BENGALURU: Tesla said on Friday it has increased its borrowing capacity for a car lease program to $1.1 billion from $600 million.

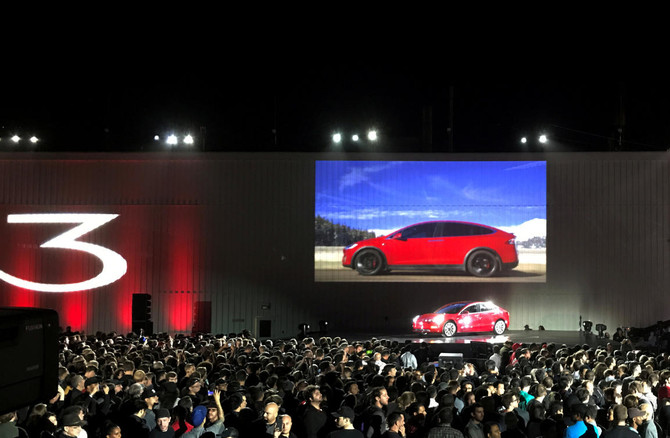

The move comes as the electric car maker spends heavily to fix production bottlenecks of its new Model 3 sedan.

The company increased the borrowing capacity under certain warehouse agreements, the company said in a filing. A spokesman said it was related to Tesla’s car lease program.

In August, Tesla said it would raise about $1.5 billion through its first-ever offering of junk bonds as it seeks fresh sources of cash to ramp up production of its new Model 3 sedan.

Tesla raises borrowing capacity for car leases to $1.1 billion

Tesla raises borrowing capacity for car leases to $1.1 billion

AI will never replace human creativity, says SRMG CEO

- Speaking to Maya Hojeij, senior business anchor at Asharq with Bloomberg, Jomana R. Alrashid expressed pride in SRMG platforms that had absorbed and adopted AI

RIYADH: Jomana R. Alrashid, CEO of Saudi Research and Media Group, highlighted how AI cannot replace human creativity during a session at The Family Office’s “Investing Is a Sea” summit at Shura Island on Friday.

“You can never replace human creativity. Journalism at the end of the day, and content creation, is all about storytelling, and that’s a creative role that AI does not have the power to do just yet,” Alrashid told the investment summit.

“We will never eliminate that human role which comes in to actually tell that story, do the actual investigative reporting around it, make sure to be able to also tell you what’s news or what’s factual from what’s wrong ... what’s a misinformation from bias, and that’s the bigger role that the editorial player does in the newsroom.”

Speaking on the topic of AI, moderated by Maya Hojeij, senior business anchor at Asharq with Bloomberg, the CEO expressed her pride in SRMG platforms that had absorbed and adopted AI in a way that was “transformative.”

“We are now translating all of our content leveraging AI. We are also now being able to create documentaries leveraging AI. We now have AI-facilitated fact-checking, AI facilities clipping, transcribing. This is what we believe is the future.”

Alrashid was asked what the journalist of the future would look like. “He’s a journalist and an engineer. He’s someone who needs to understand data. And I think this is another topic that is extremely important, understanding the data that you’re working with,” she said.

“This is something that AI has facilitated as well. I must say that over the past 20 years in the region, especially when it comes to media companies, we did not understand the importance of data.”

The CEO highlighted that previously, media would rely on polling, surveys or viewership numbers, but now more detailed information about what viewers wanted was available.

During the fireside session, Alrashid was asked how the international community viewed the Middle Eastern media. Alrashid said that over the past decades it had played a critical role in informing wider audiences about issues that were extremely complex — politically, culturally and economically — and continued to play that role.

“Right now it has a bigger role to play, given the role again of social media, citizen journalists, content creators. But I also do believe that it has been facilitated by the power that AI has. Now immediately, you can ensure that that kind of content that is being created by credible, tier-A journalists, world-class journalists, can travel beyond its borders, can travel instantly to target different geographies, different people, different countries, in different languages, in different formats.”

She said that there was a big opportunity for Arab media not to be limited to simply Arab consumption, but to finally transcend borders and be available in different languages and to cater to their audiences.

The CEO expressed optimism about the future, emphasizing the importance of having a clear vision, a strong strategy, and full team alignment.

Traditional advertising models, once centered on television and print, were rapidly changing, with social media platforms now dominating advertising revenue.

“It’s drastically changing. Ultimately in the past, we used to compete with one another over viewership. But now we’re also competing with the likes of social media platforms; 80 percent of the advertising revenue in the Middle East goes to the social media platforms, but that means that there’s 80 percent interest opportunities.”

She said that the challenge was to create the right content on these platforms that engaged the target audiences and enabled commercial partnerships. “I don’t think this is a secret, but brands do not like to advertise with news channels. Ultimately, it’s always related with either conflict or war, which is a deterrent to advertisers.

“And that’s why we’ve entered new verticals such as sports. And that’s why we also double down on our lifestyle vertical. Ultimately, we have the largest market share when it comes to lifestyle ... And we’ve launched new platforms such as Billboard Arabia that gives us an entry into music.”

Alrashid said this was why the group was in a strong position to counter the decline in advertising revenues across different platforms, and by introducing new products.

“Another very important IP that we’ve created is events attached to the brands that have been operating in the region for 30-plus years. Any IP or any title right now that doesn’t have an event attached to it is missing out on a very big commercial opportunity that allows us to sit in a room, exchange ideas, talk to one another, get to know one another behind the screen.”

The CEO said that disruption was now constant and often self-driving, adding that the future of the industry was often in storytelling and the ability to innovate by creating persuasive content that connected directly with the audience.

“But the next disruption is going to continue to come from AI. And how quickly this tool and this very powerful technology evolves. And whether we are in a position to cope with it, adapt to it, and absorb it fully or not.”