JEDDAH: The private sector was able to improve annual hiring of Saudi nationals from an average of 64,000 between 2006 and 2010, to 92,000 between 2011 and 2014, according to a report from Jadwa Investment.

Between 2006 and 2014, the number of total jobs created in the private sector (for both Saudis and non-Saudis) was, on average, 214,000 per year, it added.

“This excludes 2010 as we believe the employment growth from that year to be inconsistent with the long-term trend,” said the Jadwa researchers, who compiled the report titled — Saudi labor market outlook: Current and long-term challenges.

The report looks into data for the period 2005 — H1 2015 and analyzes the dynamic trends in the Saudi labor market.

The Saudi unemployment rate fell slightly to 11.6 percent during the first half of 2015, despite year-on-year growth in total Saudi employment continuing to fall to 1.1 percent, said the report.

The slower growth in total Saudi employment was mainly due to slower hiring levels in the public sector, while Saudi employment growth in the private sector remained healthy, added the Jadwa report.

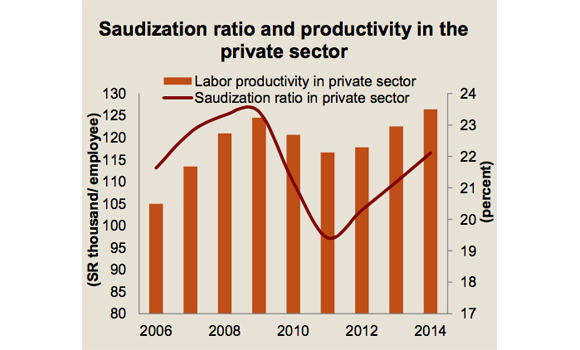

It said that 2014 full year data showed that the increase in Saudi employment and Saudization in the private sector was associated with positive growth in labor productivity in the sector.

Looking forward, the economists forecast three scenarios for employment of Saudi nationals in the private sector These three scenarios correspond to three different Saudi unemployment rates by 2025:

* A high Saudi employment growth scenario yielding zero percent Saudi unemployment, which corresponds to the Ministry of Economy and Planning’s (MEP) long-term strategy.

* A baseline Saudi employment growth scenario yielding 6 percent Saudi unemployment by 2025.

* A no-action scenario yielding 16.9 percent Saudi unemployment rate.

The report also said that 2014 data from the General Organization for Social Insurance (GOSI) showed a narrowing gap in wage differentials between Saudis and non-Saudis in the private sector. However, the differential remains sub-standard.

According to the data, average monthly wages for Saudis in the private sector increased from SR5,171 in 2013 to SR5,519 in 2014 (6.7 percent, year-on-year), while wages for non-Saudis increased from SR1,489 to SR1,636 (12.2 percent, year-on-year) during the same period. Data from the Ministry of Labor (MOL) shows a similar trend.

Official data shows that while private sector employment growth of Saudi nationals slowed slightly from 7.3 percent in 2013 to 6.8 percent in 2014, growth in public sector employment of Saudis fell from 7.2 percent to 3.3 percent during the same period, its lowest in six years.

The number of Saudi workers in the public sector reached 3.3 million in 2014, up from 3.2 million in 2013. However, the slower employment growth relative to the private sector has led to a falling proportion in public sector employment of Saudi nationals. This slower growth has also meant that the sector’s contribution toward overall employment growth of Saudis was now lower than that of the private sector.

As for the private sector, the Saudization ratio stood at 22.1 percent in 2014, meaning that the remaining 77.9 percent of jobs were held by non-Saudis.

Between 2006 and 2014, the number of total jobs created in the private sector (for both Saudis and non-Saudis) was, on average, 214,000 per year.

“This excludes 2010 as we believe the employment growth from that year to be inconsistent with the long-term trend,” said the report.

“As for our forecasted period, we assume the annual number of jobs to be created by the private sector (for both Saudis and non-Saudis) to reach 265,000,” it added.

Despite the higher forecast number of annual jobs, the growth rate is actually lower. This is in part due to a higher base.

“Our forecast for lower growth in private sector employment (for both Saudis and non-Saudis) is because we believe the actual employment from the period 2006-2014 to be on the high end,” said the report.

We believe this is in part due to the sweeping labor market measures undertaken by the Ministry of Labor between 2011 and 2013.

Saudi employment growth in private sector remains healthy

Saudi employment growth in private sector remains healthy

Arab food and beverage sector draws $22bn in foreign investment over 2 decades: Dhaman

JEDDAH: Foreign investors committed about $22 billion to the Arab region’s food and beverage sector over the past two decades, backing 516 projects that generated roughly 93,000 jobs, according to a new sectoral report.

In its third food and beverage industry study for 2025, the Arab Investment and Export Credit Guarantee Corp., known as Dhaman, said the bulk of investment flowed to a handful of markets. Egypt, Saudi Arabia, the UAE, Morocco and Qatar attracted 421 projects — about 82 percent of the total — with capital expenditure exceeding $17 billion, or nearly four-fifths of overall investment.

Projects in those five countries accounted for around 71,000 jobs, representing 76 percent of total employment created by foreign direct investment in the sector over the 2003–2024 period, the report said, according to figures carried by the Kuwait News Agency.

“The US has been the region's top food and beverage investor over the past 22 years with 74 projects or 14 projects of the total, and Capex of approximately $4 billion or 18 percent of the total, creating more than 14,000 jobs,” KUNA reported.

Investment was also concentrated among a small group of multinational players. The sector’s top 10 foreign investors accounted for roughly 15 percent of projects, 32 percent of capital expenditure and 29 percent of newly created jobs.

Swiss food group Nestlé led in project count with 14 initiatives, while Ukrainian agribusiness firm NIBULON topped capital spending and job creation, investing $2 billion and generating around 6,000 jobs.

At the inter-Arab investment level, the report noted that 12 Arab countries invested in 108 projects, accounting for about 21 percent of total FDI projects in the sector over the past 22 years. These initiatives, carried out by 65 companies, involved $6.5 billion in capital expenditure, representing 30 percent of total FDI, and generated nearly 28,000 jobs.

The UAE led inter-Arab investments, accounting for 45 percent of total projects and 58 percent of total capital expenditure, the report added, according to KUNA.

The report also noted that the UAE, Saudi Arabia, Egypt, and Qatar topped the Arab ranking as the most attractive countries for investment in the sector in 2024, followed by Oman, Bahrain, Algeria, Morocco, and Kuwait.

Looking ahead, Dhaman expects consumer demand to continue rising. Food and non-alcoholic beverage sales across 16 Arab countries are projected to increase 8.6 percent to more than $430 billion by the end of 2025, equivalent to 4.2 percent of global sales, before exceeding $560 billion by 2029.

Sales are expected to remain highly concentrated geographically, with Egypt, Saudi Arabia, Algeria, the UAE and Iraq accounting for about 77 percent of the regional total. By product category, meat and poultry are forecast to lead with sales of about $106 billion, followed by cereals, pasta and baked goods at roughly $63 billion.

Average annual per capita spending on food and non-alcoholic beverages in the region is projected to rise 7.2 percent to more than $1,845 by the end of 2025, approaching the global average, and to reach about $2,255 by 2029. Household spending on these products is expected to represent 25.8 percent of total expenditure in 13 Arab countries, above the global average of 24.2 percent.

Arab external trade in food and beverages grew more than 15 percent in 2024 to $195 billion, with exports rising 18 percent to $56 billion and imports increasing 14 percent to $139 billion. Brazil was the largest foreign supplier to the region, exporting $16.5 billion worth of products, while Saudi Arabia ranked as the top Arab exporter at $6.6 billion.