RIYADH: Saudi Arabia’s Public Investment Fund is offering SR40 billion ($10.67 billion) in investment opportunities through its private sector platform to strengthen local industries, supply chains, and business growth, its governor said.

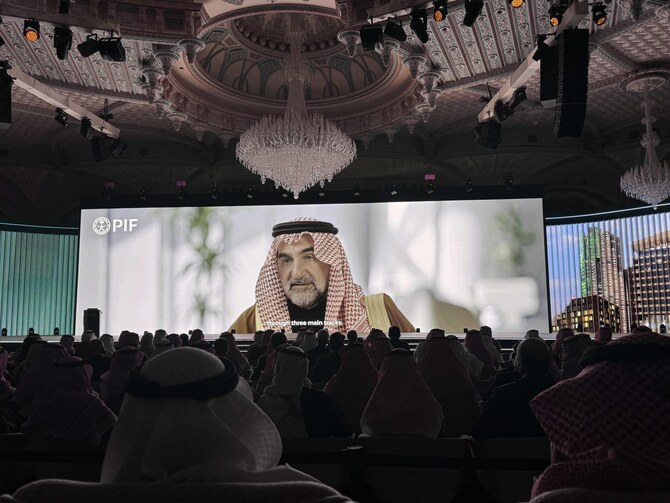

Speaking at the third PIF Private Sector Forum in Riyadh, Yasir Al-Rumayyan highlighted that the Kingdom’s sovereign wealth fund and its portfolio companies have invested around SR400 billion into local content from 2020 to 2023, supported by the MUSAHAMA Local Content Development Program.

With assets exceeding $700 billion, PIF plays a central role in Saudi Arabia’s economic diversification under Vision 2030. Al-Rumayyan emphasized that sustainable growth is driven by regulatory reforms and economic diversification efforts, with PIF serving as a key enabler.

The fund’s governor said that partnerships with private firms remain essential to PIF’s strategy, as Saudi Arabia continues regulatory reforms to foster long-term economic growth.

According to Al-Rumayyan, the fund’s efforts have significantly increased local content contribution, raising its share from 47 percent to 53 percent across PIF and its subsidiaries.

During his keynote speech, Jerry Todd, head of the National Development Division at PIF, addressed the 10,000 private sector attendees, emphasizing that the forum is designed to provide critical information and access to three major opportunity areas.

“For suppliers, there are 100 PIF portfolio companies next door in the main hall, ready to discuss their procurement priorities and show you how you can register and qualify as a vendor,” Todd said.

He added: “For supply chain developers, we will have dedicated sessions on automotive, transportation, and logistics, and for investors, 14 PIF portfolio companies will be sharing opportunities over the next two days.”

Todd also provided updates on two recently launched initiatives aimed at empowering Saudi talent.

“The first, which the governor mentioned, is our Accelerated Manufacturing Program. Thirteen small and medium enterprises were selected from 350 applicants for a six-month intensive program that began last September,” he said.

Todd added: “They will graduate tomorrow and have already secured 12 commercial agreements and two product development agreements with PIF portfolio companies. Seven private sector MoUs will be signed over the next two days, and they have tapped into seven new export markets.”

Highlighting the second initiative, Todd introduced the MUSAHAMA Design Competition, stating: “373 Saudi architectural students and 160 emerging local design firms have been competing to reimagine a community zone within one of our ROSHN developments, focusing on maximizing the use of locally sourced building materials.”

Todd said that the forum serves as a platform for businesses to explore opportunities in three key areas: supplying goods and services to PIF portfolio companies, developing local tech-enabled supply chains to support emerging sectors, and investing in Saudi Arabia’s rapidly expanding economy.

“I encourage you to meet with participants from both of these programs. Their progress, their potential, and their energy are inspiring and remind us all of our young people, who are our nation’s greatest asset,” Todd said.

He concluded by urging the private sector to collaborate in stimulating local demand, expanding domestic supply chains, and creating investment opportunities across the Kingdom.