SYDNEY: Australia, the United States, India and Japan are talking about establishing a joint regional infrastructure scheme as an alternative to China’s multibillion-dollar Belt and Road Initiative in an attempt to counter Beijing’s spreading influence, the Australian Financial Review reported on Monday, citing a senior US official.

The unnamed official was quoted as saying the plan involving the four regional partners was still “nascent” and “won’t be ripe enough to be announced’ during Australian Prime Minister Turnbull’s visit to the United States later this week.

The official said, however, that the project was on the agenda for Turnbull’s talks with US President Donald Trump during that trip and was being seriously discussed. The source added that the preferred terminology was to call the plan an “alternative” to China’s Belt and Road Initiative, rather than a “rival.”

“No one is saying China should not build infrastructure,” the official was quoted as saying. “China might build a port which, on its own is not economically viable. We could make it economically viable by building a road or rail line linking that port.”

Representatives for Turnbull, Foreign Minister Julie Bishop and Trade Minister Steven Ciobo did not immediately respond to requests for comment.

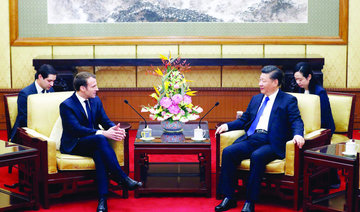

First mentioned during a speech by Chinese President Xi Jinping’s to university students in Kazakhstan in 2013, China’s Belt and Road plan is a vehicle for the Asian country to take a greater role on the international stage by funding and building global transport and trade links in more than 60 countries.

Xi has heavily promoted the initiative, inviting world leaders to Beijing last May for an inaugural summit at which he pledged $124 billion in funding for the plan, and enshrining it into the ruling Communist Party’s constitution in October.

Local Chinese governments as well as state and private firms have rushed to offer support by investing overseas and making loans.

In January, Beijing outlined its ambitions to extend the initiative to the Arctic by developing shipping lanes opened up by global warming, forming a “Polar Silk Road.”

The United States, Japan, India and Australia have recently revived four-way talks to deepen security cooperation and coordinate alternatives for regional infrastructure financing to that offered by China.

The so-called Quad to discuss and cooperate on security first met as an initiative a decade ago — much to the annoyance of China, which saw it as an attempt by regional democracies to contain its advances. The quartet held talks in Manila on the sidelines of the November ASEAN and East Asia Summits.

Australia, US, India and Japan in talks to establish Belt and Road alternative -report

Australia, US, India and Japan in talks to establish Belt and Road alternative -report

Saudi investment pipeline active as reforms advance, says Pakistan minister

ALULA: Pakistan’s Finance Minister Mohammed Aurangzeb described Saudi Arabia as a “longstanding partner” and emphasized the importance of sustainable, mutually beneficial cooperation, particularly in key economic sectors.

Speaking to Arab News on the sidelines of the AlUla Conference for Emerging Market Economies, Aurangzeb said the relationship between Pakistan and Saudi Arabia remains resilient despite global geopolitical tensions.

“The Kingdom has been a longstanding partner of Pakistan for the longest time, and we are very grateful for how we have been supported through thick and thin, through rough patches and, even now that we have achieved macroeconomic stability, I think we are now well positioned for growth.”

Aurangzeb said the partnership has facilitated investment across several sectors, including minerals and mining, information technology, agriculture, and tourism. He cited an active pipeline of Saudi investments, including Wafi’s entry into Pakistan’s downstream oil and gas sector.

“The Kingdom has been very public about their appetite for the country, and the sectors are minerals and mining, IT, agriculture, tourism; and there are already investments which have come in. For example, Wafi came in (in terms of downstream oil and gas stations). There’s a very active pipeline.”

He said private sector activity is driving growth in these areas, while government-to-government cooperation is focused mainly on infrastructure development.

Acknowledging longstanding investor concerns related to bureaucracy and delays, Aurangzeb said Pakistan has made progress over the past two years through structural reforms and fiscal discipline, alongside efforts to improve the business environment.

“The last two years we have worked very hard in terms of structural reforms, in terms of what I call getting the basic hygiene right, in terms of the fiscal situation, the current economic situation (…) in terms of all those areas of getting the basic hygiene in a good place.”

Aurangzeb highlighted mining and refining as key areas of engagement, including discussions around the Reko Diq project, while stressing that talks with Saudi investors extend beyond individual ventures.

“From my perspective, it’s not just about one mine, the discussions will continue with the Saudi investors on a number of these areas.”

He also pointed to growing cooperation in the IT sector, particularly in artificial intelligence, noting that several Pakistani tech firms are already in discussions with Saudi counterparts or have established offices in the Kingdom.

Referring to recent talks with Saudi Minister of Economy and Planning Faisal Alibrahim, Aurangzeb said Pakistan’s large freelance workforce presents opportunities for deeper collaboration, provided skills development keeps pace with demand.

“I was just with (Saudi) minister of economy and planning, and he was specifically referring to the Pakistani tech talent, and he is absolutely right. We have the third-largest freelancer population in the world, and what we need to do is to ensure that we upscale, rescale, upgrade them.”

Aurangzeb also cited opportunities to benefit from Saudi Arabia’s experience in the energy sector and noted continued cooperation in defense production.

Looking ahead, he said Pakistan aims to recalibrate its relationship with Saudi Arabia toward trade and investment rather than reliance on aid.

“Our prime minister has been very clear that we want to move this entire discussion as we go forward from aid and support to trade and investment.”