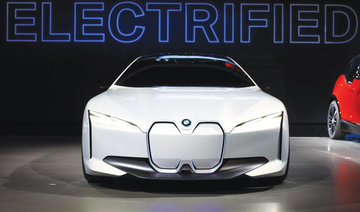

BEIJING: BMW Group said Friday it is talking with China’s biggest SUV maker about a possible partnership to produce electric versions of its Mini as automakers ramp up electric development under pressure from Beijing to meet sales quotas.

BMW said it signed a letter of intent with Great Wall Motors headquartered in Baoding, southwest of Beijing, and needs to work out a cooperation agreement and investment details.

Auto brands face pressure to meet quotas that require electric vehicles to make up at least 10 percent of sales starting next year. Later, they face pressure to raise that to meet increasingly demanding fuel efficiency standards.

Beijing is using access to its auto market, the world’s largest, as leverage to induce global automakers to help Chinese brands develop battery and other electric vehicle technology. Foreign automakers that want to manufacture in China must do so through local partners, which requires them to hand over know-how or help potential Chinese competitors develop their own.

General Motors, Volkswagen, Nissan Motor and other brands already have announced similar plans with local partners to produce dozens of electric models for China.

MINI’s first battery electric model is due to be produced at its main British factory in Oxford in 2019, according to BMW.

“This signals a further clear commitment to the electrified future of the MINI brand,” BMW said in a statement.

Sales of pure-electric passenger vehicles in China rose 82 percent last year to 468,000, according to an industry group, the China Association of Automobile Manufacturers. That was more than double the US level of just under 200,000.

China is BMW’s biggest market. The Munich-based automaker said about 560,000 BMW brand vehicles were delivered to Chinese customers in 2017, more than its next two markets — the United States and Germany — combined.

China was MINI’s fourth-largest market in 2017, with 35,000 vehicles delivered, the company said.

An electrics venture with BMW would be a boost for Great Wall, which industry analysts have warned will struggle to satisfy Beijing’s sales quotas and had yet to announce any significant electric plans.

Great Wall sells more than 1 million fuel-hungry SUVs annually. That sets a high baseline for electric sales and will make it harder to meet fleet average efficiency standards.

BMW looking at Chinese-made electric Mini

BMW looking at Chinese-made electric Mini

RLC Global Forum highlights role of Saudi youth in retail digital shift

RIYADH: Saudi Arabia’s young and highly digital population is reshaping how the Kingdom’s retail sector adopts new technologies and artificial intelligence, advancing faster than many global competitors, industry leaders told Arab News.

Speaking on the sidelines of the RLC Global Forum in Riyadh, executives told Arab News that the intersection of a youthful population and strong investment in AI is driving a shift in the industry’s priorities.

From understanding consumer behavior to leveraging the Kingdom’s growing status as a global AI leader, Saudi Arabia is becoming as a unique destination for the retail sector to thrive, learn, and evolve in the digital sphere.

Abdullah Al-Tamimi, CEO of commercial real estate company Hamat Holding, told Arab News that the firm is keen to analyze and understand consumer behavior, with a particular focus on the younger generation as a key part of that insight.

“Actually, it’s a big part of our day-to-day operation,” he said, adding that the company invests heavily in understanding customer needs and behavior and works to correct any missteps.

Al-Tamimi emphasized paying close attention to small details, noting that younger consumers are especially sensitive to the overall experience and “deserve that we work around the clock in order to improve it.”

He added that this focus “can be a competitive advantage for Saudi Arabia as well.”

Al-Tamimi said that as the younger generation grows accustomed to new technology shaping retail customer experiences, Hamat Holding is leveraging AI to enhance them further.

“We started a couple of initiatives improving digitalization,” he said, adding that the company sees digital tools as a way to enhance its work by automating day-to-day operations and allowing teams to focus on bigger-picture and more complex tasks.

While the firm has expanded its use of technology, he stressed it has not replaced human workers, emphasizing the continued importance of human capital for creativity and interaction. “AI is a big part of our strategy,” Al-Tamimi added.

Amit Keswani Manghnani, chief omnichannel and AI officer at luxury goods retailer and distributor Chalhoub Group, told Arab News that bridging a younger customer base with continuous digital development is key to advancing the Kingdom’s retail strategies.

On Saudi Arabia’s demographics, he said: “We look at 2030 as really building products which serve especially the younger population, which is growing and very digitally savvy.”

Manghnani underscored the unique characteristics of the Kingdom’s retail market as a tool for developing effective products and customer experiences.

“So it’s very digitally savvy, much more than in other markets,” he said, noting that e-commerce penetration is rising not only through online purchases but also via digital catalogs that drive in-store visits.

Manghnani said investment is focused on making products more digitally accessible and easier to use, while strengthening customer service to meet the expectations of what he described as a demanding but welcome consumer base. “Service excellence, digital — all these things together are how we are tapping into the younger population, which again is extremely savvy.”

Manghnani reinforced Al-Tamimi’s point that the Kingdom holds a competitive advantage, citing the speed at which its retail and technology industries are aligning.

“As a market, we’re tending to see the adoption of digital,” he said, referring to AI, data and other forms of digital interaction, adding that these tools are increasingly being combined.

He noted that this market is moving “much quicker than the other markets.”

The two-day RLC Global Forum brought together more than 2,000 global leaders, policymakers, and innovators from over 40 countries over the two-day event to define the next chapter of growth across retail, consumer, and lifestyle industries.