BEIJING/SHANGHAI: China will strengthen rules to defuse risks for domestic companies investing abroad and curb “irrational” overseas investment on its Belt and Road initiative, the state planner said on Friday.

The National Development and Reform Commission (NDRC) said in an online statement lauding the Belt and Road initiative that it would provide better guidance on risks to companies investing overseas in order to prevent “vicious” competition and corruption.

The state planner also cited unspecified security risks for Chinese companies investing abroad.

The NDRC did not give more details about how it planned to strengthen current rules or why it was concerned about corruption and unhealthy competition between companies.

Mergers and acquisitions by Chinese companies in countries linked to the Belt and Road initiative have been growing at a rapid rate, even as Beijing takes aim at China’s acquisitive conglomerates to restrict capital outflows.

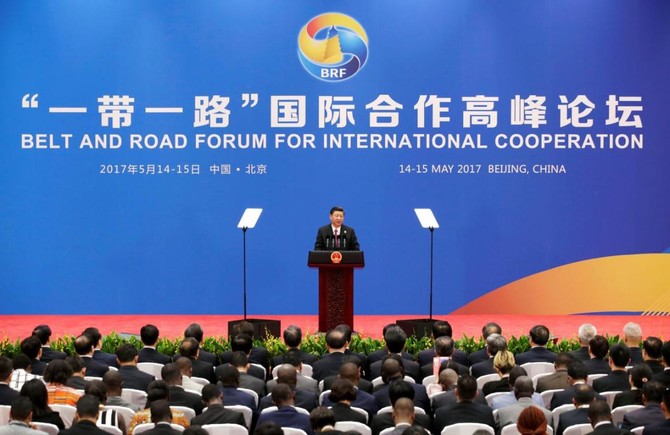

Unveiled in 2013, the Belt and Road project aims to boost trade and investment along two routes — one along the ancient “Silk Road”, connecting China by land and sea through Central Asia and the Middle East to Europe, and the second linking it to Southeast Asia and Africa.

However, the initiative has also come with some security concerns for China. This year, militants in Pakistan, a key Belt and Road partner, killed 10 workers and two teachers from China.

The largest deal in a Belt and Road country so far this year was a Chinese consortium’s $11.6 billion buyout of the Singapore-based Global Logistics Properties.

Chinese acquisitions in the 68 countries officially associated with President Xi Jinping’s signature foreign policy totaled $33 billion as of August 14, surpassing the $31 billion for all of 2016, according to Thomson Reuters data.

Lawyers and dealmakers had told Reuters that companies were enjoying a relatively smooth approval process for Belt and Road-related deals as regulators tended to classify them differently when reviewing outbound investments.

China has tightened outbound capital controls and cracked down on overseas deals it sees as risky, putting pressure on acquisitive conglomerates like Anbang Insurance Group, HNA Group, Dalian Wanda Group and Fosun International Ltd.

In the statement Friday, the NDRC cited projects such as a high-speed railway in Indonesia and a crude oil pipeline between southwest China and Myanmar as examples of how the initiative was advancing.

Up to the end of 2016, Chinese companies had invested more than $18.5 billion to build economic and trade cooperation zones in 20 countries along the Belt and Route routes, it said.

China to curb ‘irrational’ overseas Belt and Road investment

China to curb ‘irrational’ overseas Belt and Road investment

Arab Cities Culture and Creative Industries Index launched

- UNESCO official says the index ‘strengthens the evidence base on culture and creative industries in the Arab region’

- It is planned as an advanced policy-enabling tool designed to position culture and creative industries as core components of future governance models

DUBAI: The Mohammed bin Rashid School of Government launched the 2026 edition of the Arab Cities Culture and Creative Industries Index on Wednesday.

Building on UNESCO’s frameworks to quantify the contributions that culture and creativity make to urban development in the Arab region, the index is the first regionally grounded and evidence-based framework.

Ernesto Ottone Ramirez, UNESCO’s assistant director-general for culture; Hala Badri, director-general of Dubai Culture; and Ali Al-Marri, MBRSG’s executive president, attended a special panel at the World Governments Summit in Dubai, during which the index was announced.

Welcoming the launch of the Index, Ramirez said: “It strengthens the evidence base on culture and creative industries in the Arab region, providing reliable, comparable, and policy-relevant figures.

“Such data is essential to guide public investment, inform decision-making, support inclusive cultural policies, and monitor culture’s contribution to sustainable development.”

The launch marks a definitive transition from ambition-led strategies to data-informed cultural policymaking, according to Al-Marri, who said: “By positioning culture as a core component of governance and a productive economic sector with measurable impact, we provide Arab cities with the tools to benchmark their creative ecosystems against global standards while respecting our unique regional context.”

According to a media release, the index is planned as an advanced policy-enabling tool designed to position culture and creative industries as core components of future governance models, marking a significant paradigm shift in which culture is recognized not merely as a social asset but as a strategic pillar of economic resilience, innovation, and inclusive growth.

Badri emphasized that the launch of the index represents an important step in highlighting culture’s role in advancing societies and positioning the cultural and creative industries as key contributors to the emirate’s knowledge- and innovation-driven economy.