HOUSTON: A number of key Texas refineries worked to reopen or resume normal operations on Saturday, a week after Hurricane Harvey knocked out nearly one quarter of the US refining capacity and sent gasoline prices to two-year highs.

While much of the region’s refining infrastructure still remained offline from Harvey, which made landfall as a Category 4 hurricane last week and drenched Texas as a tropical storm, the restarts were a first step in alleviating concerns about US fuel supplies.

Exxon Mobil said it was restarting its 560,500 barrel per day (bpd) facility in Baytown, Texas, the second-biggest US oil refinery, after it was inundated by flooding.

Phillips 66 said it was working to resume operations at its 247,000 bpd Sweeny refinery as well as its Beaumont terminal.

The announcements come after Valero Energy said late on Friday it was ramping up production at its Corpus Christi, Texas-area refineries, as well as evaluating its 335,000 bpd Port Arthur, Texas, refinery for damage from Harvey. The refinery was shut on Wednesday.

Retail gasoline prices have risen more than 17.5 cents since August 23, before Harvey hit, amid worries the storm would trigger supply shortages.

Pump prices were at $2.59 a gallon on Saturday, according to motorists advocacy group AAA, up 3 percent from Friday and 16.7 percent higher on average than a year ago.

In another positive sign for the industry, Occidental Petroleum said it had loaded and shipped the first crude cargo from its Ingleside terminal in Corpus Christi after Hurricane Harvey first made landfall.

The Port of Corpus Christi, a major energy industry shipping hub, was partially open and hoped to resume normal operations next week, officials said.

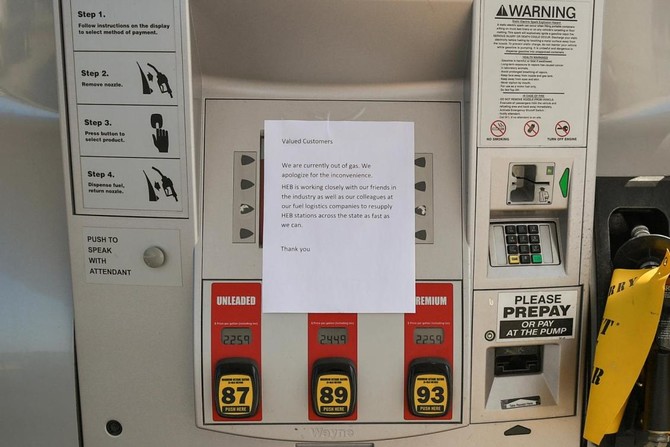

But much energy infrastructure remained offline, including the largest US refinery, the 603,000 bpd facility in Port Arthur, Texas, owned by Motiva Enterprises. Motiva has told customers to prepare for fuel shortages, said a source at convenience store and gas station chain Circle K.

In some Texas cities, including Dallas, there were long lines at gas stations on Friday.

At a QMart filling station west of Houston on Saturday, cars were clogging the pumps soon after a tanker arrived to replenish its pumps.

“We had a half a tank, but decided to get more, just in case,” said Maria Linares, a school teacher whose husband was topping their car’s tank.

The Phillips 66 brand station has not raised its fuel prices since before Harvey, said Assistant Manager Jalal Sadruddin, by policy of the station owner, Q-Mart.

“Right now, we have about 4,000 gallons, maybe two or three days’ worth,” he said. The station received a tanker load of gasoline on Saturday but was out of diesel, he said. An Exxon brand station across the street was out of fuel.

“In all this area, no one has it but us,” Sadruddin said.

Nearly half of US refining capacity is in the Gulf Coast region, an area with proximity to plentiful supplies from Texas oil fields to Mexican and Venezuelan oil imports. The majority of Texas ports remained closed to large vessels, limiting discharge of imported crude.

Texas refineries begin restart after hit from Hurricane Harvey

Texas refineries begin restart after hit from Hurricane Harvey

First EU–Saudi roundtable on critical raw materials reflects shared policy commitment

RIYADH: The EU–Saudi Arabia Business and Investment Dialogue on Advancing Critical Raw Materials Value Chains, held in Riyadh as part of the Future Minerals Forum, brought together senior policymakers, industry leaders, and investors to advance strategic cooperation across critical raw materials value chains.

Organized under a Team Europe approach by the EU–GCC Cooperation on Green Transition Project, in coordination with the EU Delegation to Saudi Arabia, the European Chamber of Commerce in the Kingdom and in close cooperation with FMF, the dialogue provided a high-level platform to explore European actions under the EU Critical Raw Materials Act and ResourceEU alongside the Kingdom’s aspirations for minerals, industrial, and investment priorities.

This is in line with Saudi Vision 2030 and broader regional ambitions across the GCC, MENA, and Africa.

ResourceEU is the EU’s new strategic action plan, launched in late 2025, to secure a reliable supply of critical raw materials like lithium, rare earths, and cobalt, reducing dependency on single suppliers, such as China, by boosting domestic extraction, processing, recycling, stockpiling, and strategic partnerships with resource-rich nations.

The first ever EU–Saudi roundtable on critical raw materials was opened by the bloc’s Ambassador to the Kingdom, Christophe Farnaud, together with Saudi Deputy Minister for Mining Development Turki Al-Babtain, turning policy alignment into concrete cooperation.

Farnaud underlined the central role of international cooperation in the implementation of the EU’s critical raw materials policy framework.

“As the European Union advances the implementation of its Critical Raw Materials policy, international cooperation is indispensable to building secure, diversified, and sustainable value chains. Saudi Arabia is a key partner in this effort. This dialogue reflects our shared commitment to translate policy alignment into concrete business and investment cooperation that supports the green and digital transitions,” said the ambassador.

Discussions focused on strengthening resilient, diversified, and responsible CRM supply chains that are essential to the green and digital transitions.

Participants explored concrete opportunities for EU–Saudi cooperation across the full value chain, including exploration, mining, and processing and refining, as well as recycling, downstream manufacturing, and the mobilization of private investment and sustainable finance, underpinned by high environmental, social, and governance standards.

From the Saudi side, the dialogue was framed as a key contribution to the Kingdom’s industrial transformation and long-term economic diversification agenda under Vision 2030, with a strong focus on responsible resource development and global market integration.

“Developing globally competitive mineral hubs and sustainable value chains is a central pillar of Saudi Vision 2030 and the Kingdom’s industrial transformation. Our engagement with the European Union through this dialogue to strengthen upstream and downstream integration, attract high-quality investment, and advance responsible mining and processing. Enhanced cooperation with the EU, capitalizing on the demand dynamics of the EU Critical Raw Materials Act, will be key to delivering long-term value for both sides,” said Al-Babtain.

Valere Moutarlier, deputy director-general for European industry decarbonization, and directorate-general for the internal market, industry, entrepreneurship and SMEs at European Commission, said the EU Critical Raw Materials Act and ResourceEU provided a clear framework to strengthen Europe’s resilience while deepening its cooperation with international partners.

“Cooperation with Saudi Arabia is essential to advancing secure, sustainable, and diversified critical raw materials value chains. Dialogues such as this play a key role in translating policy ambitions into concrete industrial and investment cooperation,” she added.