LONDON: Five years into the great financial crisis, private investment in rich countries is still dead in the water, underlining the depth of the downturn and offering fresh evidence of the global economic tilt to emerging markets.

By 2011, private investment as a share of 2007 GDP had fallen 3.4 percent in the US, 3.8 percent in Japan and 2.9 percent in the 27 countries of the European Union, according to data compiled by McKinsey Global Institute (MGI), the consultancy firm’s research arm.

No other component of GDP dropped anywhere near as sharply in any of the three economies. Investment is the seed corn of growth, so the consequences are potentially ominous.

“The slump in investment in Europe is not only constraining current GDP growth but could also cause long-term damage to the continent’s economic capacity,” MGI said in a report analyzing the dearth of investment in Europe.

On one level, it is not surprising that businesses are pulling in their horns.

Uncertainty about US tax and spending policy, questions about the very future of the euro zone and Japan’s shrinking population are all good reasons to give managers pause for thought before expanding anew after the deepest global recession in 80 years. Consumer confidence is low.

On another level, though, the extent of the retrenchment is puzzling. Businesses are sitting on huge cash piles and profits have risen sharply as a share of GDP in the United States, Japan and Canada.

Yet private investment in the EU is today nearly 15 percent below its 2007 level. Only in Poland has it risen. In Spain and Ireland, hard hit by the euro zone crisis, private investment has slumped 27 percent and 64 percent respectively. But Britain and France have also recorded sharp falls.

Overall, MGI calculates, non-government capital spending in the EU between 2007 and 2011 shrank by an unprecedented 350 billion euros — 20 times the drop in private consumption and four times the decline in real GDP.

While Germany, Belgium, Austria and Sweden have almost joined Poland in regaining pre-crisis investment levels, the EU as a whole is running well behind the average rate of recovery based on an analysis of past recessions, according to MGI.

In Greece and Spain, private investment had not yet begun to rise again by the end of 2011.

Economists Stephen King and Madhur Jha at HSBC said rising tax burdens as well as prolonged economic weakness might explain why corporate profitability, and hence investment, has been hurt in countries such as Britain and Germany.

But that argument does not hold water for America and Japan.

King and Jha hypothesized that multinational companies are ploughing capital instead into more attractive emerging markets, especially developing Asia, where investments as a share of profits have continued to rise sharply.

If they are right, it would be another example of how the center of economic gravity is switching to East from West.

“As the ‘old world’ has to deal with the myriad uncertainties of the post-crisis world, the global economy is going through a period of profound restructuring which has undermined the traditional rules of the economic game,” King and Jha wrote in a report.

So what can be done?

Andrew Smithers, who runs an eponymous consultancy in London, has long argued that executives in the US and Britain have no incentive to invest for the long term in plant and machinery because their pay packets are linked to short-term shareholder returns.

“In both countries the bonus culture means that management is paid not to invest and to keep profit margins high,” he told clients. Reform is needed.

With government budgets tight, debate is intensifying on how to catalyze more private spending on infrastructure such as power and transport.

Britain is toying with the idea of introducing more widespread motorway charging to unlock investment by regulated private operators.

Georg Zachmann with Bruegel, a Brussels think tank, suggested a temporary role for publicly owned banks to mitigate the increased post-crisis risk of infrastructure investment.

At the EU level, a pilot program for the issuance of up to 230 million euros in government-guaranteed project bonds could be ramped up to lower the cost of borrowing, Zachmann added.

McKinsey Global Institute does not want a return to the days when government tried to ‘pick winners’.

But it sees substantial scope to accelerate capital spending in Europe by cutting red tape. For instance, the consultancy believes that private investment is available and ready to finance the expansion of airport infrastructure if regulatory barriers were removed.

Retrofitting existing buildings and improving the energy efficiency of new buildings, to help Europe meet its 2020 energy targets, could lead to roughly 37 billion euros a year of extra investment, MGI said.

In retailing, planning rules in many countries limit the growth of more-productive large-format stores; in construction, fussy specifications make some projects inefficient and expensive; in transport, there are 11 separate signaling systems for rail freight in the original 15-country EU core.

“Twinning macroeconomic policy with microeconomic reforms can help to ensure that companies revive their investment plans on a sufficiently large scale for their spending to become a material driver of a robust recovery,” MGI concluded.

Rich countries still hit by private investment slump

Rich countries still hit by private investment slump

Oil creeps back up after three days of losses

Oil prices crept up on Thursday, clawing back some of the previous three days’ losses.

The gains were made despite the US Federal Reserve entertaining a further tightening of interest rates if inflation remains sticky, a move that could hurt oil demand.

Brent crude futures were up 92 cents, or 1.1 percent, at $82.82 a barrel by 1317 GMT. US West Texas Intermediate crude futures were 97 cents, or 1.3 percent, higher at $78.54. Both benchmarks fell more than 1 percent on Wednesday for their third straight day of losses.

