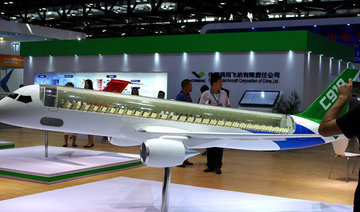

SHANGHAI: China’s self-developed C919 passenger jet completed its first long-distance flight on Friday, in a milestone that its manufacturer said marks the plane’s move into an airworthiness certification phase.

The Commercial Aircraft Corp. of China (COMAC) said in a statement the C919 flew for 2 hours and 23 minutes from Shanghai to the central Chinese city of Xi’an, traveling more than 1,300 kilometers and reaching an altitude of 7,800 meters.

The jet, which China wants to compete with Boeing’s 737 and the Airbus A320, is a symbol of China’s civil aerospace ambitions. It will remain in Xi’an to undergo further testing, the planemaker said.

“This ferry flight indicates that the C919 possess the ability to fly inter-city routes,” COMAC said in the statement. “(It) marks the move into research and development flight-testing and airworthiness certification work.”

The latest flight is the plane’s sixth test since it flew for the first time on May 5. Analysts had questioned the long time gaps between previous test flights.

COMAC is aiming to obtain certification for the plane from Chinese regulators as well as Europe’s aviation safety regulator, which in April agreed to start the certification process.

COMAC said it planned to eventually test six C919 planes and will carry out the first flight for its second jet by the end of this year. The plane currently has 27 customers who have placed orders and commitments for 730 jets, it added.

China’s C919 passenger jet completes first long-distance flight

China’s C919 passenger jet completes first long-distance flight

Emerging markets should depend less on external funding, says Nigeria finance minister

RIYADH: Developing economies must rely less on external financing as high global interest rates and geopolitical tensions continue to strain public finances, Nigeria’s finance minister told Al-Eqtisadiah.

Asked how Nigeria is responding to rising global interest rates and conflicts between major powers such as the US and China, Wale Edun said that current conditions require developing countries to rethink traditional financing models.

“I think what it means for countries like Nigeria, other African countries, and even other developing countries is that we have to rely less on others and more on our own resources, on our own devices,” he said on the sidelines of the AlUla Conference for Emerging Market Economies.

He added: “We have to trade more with each other, we have to cooperate and invest in each other.”

Edun emphasized the importance of mobilizing domestic resources, particularly savings, to support investment and long-term economic development.

According to Edun, rising debt servicing costs are placing an increasing burden on developing economies, limiting their ability to fund growth and social programs.

“In an environment where developing countries as a whole — what we are paying in debt service, what we are paying in terms of interest costs and repayments of our debt — is more than we are receiving in what we call overseas development assistance, and it is more than even investments by wealthy countries in our economies,” he said.

Edun added that countries in the Global South are increasingly recognizing the need for deeper regional integration.

His comments reflect growing concern among developing nations that elevated borrowing costs and global instability are reshaping development finance, accelerating a shift toward domestic resource mobilization and stronger economic ties among emerging markets.