As part of the continued partnership between YouGov and Arab News to research attitudes within and about the Arab world, YouGov conducted an opinion poll among Saudi nationals about their views of the decision to allow women to drive in the Kingdom.

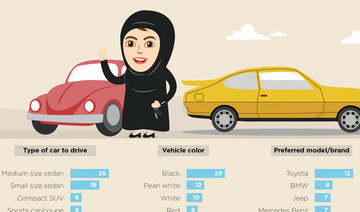

Topics were designed to capture a range of views, including the current level of familiarity with the decision, initial reactions to it, reasons for agreeing or disagreeing with the move, the impact of women driving, reasons for women wanting or not wanting to drive in KSA, and their car-purchase intentions.

The survey was conducted using an online interview administered among members of the YouGov Plc panel of close to 728,500+ individuals across the MENA region who have agreed to take part in surveys.

An email was sent to panelists selected at random from the base sample, inviting them to take part in the survey and providing a link to the survey. All figures, unless otherwise stated, are from YouGov.

The total sample size was 503 Saudi nationals who reside in the Kingdom. Fieldwork was undertaken between Oct. 1-4, 2017.

The sample was representative of the urban adult Saudi population in terms of gender, age and city of residence. The overall margin of error is 4.38 percent, which is under the admissible level.

The questionnaire included a total of 21 close-ended questions. The effective number of questions applicable per respondent groups were, however, different as they were filtered mainly based on gender.

There was an even gender split among respondents, with 50 percent males and 50 percent females. Eight in 10 of the sample group fell between the ages of 20 and 39.

The sample included residents of Riyadh (26 percent), Jeddah (19 percent) Dammam (9 percent) and other cities in Saudi Arabia.

• For full report and related articles please visit: #SaudiWomenCanDrivePoll