RIYADH: Saudi Arabia-based event booking platform webook.com has unveiled an ambitious roadmap aimed at achieving a billion-dollar valuation and a future listing on the stock exchange.

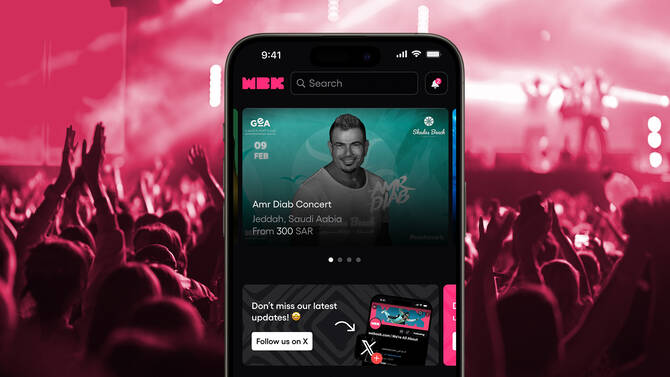

Positioning itself as the “ultimate super app for fun,” the company is rapidly expanding its offerings beyond event ticketing. New services include flight and hotel bookings, restaurant reservations, sports facility access, and live streaming. The platform is also leveraging cutting-edge technology and forging strategic partnerships to accelerate its global reach.

In an interview with Arab News, Nadeem Bakhsh, CEO of webook.com, highlighted the company’s growth strategy, structured around four key pillars: diversification, innovation, globalization, and automation.

“Our goal is to become the ultimate super app for fun worldwide, helping people discover and book experiences that bring them together,” Bakhsh said.

Strategic blueprint for growth

Webook.com’s roadmap—referred to internally as DIGA—outlines a methodical approach to scaling the business and establishing a global presence.

The first pillar, diversification, focuses on broadening revenue streams by integrating travel and hospitality services such as flights, hotels, and dining. The company is also fostering fan communities to deepen user engagement.

Innovation plays a central role, with webook.com deploying advanced technologies to streamline the user experience. New features include ticket auctions, built-in resale options, anti-scalping protections, and interactive community tools, all designed to offer a secure and seamless platform.

Under its globalization initiative, webook.com has already launched operations in eight countries and continues to grow its international team to support further expansion.

Meanwhile, automation is enabling the company to scale efficiently. By optimizing its engineering and operational infrastructure, webook.com aims to deliver a frictionless customer experience while supporting its broader growth ambitions.

Rapid international expansion and user growth

The event platform is rapidly expanding its international footprint, claiming a user base of more than 7 million across 160 countries and access to over 520 global events since its launch.

The company credits its rapid growth to an unwavering focus on user experience and strategic collaborations.

Nadeem Bakhsh, CEO of webook.com.

“User experience is at the heart of our success,” said Bakhsh. “We have built a strong design and research team that benchmarks best practices from industries such as banking, e-commerce, transport, and social networks.”

In addition to refining its platform’s usability, webook.com has developed tailored tools for event organizers and partners, ensuring system stability even during peak demand.

“Unlike recently publicized high-profile concerts like Taylor Swift and Coldplay, where overwhelming demand left fans frustrated, our infrastructure guarantees high performance,” the CEO noted.

Lifestyle integration, dining partnerships

Expanding its footprint beyond ticketing, webook.com is weaving lifestyle services into its ecosystem. A notable partnership with dining reservation platform Servme aims to enhance the post-event experience by linking event attendees with nearby restaurants in Saudi Arabia.

“We have 8 million users, many of whom actively seek entertainment and dining experiences,” Bakhsh said. “During peak season, we process an average of 100,000 tickets per day, with a high of 150,000 on a single day. Each ticket presents an opportunity to upsell dining options.”

Using data-driven personalization, webook.com recommends dining venues based on users’ tastes and spending habits.

“Seamless integration allows users to book restaurants near their event venue effortlessly, enhancing their overall experience while driving traffic to restaurant partners,” Bakhsh explained.

Boosting digital streaming capabilities

In parallel, the platform is advancing its digital streaming features, bolstered by exclusive rights to Riyadh Season events.

“Our streaming service is built on a scalable infrastructure that can handle millions of users simultaneously,” Bakhsh said.

To enrich the virtual experience, the company is integrating interactive features such as live polls, real-time chat, and merchandise auctions during concerts.

“Our goal is to offer a virtual front-row experience, ensuring users never miss a moment, whether they are at the venue or streaming remotely,” Bakhsh said.

Looking ahead, webook.com is also building out pay-per-view capabilities for sports events, including boxing, and exploring multi-angle viewing to create a more immersive streaming experience.

Tackling fraud and enhancing security

Ticket fraud remains a widespread issue in the live events industry, and webook.com is taking aggressive measures to address it. Over the past year, the platform has nullified 40,000 black market tickets and shut down more than 5,000 fraudulent accounts.

“We have also launched a verified resale platform, which has facilitated the sale of over 200,000 tickets through official channels,” said Bakhsh.

In addition to digital safeguards, the company is pursuing legal action against major black market platforms.

“While fraudsters continuously adapt, our dedicated anti-fraud team works proactively to stay ahead, ensuring a safe and seamless experience for our users,” he added.

Strengthening sports ticketing presence

Webook.com has recently secured a three-year partnership with the Roshn Saudi League to manage ticket sales for football matches, reinforcing its role in the sports sector.

“This partnership aligns perfectly with our mission to be the gateway for entertainment,” Bakhsh said. “It allows us to strengthen our presence in sports ticketing while providing fans with a seamless booking experience on one platform.”

Future plans include exclusive fan content, loyalty programs, and community-driven in-app features.

“For the league, it ensures a reliable and fraud-free ticketing system while expanding reach through webook.com’s growing user base,” he said.

From local roots to global vision

The company’s journey began under its original name, Halayalla, which Bakhsh said was limiting in terms of international reach.

“Our former and original brand had a very local flair but didn’t translate internationally and wasn’t descriptive as to what we do,” he explained.

Following extensive market research and testing, the company rebranded to webook.com, a move that significantly boosted its global recognition and credibility.

IPO preparations underway

As part of its long-term vision, webook.com is actively preparing for an initial public offering. The company is enhancing its internal governance, aligning with global regulatory standards, and bringing in experienced leadership.

“Over the past year and a half, we have been hiring a CFO with IPO experience and engaging a top consultancy for an IPO readiness assessment,” Bakhsh said.

“Our three-to-four-year timeline for the listing is carefully structured, with every step aligned to ensure a smooth transition to becoming a publicly traded company.”

The company is also working with leading consultants to streamline operations and ensure full transparency under public market scrutiny.

Looking ahead

With operations already established in Morocco and Bahrain, webook.com is now focused on Europe as it charts its five-year growth trajectory.

“Our vision is to make webook.com a household name from Hawaii to Tokyo,” Bakhsh said.

To achieve this, the company plans continued investments in technology, talent, brand development, and platform security—while keeping customer satisfaction at the forefront.

“We remain committed to delivering the best possible experience for our users as the super app for fun,” he said, adding: “Our priority is ensuring users can easily discover, book, and enjoy world-class events effortlessly.”

With its momentum building, webook.com is poised to reshape the global event booking landscape through innovation, security, and a customer-first approach.