RIYADH: Saudi Arabia and Slovakia have signed an agreement to avoid double taxation, as the Kingdom steadily strives to become a prominent business hub for investors globally, the Saudi Press Agency reported.

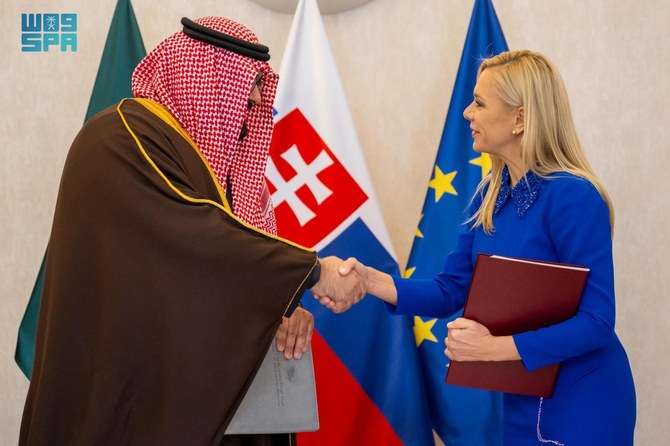

Saudi Minister of Economy and Planning Faisal bin Fadhil Al-Ibrahim signed an agreement with Slovak authorities during his visit to the country.

The report added that the agreement aims to provide tax benefits and exemptions on government investments, promote fairness and equal opportunities for investors, along with elevating economic cooperation between the Saudi Arabia and Slovakia.

Earlier this month, Saudi Investment Minister Khalid Al-Falih, during an interview with Bloomberg said that more than 180 companies have established their regional headquarters in the Kingdom, thus surpassing the previously set target of attracting 160 firms to the Kingdom by the end of this year.

“We had a target by year-end to have 160 regional headquarters for global companies. So far, the year is not up yet, and we have issued 180 licenses. In fact, the rate is picking up to the tune of 10 companies per week that are being licensed in Saudi Arabia, and they are being provided with a good set of incentives,” the minister revealed.

A few days back, Al-Ibrahim met North Macedonia Economy Minister Kershnik Bekteshi, and discussed ways to boost economic cooperation.

During the meeting, both leaders discussed potential commerce and investment opportunities, and mutual cooperation in sectors that included agriculture, energy, and infrastructure.