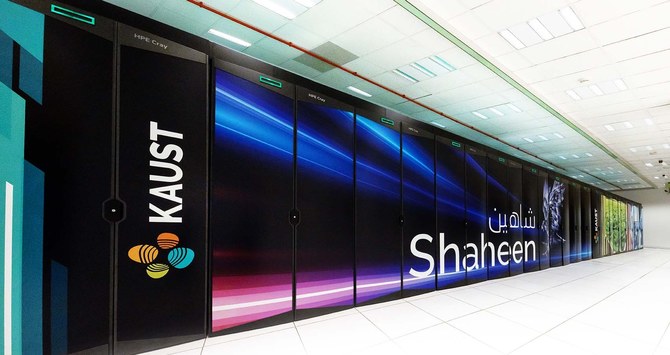

RIYADH: Scientific exploration and innovation are set to receive a boost with the operation of the Shaheen III supercomputer at King Abdullah University of Science and Technology in Saudi Arabia.

Developed by Hewlett Packard Enterprise, Shaheen III has already secured its place as the most powerful supercomputer in the Middle East, according to a recent report by TOP500, known for releasing statistics for this sector.

Tony F. Chan, president of KAUST, said: “Shaheen III takes KAUST’s world-class research capabilities to the next level through its processing power and ability to create models across many fields in a short period of time.”

The system is expected to play a pivotal role in supporting the construction and testing of predictive mathematical models. It employs a multifaceted approach that includes traditional simulations based on differential equations, statistical emulation, and machine learning based on neural networks.

These mathematical models will be used in various operations including scientific discovery, engineering design, and policy support.

He added: “Shaheen III will be crucial in supporting sustainability campaigns related to our National Center for Climate Change and for national projects that align with the Kingdom’s Vision 2030, helping to accelerate Saudi Arabia’s growth in areas such as sustainable development.”

Ranked 20th globally for supercomputer efficiency, the system is six times faster than its predecessor, Shaheen II, and boasts processing power exceeding that of 500,000 of the latest MacBook Pros.

“Supercomputing is part of KAUST’s research and curricular DNA, with many of our faculty recruited around supercomputing. Computational approaches formerly lagged theoretical, observational, and experimental approaches. Now, more often than not, they lead because of supercomputers like Shaheen III,” said David Keyes, KAUST’s founding dean.

In its initial operational phase, Shaheen III will focus on powering research contributing to sustainability goals, encompassing materials, catalysis, combustion of alternative fuels, carbon sequestration, and bioinformatics.

“Research universities like KAUST are increasingly putting supercomputers at the heart of their curriculum because modeling, simulation, machine learning and AI capabilities are fundamental to scientific discovery and innovation,” said Trish Damkroger, senior vice president and chief product officer, HPC, AI & Labs at HPE.

According to TOP500’s list, Frontier, hosted at the Oak Ridge Leadership Computing Facility in Tennessee, retains its status as the world’s most advanced supercomputer.

Following closely are Argonne National Laboratory’s Aurora and Microsoft’s Eagle, securing the second and third spots, respectively.