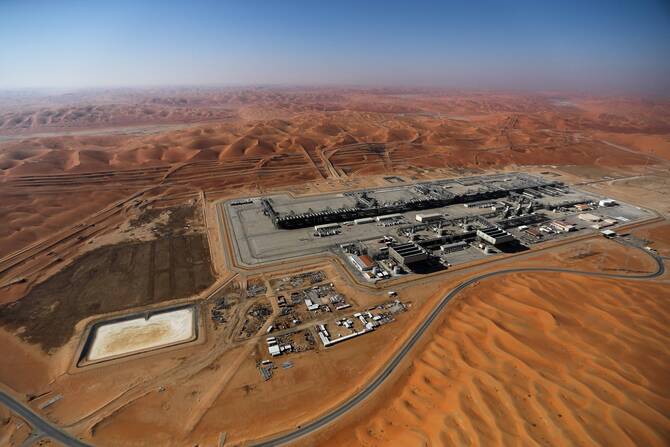

RIYADH: Saudi Aramco has made a series of groundbreaking oil and gas discoveries in the Eastern Province and the Empty Quarter, further cementing Saudi Arabia’s position as a global energy leader.

Announced by Energy Minister Prince Abdulaziz bin Salman on Wednesday, the discoveries include six oil fields, two oil reservoirs, two natural gas fields, and four natural gas reservoirs—highlighting the Kingdom’s vast and growing hydrocarbon potential.

In the Eastern Province, the Jabu oil field was identified after very light Arab crude oil flowed at a rate of 800 barrels per day from well Jabu-1.

Another notable find was in the Sayahid field, where very light crude flowed from well Sayahid-2 at a rate of 630 bpd. The Ayfan field also showed promising results, with well Ayfan-2 producing 2,840 bpd of very light crude and approximately 0.44 million standard cubic feet of gas per day.

Further exploration confirmed the Jubaila reservoir in the Berri field, where light crude flowed from well Berri-907 at a rate of 520 bpd, along with 0.2 MMscf of gas daily. Additionally, the Unayzah-A reservoir in the Mazalij field yielded premium light crude from well Mazalij-64 at 1,011 bpd, coupled with 0.92 MMscf of gas per day.

In the Empty Quarter, the Nuwayr field produced medium Arabian crude at 1,800 bpd from well Nuwayr-1, along with 0.55 MMscf of gas daily. The Damdah field, tapped via well Damda-1, showed medium crude flow from the Mishrif-C reservoir at 200 bpd, and very light crude from the Mishrif-D reservoir at 115 bpd. The Qurqas field also produced medium crude at 210 bpd from well Qurqas-1.

Regarding natural gas, notable discoveries were made in the Eastern Province. Gas was found in the Unayzah B/C reservoir of the Ghizlan field, with well Ghizlan-1 yielding 32 MMscf of gas per day and 2,525 barrels of condensate. In the Araam field, well Araam-1 produced 24 MMscf of gas per day along with 3,000 barrels of condensate. Unconventional gas was also discovered in the Qusaiba reservoir of the Mihwaz field, where well Mihwaz-193101 produced 3.5 MMscf per day and 485 barrels of condensate.

In the Empty Quarter, significant natural gas flows were recorded in the Marzouq field, with 9.5 MMscf per day from the Arab-C reservoir and 10 MMscf from the Arab-D reservoir. Additionally, the Upper Jubaila reservoir yielded 1.5 MMscf of gas per day from the same well.

Prince Abdulaziz emphasized the importance of these discoveries, noting their contribution to solidifying Saudi Arabia’s leadership in the global energy sector and enhancing the Kingdom’s hydrocarbon potential.

These findings are expected to drive economic growth, strengthen Saudi Arabia’s ability to meet both domestic and international energy demand efficiently, and support the country’s long-term sustainability goals. They align with the objectives of Vision 2030, which aims to maximize the value of natural resources and ensure global energy security.