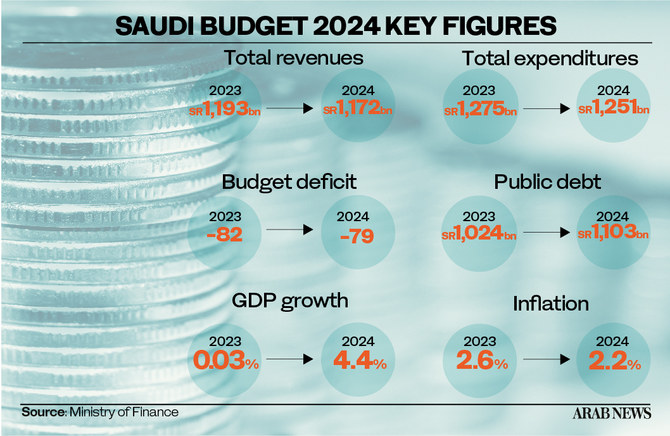

RIYADH: Saudi Arabia on Wednesday approved the state budget for 2024 with revenues projected at SR1.17 trillion ($312.48 billion) and expenditure at SR1.25 trillion, leading to a deficit of SR79 billion.

In its announcement, the Finance Ministry projected the Kingdom’s gross domestic product growth at 4.4 percent in 2024 an increase from the estimated 0.03 percent in 2023.

It predicted the Kingdom’s public debt for the next fiscal year to stand at SR1.103 trillion or 25.9 percent of GDP. This represents a 7.71 percent increase from the re-estimated 2023 figures of SR1.024 trillion, constituting 24.8 percent of the GDP.

Saudi Crown Prince Mohammed bin Salman said the 2024 budget aims to boost growth in the non-oil economy by increasing spending and investment in infrastructure, local industry and services.

The crown prince stressed the importance of strengthening partnerships with the private sector to achieve the goal of economic diversification and increasing job opportunities for the Saudi workforce, the Saudi Press Agency reported.

According to the ministry, the Kingdom’s budget deficit arises from increased spending to expedite the implementation of key programs vital to the objectives of Saudi Vision 2030.

Finance Minister Mohammed Al-Jaadan said the Kingdom’s annual budgets stem from “very conservative” estimates of oil revenue, meaning deficits are the product of deliberate decision to boost spending rather than (caused) from fluctuating oil prices.

Nevertheless, the economy will remain robust according to the ministry, supported by substantial fiscal space, strong government reserves, and sustainable debt levels. Moreover, the Kingdom’s strong fiscal position and high sovereign credit rating provide spending flexibility crucial to the country’s commitment to economic development, it said in its pre-budget statement report.

Positive indicators include sustained GDP growth, improved non-oil sector performance, a growing labor force, modest inflation rates, and a declining unemployment rate.

The positive outlook for the Saudi economy in 2024 is attributed to favorable developments in the first half of 2023. Estimates suggest a robust 4.4 percent growth in real GDP for 2024, primarily fueled by non-oil activities.

Revenue from taxes is estimated to be 30 percent of total non-oil income in 2024 at SR361 billion, which is 2.56 percent higher than 2023 estimates.

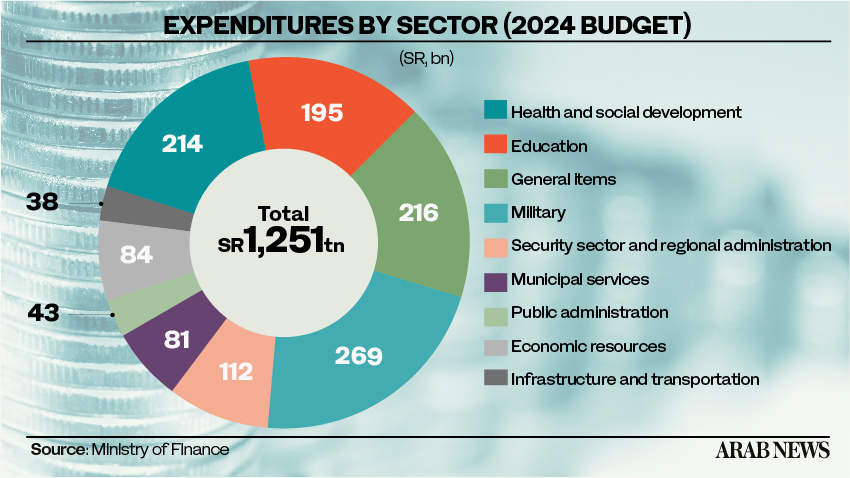

In terms of sector-specific expenditures, the military sector received the largest allocation at SR269 billion, marking an 8.5 percent increase compared to the 2023 estimates.

The health and social development sector followed with a 17 percent share amounting to SR214 billion. Nevertheless, this figure reflects a 14.4 percent decrease from the 2023 estimates.

Education with 16 percent share of 2024 budgeted expenditures will be allocated SR 195 billion.

The projected revenues for 2025 and 2026 are estimated at SR1.227 trillion and SR1.259 trillion, respectively. Expenditures are projected to reach SR1.3 trillion in 2025 and SR1.368 trillion in 2026.

Consequently, the budget is expected to incur deficits of SR73 billion and SR109 billion for 2025, 2026 respectively. Public debt levels are estimated to be SR1.176 trillion in 2025 and SR1.1285 trillion in 2026.

Addressing a press conference, Al-Jadaan said the 2024 budget is poised to continue the trajectory of success, aligning with the national strategies closely linked to the goals outlined in Saudi Vision 2030 and national priorities, reinforcing the commitment to long-term sustainable development.

Responding to a question by Arab News on Expo 2030, the minister said: “The country that is capable of receiving and building the infrastructure to accommodate 150 million individuals, can host our guests at Expo 2030 without increasing costs.”

He added: “The infrastructure and projects planned for construction in the Kingdom, particularly in Riyadh, from now until 2030 as outlined in the early stages of the vision, including the transportation and logistical services strategy, tourism strategy, expansion in hotel construction, and also the expansion of water projects, will be sufficient to provide the necessary infrastructure for hosting expo and potentially three other expos.”

The minister added: “Expo village is going to be a commercial property, built by commercial companies and will be invested in beyond the six months,” adding: “That site will be a commercial site, it will not be wasted. And it will be obviously built sustainably.”

The minister said in a statement that the government is working on continuing borrowing according to the approved annual borrowing plan to finance the expected budget deficit and repay the outstanding debt by 2024.

The minister also revealed that since the inception of Saudi Vision 2030, the country has undergone considerable economic and structural reforms, resulting in the gross domestic product an increase, reaching more than SR4.1 trillion today, with an expected growth average at a rate of 6 percent from now until 2030.

He also stated that the Kingdom’s economy created more than 1 million jobs during 2023, adding that oil price fluctuations that previously affected the budget have become much less affected thanks to non-oil revenues.