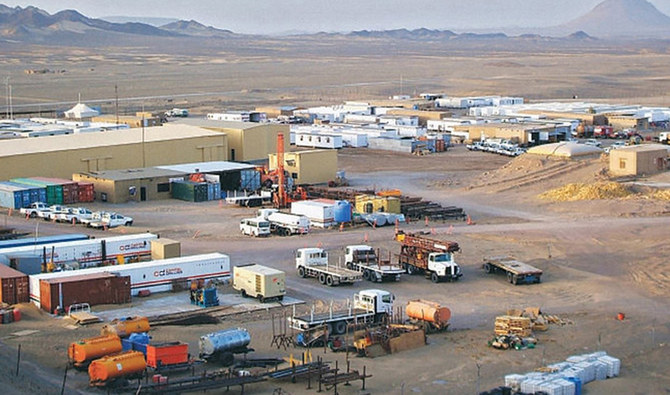

ISLAMABAD: Barrick Gold Corp. CEO Mark Bristow has said there is newfound “interest” from multinational mining firms to develop the $7 billion Reko Diq gold and copper mine in southwestern Pakistan, Bloomberg reported on Thursday.

Barrick Gold owns a 50 percent stake in Pakistan’s Reko Diq mine, with the remaining 50 percent owned by the governments of Pakistan and the province of Balochistan. Barrick considers the mine one of the world’s largest underdeveloped copper-gold areas.

“They have an interest,” Bristow said in an interview to Bloomberg, declining to name the mining companies interested in Reko Diq or what he meant by “interest.”

“Of course, they’re a lot more conservative than I am, but as we open up these areas, whatever way you look at copper, there’s not enough of it.”

Last month Barrick said it was open to bringing in Saudi Arabia’s wealth fund as one of its partners in the Reko Diq project but has dismissed reports it was in talks with fellow Canadian miner First Quantum Minerals on a possible acquisition.

Barrick won’t be diluting its equity in the project but “will not mind” if Saudi Arabia’s Public Investment Fund (PIF) wants to buy out the equity of the Pakistan government, Bristow had said in a Reuters interview.

“There is a strong relationship between Saudi and Pakistan and since we control the project we have the first right of refusal,” the CEO added, saying Barrick would support PIF coming into the mine through Pakistan’s 25 percent equity stake.

In an out of court agreement last year, Barrick Gold ended a long-running dispute with Pakistan, and agreed to restart development on the mine. Under the deal, the company withdrew its case in an international arbitration court, which had slapped a penalty of $11 billion on Pakistan for suspending the contracts of the company and its partners in 2011.

The company’s license to mine the untapped deposits was canceled after the Supreme Court ruled illegal the award granted to it and its partner, Chile’s Antofagasta. Antofagasta had agreed to exit the project, saying its growth strategy was focused on production of copper and by-products in the Americas.

Pakistan’s mineral-rich province of Balochistan is home to separatist militants who have engaged in insurgency against the government for decades, demanding a greater share of the region’s resources.

Barrick CEO says big miners showing interest in Pakistan’s Reko Diq project

https://arab.news/4k56r

Barrick CEO says big miners showing interest in Pakistan’s Reko Diq project

- Barrick owns 50 percent stake in Reko Diq, 50 percent owned by governments of Pakistan, province of Balochistan

- Barrick Gold considers the Reko Diq mine one of the world’s largest underdeveloped copper and gold areas

IMF hails Pakistan privatization drive, calls PIA sale a ‘milestone’

- Fund backs sale of national airline as key step in divesting loss-making state firms

- IMF has long urged Islamabad to reduce fiscal burden posed by state-owned entities

KARACHI: The International Monetary Fund (IMF) on Saturday welcomed Pakistan’s privatization efforts, describing the sale of the country’s national airline to a private consortium last month as a milestone that could help advance the divestment of loss-making state-owned enterprises (SOEs).

The comments follow the government’s sale of a 75 percent stake in Pakistan International Airlines (PIA) to a consortium led by the Arif Habib Group for Rs 135 billion ($486 million) after several rounds of bidding in a competitive process, marking Islamabad’s second attempt to privatize the carrier after a failed effort a year earlier.

Between the two privatization attempts, PIA resumed flight operations to several international destinations after aviation authorities in the European Union and Britain lifted restrictions nearly five years after the airline was grounded following a deadly Airbus A320 crash in Karachi in 2020 that killed 97 people.

“We welcome the authorities’ privatization efforts and the completion of the PIA privatization process, which was a commitment under the EFF,” Mahir Binici, the IMF’s resident representative in Pakistan, said in response to an Arab News query, referring to the $7 billion Extended Fund Facility.

“This privatization represents a milestone within the authorities’ reform agenda, aimed at decreasing governmental involvement in commercial sectors and attracting investments to promote economic growth in Pakistan,” he added.

The IMF has long urged Islamabad to reduce the fiscal burden posed by loss-making state firms, which have weighed public finances for years and required repeated government bailouts. Beyond PIA, the government has signaled plans to restructure or sell stakes in additional SOEs as part of broader reforms under the IMF program.

Privatization also remains politically sensitive in Pakistan, with critics warning of job losses and concerns over national assets, while supporters argue private sector management could improve efficiency and service delivery in chronically underperforming entities.

Pakistan’s Cabinet Committee on State-Owned Enterprises said on Friday that SOEs recorded a net loss of Rs 122.9 billion ($442 million) in the 2024–25 fiscal year, compared with a net loss of Rs 30.6 billion ($110 million) in the previous year.