ISLAMABAD: Pakistan’s Finance Minister Muhammad Aurangzeb on Monday met with a delegation from the US-Pakistan Business Council (USPBC) in Washington D.C. and discussed with them his government’s commitment to improving business climate in Pakistan.

Aurangzeb arrived in Washington D.C. on Sunday to participate in spring meetings of the International Monetary Fund (IMF) and the World Bank, amid Islamabad’s efforts to reach an agreement with the IMF for a new loan program by June this year.

The South Asian country of more than 240 million people remains in desperate need of external financing to shore up its foreign exchange reserves and escape yet another macroeconomic crisis after it barely averted a default last year, thanks to a $3 billion IMF program.

In order to overcome the present economic woes, Islamabad has been making efforts to attract foreign direct investment to keep the $350 billion economy afloat.

“During the meeting, the Finance Minister highlighted the government’s dedication to attracting both foreign and domestic investments in key sectors,” Aurangzeb’s ministry said in a statement. “These sectors include agriculture, IT, mines & minerals, and energy.”

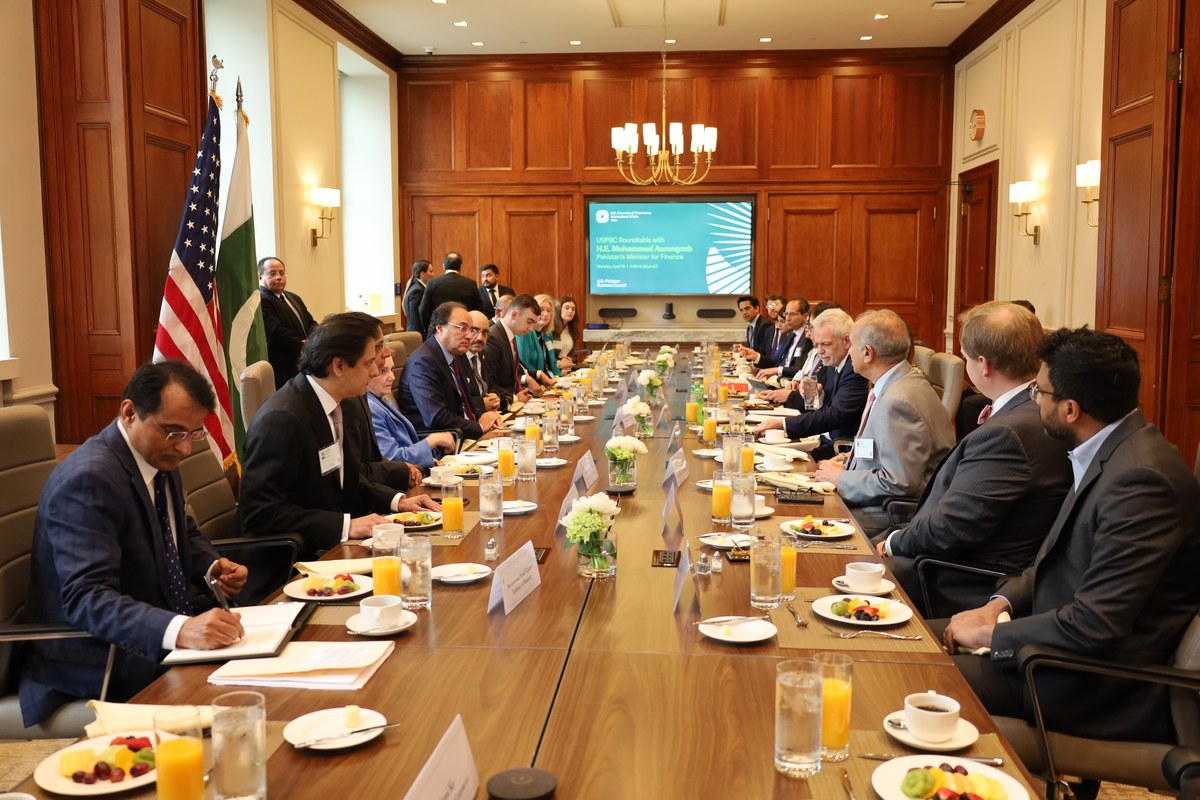

Pakistan's Federal Minister for Finance and Revenue, Muhammad Aurangzeb (5L), meets with a delegation from the US Pakistan Business Council in Washington, US, on April 15, 2024. (Pakistan Finance Ministry)

The statement came days after Aurangzeb met with Prime Minister Shehbaz Sharif to discuss Pakistan’s economic strategy ahead of his meetings with IMF and World Bank officials.

“He discussed with the prime minister his scheduled meetings with the International Monetary Fund, World Bank and other organizations during the visit,” the Pakistani finance ministry said. “The overall economic situation of the country was also discussed in the meeting.”

Pakistan this month completed a final review of its current $3 billion IMF deal that cleared the way for the disbursement of a final tranche of nearly $1.1 billion. The South Asian country is now looking for another bailout program.

Last week, IMF chief Kristalina Georgieva confirmed Pakistan was in discussions with her organization on a potential follow-up loan program to its nine-month, $3 billion stand-by arrangement (SBA).

The IMF chief recognized Pakistan’s commitment to structural economic reforms during an event at the Atlantic Council think tank in Washington. She, however, noted that some important issues, including the tax base and overall economic transparency, were yet to be addressed by Pakistani authorities.