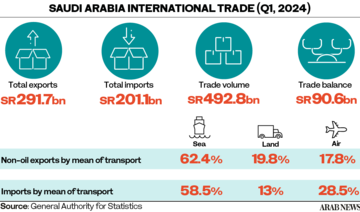

Saudi crude exports

Saudi Arabia’s crude exports reached 6.41 million barrels per day in March, according to an analysis from the Joint Organizations Data Initiative.

This figure increased by 96,000 bpd, or 1.52 percent, compared to the previous month, marking a nine-month high. Furthermore, the data indicated that the Kingdom’s crude production fell to 8.97 million bpd, reflecting a monthly decrease of 0.42 percent.

This can be linked to the voluntary oil production cuts adopted by members of the Organization of the Petroleum Exporting Countries and their allies, known as OPEC+. Saudi Arabia announced in March the extension of its 1 million bpd cut, initially implemented in July 2023, until the end of the second quarter of 2024.

The Ministry of Energy said that the Kingdom’s production will be approximately 9 million bpd until the end of June.

Meanwhile, refinery crude output, representing the processed volume of crude oil yielding gasoline, diesel, jet fuel, and heating oil, fell by 4 percent compared to the previous month, reaching 2.56 million bpd, according to JODI data.

IMF demands Pakistan secure parliamentary approval on reforms for loan agreement— official

- Government will present “prior actions” needed to secure IMF loan in federal budget next month, says finance ministry official

- Leading economist says Pakistan left with no option but to secure IMF bailout to meet external financing needs of $80 billion

ISLAMABAD: The International Monetary Fund (IMF) has asked Pakistan to seek parliamentary approval on major economic reforms related to the energy, power, tax sectors and on the privatization of state-owned enterprises (SOEs) before starting formal talks for another loan program, a finance ministry official said on Thursday.

Facing low foreign exchange reserves, currency devaluation and high inflation, Pakistan last month completed a short-term $3 billion IMF program that helped stave off a sovereign default. However, the government of Prime Minister Shehbaz Sharif has stressed the need for a fresh, longer-term program with the global lender.

An IMF mission reached Islamabad last week to negotiate with Pakistani authorities for a fresh bailout program, holding talks with officials on reforms in key economic sectors. The mission is wrapping up its visit today, Thursday, without reaching any staff-level agreement with Islamabad.

The government would present the economic reforms demanded by IMF or “prior actions” in parliament in the Finance Bill 2024-25 likely to be presented on June 7, the finance ministry official with knowledge of the negotiations, said on condition of anonymity.

“The IMF has suggested authorities to get parliamentary approval for the new loan program’s targets and conditions before initiation of the formal talks,” the official told Arab News.

“In fact, these are the prior actions that Pakistan is required to take care of before reaching a staff-level agreement with the Fund for the new bailout package.”

The international lender has urged Islamabad to overhaul its SOEs and introduce tax, energy and power reforms. Pakistan has had to take painful measures in line with the IMF’s demands since 2022, which included hiking fuel and food prices.

The finance ministry official said the government intends to introduce key reforms in the energy and power sectors in line with the IMF’s demands, besides broadening the tax base through progressive initiatives.

“The government will take all parliamentary parties into confidence over the digitalization of the Federal Board of Revenue and the privatization of the SOEs,” he added.

Sajid Amin, a senior economist and deputy executive director at the Sustainable Development Policy Institute (SDPI), said the government had “no option but to secure the IMF loan program.” He said the IMF’s program was critical in helping Pakistan meet its external financing needs of around $80 billion in the next three years.

“The IMF wants political ownership of the loan program and that’s why it is pushing the government to get all the targets and conditions approved by the parliament,” Amin told Arab News.

“The biggest challenge for the government is to convince the coalition partners and opposition over its reforms agenda to secure the IMF loan,” he said.

Amin warned the upcoming IMF program would be the “toughest” one for the government as it would not be easy for it to complete it.

Goldman Sachs to establish regional headquarters in Riyadh: report

RIYADH: Goldman Sachs Group is set to become the first Wall Street bank to establish its regional headquarters in Saudi Arabia as it has reportedly obtained a license from the Ministry of Investment, reported Bloomberg.

As per the recently approved laws in Saudi Arabia, companies with state contracts must have a regional headquarters in the Kingdom with a minimum of 15 employees.

Arab News contacted the Investment Ministry to get a confirmation of the news but officials declined to comment.

It would be pertinent to mention here that Goldman Sachs currently has offices in Doha, Riyadh and Dubai.

Saudi Arabia has outperformed its target for attracting regional headquarters, with over 180 companies now established in the Kingdom. This number surpassed the initial goal of securing 160 HQs by the end 2023.

Saudi Arabia offers tax incentives for foreign companies that locate their regional headquarters in the Kingdom, including a 30-year exemption for corporate income tax.

