, Bahrain and Egypt since June when those countries cut ties with Qatar, accusing it of supporting terrorism. Doha denies the charges.

“We have increased our operating costs. We had to also take a hit on revenues so we don’t think that our results for the last financial year will be very good,” Chief Executive Akbar Al-Baker told reporters at the Eurasia Airshow in Antalya, Turkey.

“I don’t want to say the size of the loss but it was substantial.”

Other parts of the business were profitable though that was not enough to make up for the airline loss, Baker said.

Qatar Airways has several subsidiaries including airport ground handling services and catering units.

The airline had warned of the loss for several months.

The state-owned airline will need another eight weeks to finalize its books and make adjustments before it announces its financial results for the year to March 31, Baker said.

Qatar Airways made 1.97 billion Qatari riyals ($541 million) profit in its previous fiscal year.

Neighboring Saudi Arabia and the UAE were popular routes for Qatar Airways, which has also been banned from the airspace of the four boycotting states.

Qatar Airways confirms ‘substantial’ annual loss, blames row with regional neighbors

Qatar Airways confirms ‘substantial’ annual loss, blames row with regional neighbors

Closing Bell: Saudi main index closes in red at 10,947

RIYADH: Saudi Arabia’s Tadawul All Share Index dipped on Thursday, losing 208.20 points, or 1.87 percent, to close at 10,947.25.

The total trading turnover of the benchmark index was SR4.80 billion ($1.28 billion), as 14 of the listed stocks advanced, while 253 retreated.

The MSCI Tadawul Index decreased, down 25.35 points, or 1.69 percent, to close at 1,477.71.

The Kingdom’s parallel market Nomu lost 217.90 points, or 0.92 percent, to close at 23,404.75. This came as 24 of the listed stocks advanced, while 43 retreated.

The best-performing stock was Musharaka REIT Fund, with its share price up 2.12 percent to SR4.34.

Other top performers included Al Hassan Ghazi Ibrahim Shaker Co., which saw its share price rise by 1.18 percent to SR17.20, and Saudi Industrial Export Co., which saw a 0.8 percent increase to SR2.51.

On the downside, Abdullah Saad Mohammed Abo Moati for Bookstores Co. was among the day’s biggest decliners, with its share price falling 9.3 percent to SR39.

National Medical Care Co. fell 8.98 percent to SR128.80, while National Co. for Learning and Education declined 6.35 percent to SR116.50.

On the announcements front, Red Sea International said its subsidiary, the Fundamental Installation for Electric Work Co., has entered into a framework agreement with King Salman International Airport Development Co.

In a Tadawul statement, the company noted that the agreement establishes the general terms and conditions for the execution of enabling works at the King Salman International Airport project in Riyadh.

Under the 48-month contract, the scope of work includes the supply, installation, testing, and commissioning of all mechanical, electrical, and plumbing systems.

Utilizing a re-measurement model, specific work orders will be issued on a call-off basis, with the final contract value to be determined upon the completion and measurement of actual quantities executed.

The financial impact of this collaboration is expected to begin reflecting on the company’s statements starting in the first quarter of 2026, the statement said.

The company’s share price reached SR23.05, marking a 2.45 percent decrease on the main market.