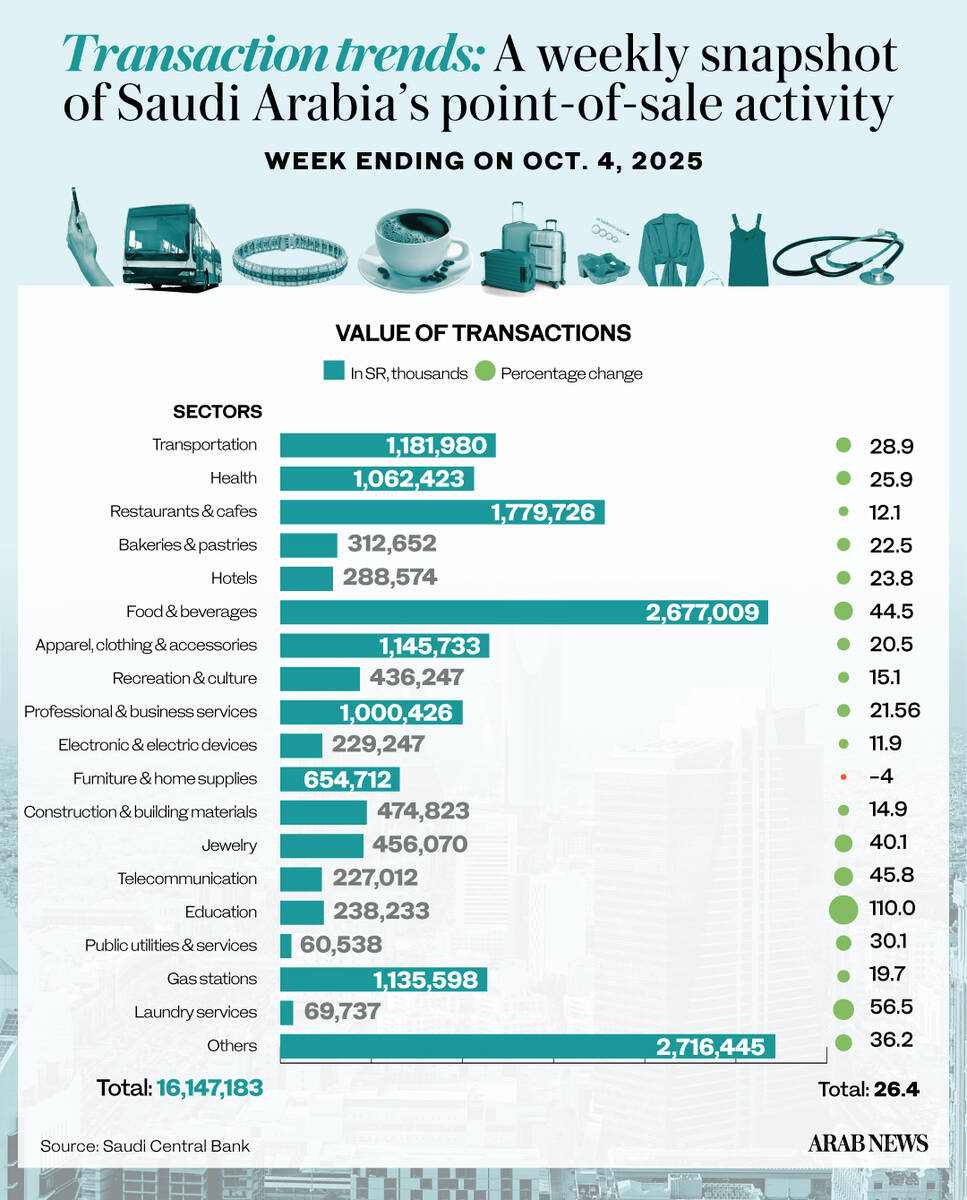

RIYADH: Saudi Arabia’s point-of-sale transactions climbed to SR16.14 billion ($4.30 billion) in the week ending Oct. 4, representing a 26.4 percent rise compared to the previous seven days, driven by an increase in spending across the majority of sectors.

