ISLAMABAD: Caretaker Commerce Minister Dr. Gohar Ejaz and US Trade Representative Ambassador Katherine Tai discussed enhancing economic cooperation between the two countries on Tuesday through bilateral trade and investment, Pakistan’s Ministry of Commerce said in a statement.

The two representatives held a virtual meeting to discuss progress made by both sides after the 9th Pakistan-United States Trade and Investment Framework Agreement (TIFA) Council meeting, which was held in February. The high-level trade talks between the two countries took place this year after a gap of seven years, with the last one taking place in Islamabad in 2016.

TIFA provides a forum for the two countries to discuss bilateral trade and investment, and explore access for Pakistani exports to the US market.

“Both sides agreed to work closely on the various bilateral trade and investment matters with the objective of enhancing the economic cooperation between Pakistan and the USA,” the commerce ministry said.

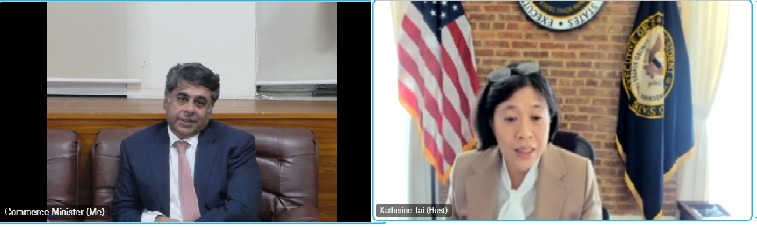

The photo shows Pakistan's Caretaker Commerce Minister Dr. Gohar Ejaz (right) and US Trade Representative Ambassador Katherine Tai holding a virtual meeting on October 24, 2023. (Photo courtesy: Ministry of Commerce)

Ejaz informed Tai of steps taken by the Pakistani government to improve the country’s business climate, the statement said. The minister also urged Tai to consider allowing duty free access of Pakistani textile and garments exports to the US, adding that Pakistan imports a major chunk of cotton from the US.

He urged Tai to explore a joint venture between the two countries in textile and industrial manufacturing to add value to bilateral trade between Washington and Islamabad, the statement added.

“Ambassador Tai highlighted the importance of Pakistan as an important trading partner of the US. and acknowledged that the continuous engagement between both countries is always encouraging,” the commerce ministry said.

Once close allies, Islamabad’s and Washington’s ties deteriorated over the years mostly due to concerns about Pakistan’s alleged support to the Taliban in Afghanistan. Islamabad vehemently denies sheltering the Taliban in sanctuaries, something Washington has always regarded with suspicion.

Relations between the two countries further deteriorated when former prime minister Imran Khan last year accused Washington of having a hand in his ouster. Khan alleged the US colluded with his political rivals and Pakistan’s army last year in what he said was a “foreign conspiracy” to remove him from power. Khan said Washington had decided to oust him since his administration was forging closer ties with Russia. Washington and Pakistan’s army have both denied Khan’s allegations.