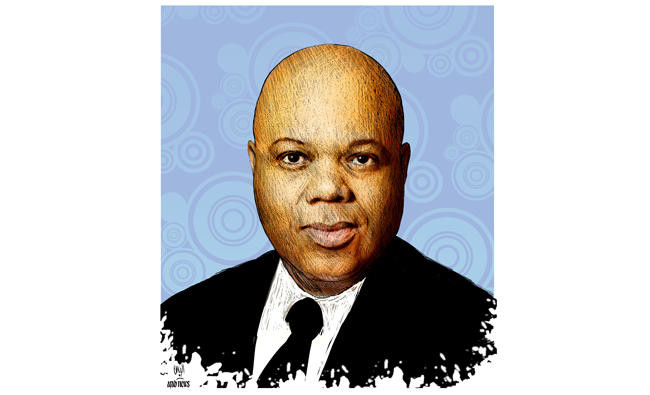

DUBAI: It is an exciting but unpredictable time for US-Saudi Arabia relations, and Edward Burton is at the heart of it. “I think one can say the reset button has been officially and earnestly pushed by both sides,” he said.

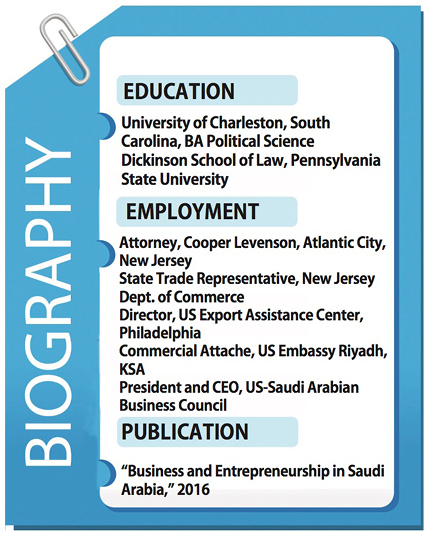

Burton, a political scientist and lawyer by training and a one-time diplomat as commercial attache in the US Embassy in Riyadh, is now president and chief executive of the US-Saudi Arabian Business Council (USSABC), based in Washington and which also has offices in Riyadh.

The council’s aim is to maintain and promote economic and commercial ties between the two countries, and to encourage reciprocal bilateral investment. It was set up in 1993, and Burton took over in 2006.

“Over the years, our council has evolved from being primarily a public-information provider and business-event organizer, to a full-service corporate-membership-driven consultancy,” he said. It counts 400 of the biggest names in business in the US and the Kingdom on its membership roll.

“It’s also important to understand that we are a bilateral council, which means we not only assist American companies in entering the Saudi market, but we also assist Saudi companies to do business in the US,” he added.

At the moment, business is buzzing. The visit of US President Donald Trump to Riyadh in May and the billions of dollars of deals signed then were seen as heralding a new age in the relationship between the two countries, which was sometimes strained under previous US administrations.

“It is somewhat difficult to understate the level of enthusiasm held generally by Saudis for what is being viewed as a new beginning for relations with the US, owing not only to President Trump’s visit to the Kingdom, but a much broader and more meaningful engagement with Saudi Arabia by the new administration,” Burton said.

“There is a renewed sense of optimism and real intent to extend the already formidable and deep economic and commercial ties companies and public-sector entities share between the two countries. American companies that have been doing business in Saudi Arabia for decades are putting their investment capital into the Kingdom’s economic roadmap that will take it to a new Saudi Arabia under Vision 2030. Today, the two nations enjoy a special partnership centered upon the pillars of security, energy cooperation, and mutually beneficial business ties,” he added.

But there is a cloud on the horizon of this generally benign outlook: The diplomatic and commercial standoff between the Anti-Terror Quartet — Saudi Arabia, the UAE, Bahrain and Egypt — and Qatar over Doha’s alleged funding of global terrorism.

Burton points out that the USSABC does not usually involve itself in political issues, unless they directly impact business relationships, but he does offer a personal perspective as a former top-level diplomat in the region.