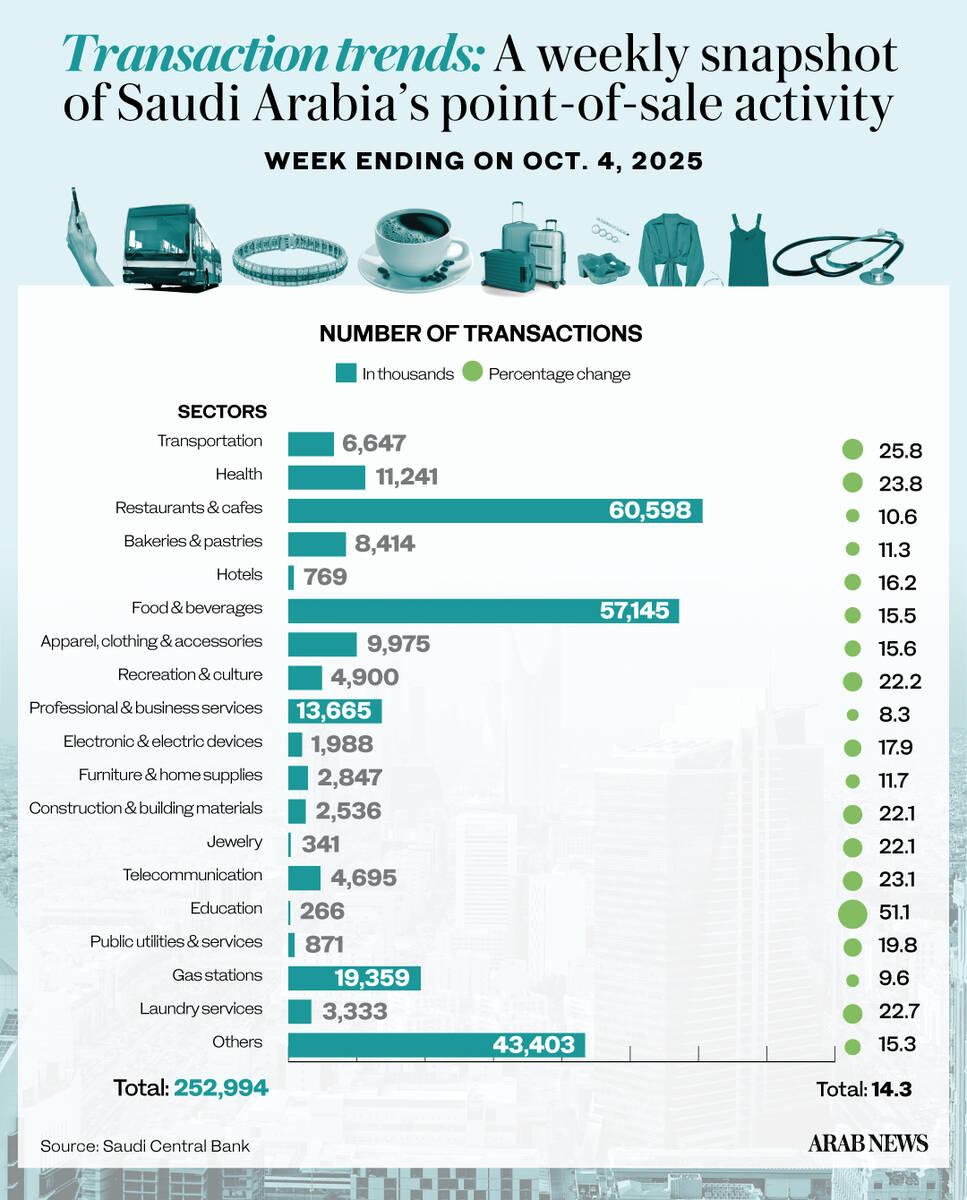

According to the latest report released by the Saudi Central Bank, also known as SAMA, the number of transactions also grew by 14.3 percent to 252.99 million.

The robust momentum in POS spending in Saudi Arabia reflects rising consumer confidence and the Kingdom’s ongoing digital payments transformation under the Vision 2030 initiatives.

SAMA revealed that the food and beverages sector remained the top driver for POS spending at SR2.67 billion, representing a 44.5 percent rise compared to the previous week.

Restaurants and cafes witnessed spending amounting to SR1.77 billion, up 12.1 percent, while transactions in the transportation sector rose by 28.1 percent to SR1.18 billion.

Spending on apparel, clothing, and accessories rose by 20.5 percent to SR1.14 billion, followed by transactions in the health sector at SR1.06 billion, a 25.9 percent increase.

Expenditure at gas stations reached SR1.13 billion, while professional and business services totaled SR1 billion.

By contrast, spending on furniture and home appliances fell 4 percent to SR654.71 million.

The central bank’s latest data show consumer confidence remains firm despite global economic headwinds, providing vital support to Saudi Arabia’s broader transformation agenda.

In April, SAMA reported that non-cash retail transactions in the Kingdom reached 12.6 billion in 2024, up from 10.8 billion in 2023, highlighting the continued expansion of electronic payment systems across the Kingdom.

It added that electronic payments accounted for 79 percent of total retail transactions in 2024, up from 70 percent in 2023.

Geographically, Saudi Arabia’s capital city, Riyadh, recorded POS transactions totaling SR5.50 billion, representing a weekly rise of 20.8 percent.

The number of transactions in Riyadh also increased by 12.2 percent to 82.02 million.

In Jeddah, the total value of transactions amounted to SR2.13 billion, followed by Dammam at SR790.57 million, Madinah at SR621.01 million and Makkah at SR612.15 million.

Alkhobar recorded POS transactions totaling SR453.30 million, while Buraidah and Abha stood at SR391.75 million and SR199.74 million, respectively.