RIYADH: Saudi Arabia granted 412 new industrial licenses in the third quarter, marking an 83.9 percent surge compared to the corresponding period in the previous year, according to the latest Investment Ministry data.

The ministry attributed this increase, along with a 1.5 percent rise in capital for newly licensed factories, to the Kingdom’s efforts to enhance the competitiveness of the industrial environment, elevate the value of local content and support domestically manufactured products.

These initiatives fall under the National Industrial Development and Logistics Program and the Saudi Export Development Authority, which introduced the “Made in Saudi” program in 2021 to promote local talent and innovation.

The program seeks to boost the economy, position Saudi products internationally, and attract investments by supporting businesses locally and globally.

Businesses collaborating in this initiative can use the “Saudi Made” logo to enhance the country’s global image.

In alignment with Vision 2030, the initiative strives to build a diversified and sustainable Saudi economy, targeting an increase in non-oil exports to 50 percent of non-oil gross domestic product by 2030.

The ministry issued 2,202 licenses in the third quarter, including those granted as part of anti-concealment law enforcement, representing an 89 percent increase over the same period last year.

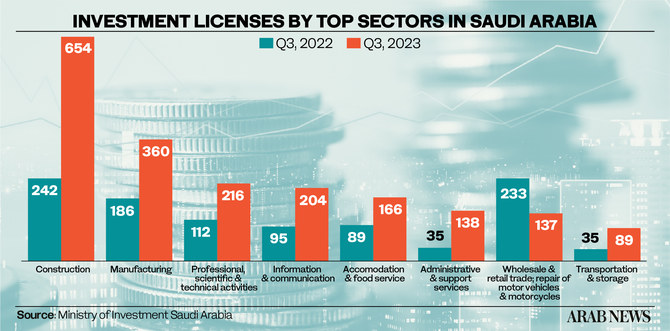

The construction sector led in investment licenses with 654 licenses, a 170 percent increase, over the third quarter of last year.

On the other hand, the manufacturing sector bagged 360 licenses, reflecting a 94 percent increase.

Professional, scientific, and technical activities saw a boost with 216 new licenses, a 93 percent increase, while the information and communication sector obtained 204 licenses, indicating a 115 percent increase.

Notably, public administration and support services witnessed the most substantial growth in investment licenses, with an increase of 294.3 percent.

Following closely, the electricity, gas, steam, and air conditioning sector saw a rise of 175 percent in granted licenses.

The construction sector also experienced a notable increase of 170 percent during this period.

According to MISA investment data, the third quarter closed 19 deals, with the education & training and culture sectors attracting the highest investor interest, each securing four agreements.

China led in the origin of investments with five deals in the third quarter, followed by Japan with three in Saudi Arabia. The remaining deals were distributed among 12 other countries.