“I held ‘top secret’ security clearance during my time (in the diplomatic) post and was entrusted with various levels of classified information on a variety of subject matters, but then and now, no security clearance is required to understand that Iran has posed a real threat to peace and security for a number of nations in the region, including Saudi Arabia. I witnessed first-hand and close-up the horrible impact terrorism has wrought within Saudi borders,” he said.

While Burton does not rule out an escalation in the confrontation — “every nation has the sovereign right to guard its borders and protect itself from harmful influences and threats from any neighbor,” he said — he does not think it will affect crucial trading relationships in the region. “I foresee no negative impact in terms of business relations,” he emphasized.

The economic transformation underway in the Kingdom has certainly caught the attention of the US business community, but what of ordinary Americans? Are they beginning to see Saudi Arabia in a new light?

“The United States is such a large and diverse country, I know it is somewhat unrealistic to expect most Americans to be aware of the profound economic and societal changes occurring in the Kingdom today,” Burton said. But there has been a trickle-down effect from the increasingly frequent visits to the US by top Saudi policymakers, especially those by Crown Prince Mohammed bin Salman.

“More business and political leaders are cognizant of what’s happening in the Kingdom. But, also, these well-publicized visits by Saudi leaders are widening the attention span of ordinary Americans as to the tremendous changes occurring in Saudi Arabia today,” he said.

The Riyadh meetings in May — held during Trump’s visit to the Kingdom — were deemed a great success by all sides, but some industry skeptics cast doubt on the ultimate practicality of the huge deals announced at the time, questioning whether there was a real determination to see them through to fruition.

Burton does not see it like that, instead believing that there is a new determination to implement these and other transactions. “My optimism is based upon the Saudi realization of how important follow-up is to having future successes materialize … the Saudi CEO Summit featured numerous business deals that had been in the works and in the negotiation phase for some time prior to the actual summit,” he said.

“We are in contact with some of our member companies that signed deals in Riyadh during the May summit. These companies are working to implement the agreements that were inked. These deals have their own timelines, but we are confident that with the proper attention, they will all come to contribute to the economic and employment gains aspired to for such deals in Saudi Arabia.”

Deals in the defense sector dominated the Riyadh announcement, which Burton thought was only to be expected, given the fact that “Saudi Arabia is the United States’ largest foreign military sales customer.”

But future business will not be limited to military hardware, he said. “Given the priorities as outlined in Vision 2030, there are so many other industry sector opportunities for global competitors to take advantage of that it almost defies brevity in description.

“Besides the stalwart mainstays of the Saudi industrial and business base — such as oil and gas, petrochemicals, medical and health care, real estate, consumer goods and foodstuffs — we view broad-based industrial manufacturing and infrastructure development as areas holding particular promise for long-term profit potential for competitive US companies,” Burton said.

He sees opportunities especially in domestic manufacturing, which has grown by 15 percent over the past year, with an emphasis on “localization” — focusing on developing industrial clusters that employ Saudi citizens and which source their suppliers from the local market.

He points to the growing power of cities like Dammam in the Eastern Province as an industrial ecosystem for manufacturing and distribution, and increasing American commercial partnerships.

Big US firms like Dow Chemical and Bechtel are already prominently involved in Saudi industry, and American companies have big shares of the markets for construction and transport projects, second only to Saudi firms themselves.

There is more work to be done by Americans in energy and utilities projects, where US partners lag behind South Korean and some European countries, Burton pointed out.

Talk of the energy sector inevitably turns to the oil industry, and the big question on the minds of many business and financial people in the US and Kingdom is: Where will Saudi Aramco choose to list its shares in the initial public offering (IPO) being planned for next year, in what will be the biggest share flotation in history, with up to $100 billion of equity to be listed on global exchanges as well as on Riyadh’s Tadawul.

The IPO process is getting down to the crucial issue of whether the New York Stock Exchange (NYSE) or London Stock Exchange (LSE) would be the better venue in the West. Recent reports suggest that, while some advisers think London is the better market, with the LSE showing signs of flexibility to accommodate Aramco’s record-breaking share issue, the final decision will be as much a political one as an investment choice. The US-Saudi “reset” would seem to give New York the upper hand in this regard.

