ISLAMABAD: Pakistan’s Prime Minister Shehbaz Sharif visited the Chinese embassy in Islamabad on Wednesday to condemn an attack on Chinese nationals in Karachi a day earlier, vowing to bring the perpetrator of the crime to book.

Pakistan police have filed terrorism charges against a security guard for firing at four Chinese nationals on Tuesday morning at a textile mill in Karachi. The Chinese nationals were at the mill to install new machinery when the guard opened fire at them “for unknown reasons” before fleeing, police said.

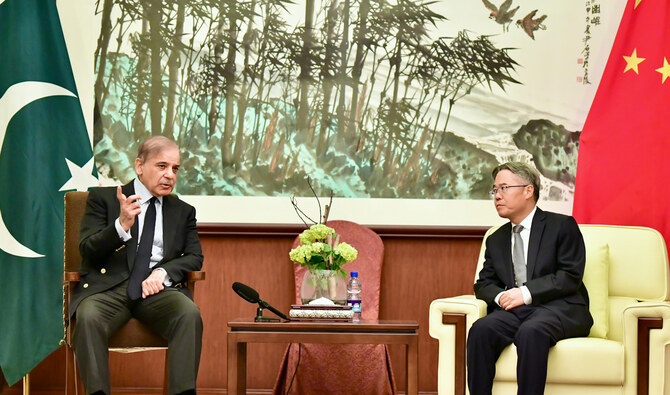

Two Chinese nationals were injured in the attack. Sharif visited the Chinese embassy in Islamabad on Wednesday where he met the country’s envoy Jiang Zaidong to condemn the incident.

“I have come here to meet you to condemn this attack on Chinese nationals and to inquire after the injured,” Sharif told Zaidong according to a statement by the Prime Minister’s Office (PMO).

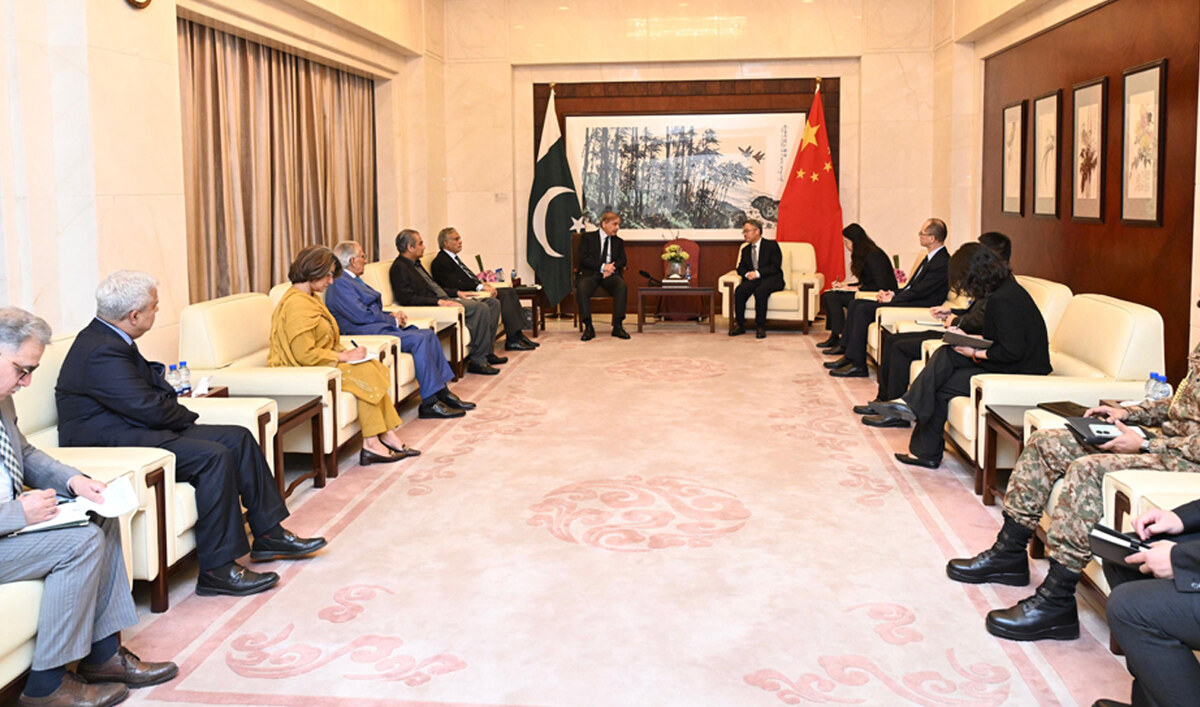

Prime Minister Shehbaz Sharif meets Chinese Ambassador to Pakistan Jiang Zaidong at the Chinese Embassy in Islamabad on November 6, 2024. (Photo courtesy: PMO)

The prime minister assured the Chinese ambassador that the culprit would be arrested soon and handed an exemplary punishment.

“I am personally monitoring the process of arresting the people involved in the incident and bringing them to justice,” Sharif said.

The Pakistani premier said he had issued instructions for the injured Chinese nationals to be provided the best possible medical care, describing China as a longstanding friend of Pakistan.

“The attack on Chinese citizens is a blatant attempt to damage the brotherly relations between Pakistan and China,” Sharif said.

He said that the security of Chinese nationals in Pakistan is the government’s top priority. The Chinese ambassador thanked Sharif for his visit and hoped the premier would play his role in ensuring the culprit is punished, the PMO said.

Sharif was accompanied by Deputy Prime Minister Ishaq Dar, Interior Minister Mohsin Naqvi and his aide Tariq Fatemi.

ATTACKS ON CHINESE NATIONALS

Pakistan has witnessed a surge in attacks on Chinese nationals in recent months by separatist outfits based in its southwestern Balochistan province.

China, breaking with tradition, recently spoke out publicly against security threats to its workers and nationals in Pakistan, where hundreds work on Beijing-funded projects linked to the over $60 billion China-Pakistan Economic Corridor (CPEC).

Last month, two Chinese nationals were killed in a suicide bombing near the international airport in Karachi. In March this year, a suicide bombing killed five Chinese engineers and a Pakistani driver in northwestern Pakistan as they headed to the Dasu Dam, the largest hydropower project in the country.

In 2022, three Chinese educators and their Pakistani driver were killed when an explosion tore through a van at the University of Karachi. A bus blast in northern Pakistan in 2021 killed 13 people, including nine Chinese nationals.

Pakistan announced in a joint statement with China last month it had agreed to increase security for Chinese citizens and projects in the South Asian nation, as Beijing called for urgent security measures following a surge in militant threats.