ISLAMABAD: The Pakistan Stock Exchange (PSX) on Thursday gained 1,700 points, surging past the 97,000 mark during intra-day trading for the first time, with analysts attributing the rally to strong economic data and rising investor optimism over government reforms.

The benchmark KSE-100 index rose by 1,781.94 points, or 1.86 percent, to close at 97,328.39. It touched an unprecedented peak of 97,437.15 during intra-day trading.

Analyst Ahsan Mehanti of Arif Habib Corporation said surging foreign exchange reserves and speculations over the government’s decisions on economic reforms and privatization “played a catalyst role in the record surge at the PSX.”

“Stocks are bullish, led by scrips across the board as investors weigh a drop in government bond yields and robust economic data for current account surplus, remittances, exports and foreign direct investments,” Mehanti told Arab News.

In October, Pakistan’s external current account recorded a surplus of $349 million, marking the third consecutive month of surplus and the highest in this period. The current account reflects a nation’s transactions with the world, encompassing net trade in goods and services, net earnings on cross-border investments and net transfer payments.

A surplus indicates that a country is exporting more than it is importing, thereby strengthening its foreign exchange reserves.

A bullish trend has been observed in the stock market since Pakistan’s central bank cut its key policy rate by 250 basis points, bringing it to 15 percent earlier this month. Economic indicators have also steadily improved since securing a 37-month, $7 billion bailout from the International Monetary Fund (IMF) in September.

In the past, the country faced a prolonged economic crisis that drained its foreign exchange reserves and saw its currency weaken amid double-digit inflation. Last year, Pakistan narrowly avoided a sovereign default by clinching a last-minute $3 billion IMF bailout deal.

Pakistani stocks surge past 97,000 as investor confidence grows on economic reforms

https://arab.news/bkc46

Pakistani stocks surge past 97,000 as investor confidence grows on economic reforms

- Analysts attribute rally to strong economic data, rising optimism over government reforms

- Stock market has remained bullish since the government slashed policy rate in November

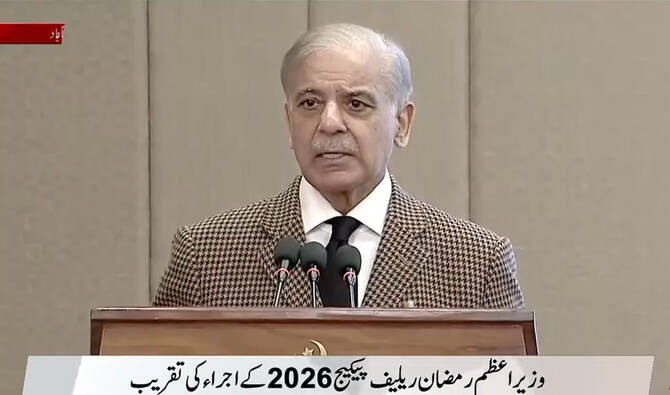

Pakistan launches $136 million Ramadan relief package for 12.1 million families

- Rs13,000 per family to be transferred via bank accounts, mobile wallets under cashless system

- Pakistan’s national space agency says the Muslim fasting month is likely to begin from Feb. 19

ISLAMABAD: Prime Minister Shehbaz Sharif on Saturday launched a Rs38 billion ($136 million) Ramadan relief package, pledging direct digital cash transfers of Rs13,000 ($47) each to 12.1 million low-income families across Pakistan.

Pakistan’s national space agency announced a day earlier the Ramadan crescent would likely be visible on Feb. 18, with the first fast expected to fall on Feb. 19, subject to official confirmation.

The government will distribute the relief package through bank accounts and regulated mobile wallet platforms, fully replacing the previous utility store-based subsidy model with a digital payment mechanism overseen by the State Bank of Pakistan.

“This year, Rs38 billion have been allocated ... that will not only be distributed to the rightful people in all four provinces, but also to Gilgit-Baltistan and Azad Kashmir through these wallets and digital bank accounts,” the prime minister said during a ceremony in the federal capital, adding that 12.1 million families would benefit.

The allocation marks a sharp increase from last year’s Rs 20 billion ($72 million) Ramadan program, as the government expands coverage and deepens its shift toward cash-based targeted subsidies.

Officials said Rs28 billion ($101 million) has been earmarked for families not currently receiving support under any federal income assistance program, while an additional Rs10 billion ($36 million) will go to those already registered under existing social protection schemes.

Syed Imran Shah, federal minister for poverty alleviation and social security, said the digital framework would allow transfers to be made in a “safe, effective and easy way,” reducing leakages and preserving beneficiaries’ dignity by eliminating long queues and physical distribution centers.

Amir Ali Ahmed, secretary of the Benazir Income Support Program (BISP), said the 2026 rollout builds on last year’s digital transition, when around two million beneficiaries received payments electronically.

A third-party validation report issued in December 2025 confirmed the transparency and operational effectiveness of the system, he added.

The prime minister said he would personally oversee periodic reviews of the program to ensure timely disbursement.

The government had scrapped the Utility Store-based Ramadan subsidy system last year, arguing that it led to quality concerns, long queues and administrative inefficiencies.

The digital transfer model aims to move toward a targeted subsidy regime aligned with broader efforts to expand financial inclusion and reduce cash-based leakages.