The tax incentives include zero income tax for foreign entities that move their regional headquarters in the Kingdom, and these benefits can be availed from the date of the regional headquarters issuance license, according to Ministry of Investment.

Saudi Arabia issues 54 industrial licenses in March

RIYADH: Saudi Arabia maintained the issuance of over 300 industrial licenses in the first quarter of 2024, consistent with the previous year, official data has revealed.

According to a statement released from the Kingdom’s Ministry of Industry and Mineral Resources, as many as 324 industrial permits were issued in the first three months of the year, with 54 approvals issued in March alone.

The report further showed that the volume of investments in March amounted to SR1.047 billion ($279 million).

This falls in line with the Saudi Arabia’s ambition to transform mining into a foundational industrial pillar of the country’s economy.

It also aligns with the ministry’s goal to strengthen the sector as well as contribute to the ongoing developments in accordance with Vision 2030.

Moreover, the report, which was issued by the ministry’s National Industrial and Mining Information Center, disclosed that the permits in March were distributed across several sectors, including the manufacturing of non-metallic mineral and food products and formed metal goods as well as chemicals and paper and its products.

According to the analysis, the new industrial licenses were distributed among multiple regions, including the Eastern Province, Riyadh and Makkah, as well as Qassim, Jazan, Madinah, Al-Jouf, and Al-Baha.

The distribution of new permits shows that small enterprises comprised 77.78 percent, with medium-sized companies following at 22.22 percent.

In terms of the type of investments, national factories accounted for the largest percentage of the total licenses, with 98.15 percent, followed by foreign establishments with 1.85 percent.

Furthermore, the study also indicated that the number of factories existing and under construction in the Kingdom until the end of the same month reached 11,832 factories, up from 11,757 facilities in February, with an investment volume of SR1.528 trillion.

Meanwhile, 69 factories started production in March, with an investment volume of SR1.339 billion.

The ministry issues its report monthly to establish the sector’s most critical indicators in Saudi Arabia, demonstrating the extent of change and the growth of industrial investments.

In April, the Kingdom introduced the Mining Exploration Enablement Program, inviting global firms and explorers to participate in the initiative in an attempt to further expand the sector.

According to a statement at the time, Saudi Arabia’s Ministry of Industry and Mineral Resources and the Ministry of Investment extended invitations to international companies in the sector to register for the scheme.

The statement further added at the time that the program is expected to boost exploration activities, optimize the value extracted from the mining sector, and expand the Kingdom’s survey potential by focusing on uncharted territories.

Saudi Arabia to reshape global tourism landscape, says Al-Khateeb

RIYADH: Saudi Arabia is on track to change the map of tourism on a global level, according to a top minister.

Participating in a dialogue session on the sidelines of the 50th UN Tourism Regional Commission for the Middle East taking place from May 22 to 24 in Muscat, Saudi Tourism Minister Ahmed Al-Khateeb stressed that the Kingdom is working in cooperation with regional member states of the organization to further develop the industry, according to the Saudi Press Agency.

This is in line with Saudi Arabia’s National Tourism Strategy, which aims to reach 150 million visitors by 2030, grow the private sector’s contribution, and attract direct foreign investments, adding to the economic growth and diversification.

“The Kingdom will change the map of tourism in the world, and the opportunities and facilities that we provide to investors will make the tourism sector more attractive, and we are proceeding in a distinctive way in building the sector,” Al-Khateeb affirmed.

During the session, the minister also indicated that Saudi Arabia has begun to develop the tourism division as part of its Vision 2030 plan, noting that the development efforts have succeeded in raising the sector’s contribution from 3 percent of the local economy to 4.5 percent by the end of the last year.

Al-Khateeb also drew attention to the fact that the Middle East has great potential and natural resources that enable it to become one of the most important tourist destinations in the world.

He explained that the countries in the region are moving as a single bloc in the right direction regarding developing the tourism sector, as they have begun designing plans and strategies to benefit from this promising industry.

The minister highlighted that attracting and qualifying the national human resources are two important factors for developing the regional sector, stressing that the Saudi Ministry of Tourism pays great attention to the issue of qualifying national cadres working in the field.

The body also works to attract young men and women in the Kingdom to work in the industry.

In April, the deputy minister of destination enablement at the Ministry of Tourism said that Saudi Arabia is open to readjusting its goal of attracting 150 million visitors by 2030 if those numbers are achieved ahead of time.

Speaking in an interview with Arab News on the sidelines of the first day of the Future Hospitality Summit in Riyadh, Mahmoud Abdulhadi explained that goals are adjusted based on performance.

“As we hit our target seven years ahead of target, our 100 million target, we therefore now have a new goal. I’m sure if we were to hit that new target with a significant overperformance in terms of the timeline, our targets would also be adjusted,” Abdulhadi said.