RIYADH: Bilateral non-oil trade between Turkiye and the UAE reached $13.5 billion in the first half of 2023, marking an 87 percent increase compared to the same period of the previous year.

This figure is nearly equivalent to the total non-oil trade for 2021 and is twice the amount achieved in 2020.

Turkiye has become the UAE’s fastest-growing trading partner among its top 10 international commerce allies and ranks as the sixth largest overall, accounting for more than 3 percent of the country’s total non-oil trade, according to the Emirates News Agency.

In terms of investment, the UAE’s foreign direct investment in Turkiye now stands at $7.8 billion.

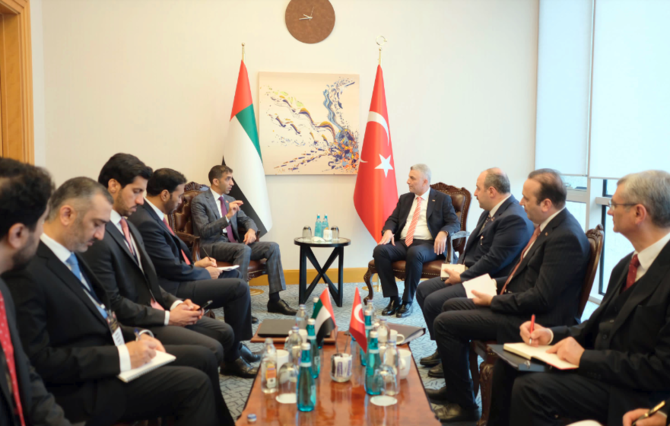

The UAE’s Minister of State for Foreign Trade, Thani bin Ahmed Al-Zeyoudi, led a delegation of representatives from the public and private sectors to participate in the inaugural session of the UAE-Turkiye Joint Economic and Trade Commission in Istanbul.

Established following Turkish President Tayyip Erdogan’s visit to the UAE in July of this year, the commission’s primary objective is to enhance and diversify the trade and commercial relations between the two nations.

It aims to fulfill the goals of the Comprehensive Economic Partnership Agreement, which came into force on Sept. 1, with the aspiration of boosting non-oil trade to $40 billion within the next five years.

During this meeting, Al-Zeyoudi and Omer Bolat, Turkiye’s minister of trade, celebrated the progress of UAE-Turkish relations and expressed optimism regarding the potential for further economic integration.

Discussions encompassed various sectors, including agro-food, automotive, fintech, healthcare, water technology, infrastructure, logistics, and collaborative projects in third countries.

With the upcoming 2023 UN Climate Change Conference scheduled to take place in Dubai in November and December, both parties reiterated their commitment to collaborating on energy transition projects, transitioning to a low-carbon practice, and supporting the development of a circular economy.

Al-Zeyoudi emphasized: “This Joint Economic and Trade Commission is a crucial platform for achieving our ambitious non-oil trade targets.”

He also stressed the importance of active participation from the private sector, stating: “The Comprehensive Economic Partnership Agreement has opened the door to greater trade and investment, but it requires the cooperation and collaboration of our private sectors to fully realize its benefits.”

The minister echoed this message in a series of business events held alongside the joint commission, which included the Turkiye-UAE Business Forum and a high-level roundtable.

Representatives of leading companies and investors from both countries participated in these sessions, where they held a series of bilateral meetings to exchange ideas and explore high-potential investment and partnership opportunities.

As a result, three memorandums of understanding were exchanged between Emirati and Turkish entities, including an MoU between the Abu Dhabi Department of Economic Development and DEİK, the Foreign Economic Relations Board of Turkiye.

Another agreement was signed between the UAE-based Sharjah Research Technology and Innovation Park and Turkiye’s Yıldız Technopark.

SRTIP also signed an MoU with the World Business Angel Forum.

Reflecting on the success of the events in Istanbul, Special Envoy to the Republic of Turkiye Sultan bin Saeed Al-Mansoori, said: “The UAE recognizes the immense potential of our relationship with Turkiye, a like-minded, pro-growth nation that has emerged as one of the region’s most dynamic economies.”

On his part, Trade Minister Bolat stated: “UAE-Turkish relations are currently experiencing a remarkable period of growth, owing to the shared commitment from both sides to deepen our economic ties.”

He added: “This can be observed in the record growth of our bilateral non-oil trade, which continues to flourish compared to previous years. We anticipate that the value of non-oil trade will further climb, supported by the Comprehensive Economic Partnership Agreement between the UAE and Turkiye, which came into effect in early September.”

He concluded: “Other areas of cooperation are also witnessing tangible positive developments. For instance, Turkish construction companies have undertaken 141 projects worth $12.6 billion in the UAE to date, positioning the Emirates as the tenth globally for the number of projects undertaken by Turkish companies.”

The visiting delegation to Istanbul included 79 participants, including senior federal and local government officials, along with representatives from major UAE companies operating across various sectors, such as trade and investment, logistics, industry, energy, technology, healthcare, environment, agriculture, food security, and financial services.

The second session of the JETCO will be held in the UAE, with the date to be agreed upon in the near future.

Turkiye’s tourism surges, manufacturing contracts

Meanwhile, Turkiye’s tourism income increased by 13.1 percent in the third quarter of 2023, reaching more than $20 billion, with 16.5 percent of tourism income obtained from its citizens resident abroad.

Turkish tourism expenditure, which is the expenditure of the Turkish citizens resident in Turkiye and visiting abroad, grew by 74.8 percent compared to the same quarter of the previous year, reaching $1.9 billion.

In October, Turkish manufacturing saw its fourth consecutive month of contraction, as businesses faced challenges in securing new orders and reduced their production, according to an S&P Global report.

The Purchasing Managers’ Index for manufacturing dropped from 49.6 in September to 48.4, as reported by the Istanbul Chamber of Industry and S&P Global, indicating a move further below the critical 50-point threshold that separates growth from contraction.

An Istanbul Chamber of Industry Turkiye Manufacturing PMI survey revealed a significant slowdown in new orders, reflecting weakened demand both domestically and internationally. Production decreased, leading to staffing reductions.

Manufacturers also scaled back their procurement, purchase stocks, and finished product inventories in response to declining order volumes. The survey noted that rising prices were often linked to currency depreciation, but the rates of increase in input costs and output prices moderated.

Andrew Harker, economics director at S&P Global Market Intelligence, said: “Demand conditions were the main limiting factor on the Turkish manufacturing sector in October, with firms struggling to secure sufficient volumes of new orders to support production and maintain staffing levels.”

He added: “There was some further respite in terms of inflation, however, which may provide some grounds for optimism that an improved demand environment can become established soon.”