Burton is well aware of the importance of the decision. “The IPO is the most anticipated event in global equity markets in recent history. The speculative milieu of this event is fostering its own brand of urban legend within the world’s financial services community,” he said.

He added, “I would not presume to add to the speculation, as only those very high up in Saudi leadership, Saudi Aramco and those financial services firms hired by the Kingdom are truly in the know.” However, he believes there are a couple of safe assumptions on the subject.

“First, NYSE is one of the world’s leading securities markets in the running to offer a piece of Saudi Aramco for the first time to the public. Other exchanges such as the LSE are also in hot pursuit of this historic business. These are two of the most developed and mature global equity markets in the world offering access to a definitive phalanx of capital investing elites,” he said.

“Second, for Saudi Aramco, an international listing of what is expected to be around 5 percent of its assets means the type of investor scrutiny the company is not used to historically. It will need to come out displaying the kind of transparency many Saudi companies are unaccustomed to routinely offering.

“Disclosing essential information such as precise oil reserves and full financial disclosure will be the order of the day for Saudi Aramco if compliance to the rules of exchanges such as the NYSE and the LSE are to be observed.

“For example, a listing on the NYSE would mean Saudi Aramco would have to undergo a complete audit by the US Securities and Exchange Commission. Perhaps a bridge too far for the world’s largest oil company. There is talk of the LSE somewhat relaxing its stringent rules to accommodate the Saudi Aramco listing, however, that remains to be seen,” he added.

But there is no doubt as to what Burton would like to see happen. “I am hoping that the final decision turns on the promise the new dawn of US-Saudi relations holds for two of the world’s top-20 economies. Having Saudi Aramco’s IPO served up on the NYSE would further solidify the decades-old intertwining of these two great countries,” he added.

New York listing for Saudi Aramco will set seal on ‘new dawn’ in Saudi-US ties — exec

New York listing for Saudi Aramco will set seal on ‘new dawn’ in Saudi-US ties — exec

Crown prince sponsors launch of world-class Arabic calligraphy center in Madinah

- The Prince Mohammed bin Salman Global Center for Arabic Calligraphy was inaugurated by Prince Salman bin Sultan bin Abdulaziz

RIYADH: A new center for Arabic calligraphy under the patronage of Crown Prince Mohammed bin Salman officially opened in Madinah on Monday.

The Prince Mohammed bin Salman Global Center for Arabic Calligraphy was inaugurated by Prince Salman bin Sultan bin Abdulaziz, governor of Madinah region.

He was joined by Culture Minister Prince Badr bin Abdullah bin Farhan, touring the new facility’s exhibition spaces and receiving briefings on cultural programming and the center’s achievements.

They also viewed collections highlighting Arabic calligraphy’s artistic and historical importance.

Speaking at the opening, Prince Badr said: “From this land of enlightenment and scholarship, we proudly launch a global platform dedicated to Arabic calligraphy as an invaluable cultural asset.”

He went on to credit the crown prince’s “generous and boundless support” for the cultural sector.

The minister said that the center demonstrated to the world the legacy of Arabic calligraphy while underscoring Saudi Arabia’s commitment to safeguarding its cultural identity and heritage.

According to Prince Badr, the facility represents an ambitious vision to elevate Arabic calligraphy as both a universal communication tool and an integral element of Arab heritage, art, architecture and design.

The center further aims to enhance the Kingdom’s cultural identity and strengthen its international presence, targeting calligraphers, emerging talents, visual artists, Islamic arts researchers, educational and cultural institutions, as well as art and heritage enthusiasts worldwide.

It will deliver specialized programs including research and archival services, calligraphy instruction, academic grants, a permanent museum, touring exhibitions, an international calligraphy association and a business incubator supporting calligraphy enterprises.

Additional offerings feature artist residency programs, expert-led workshops, and standardized curriculum development, complemented by international educational partnerships aimed at heritage conservation and expanding global appreciation for this time-honored art form.

The center’s establishment in Madinah carries particular significance, given the city’s historical role as the cradle of Arabic calligraphy and its association with transcribing the Qur’an and preserving Islamic knowledge.