RIYADH: Dubai Electricity and Water Authority has awarded a contract worth 5.5 billion dirhams ($1.5 billion) to Abu Dhabi-based Masdar to construct the sixth phase of the 1,800 megawatt Mohammed bin Rashid Al Maktoum Solar Park.

At least 23 international companies participated in the bidding process, but Masdar was given the contract as it offered a levelized cost of energy of $1.621 cents per kilowatt hour, the lowest of any of DEWA’s solar independent power producer model projects to date, according to a press statement.

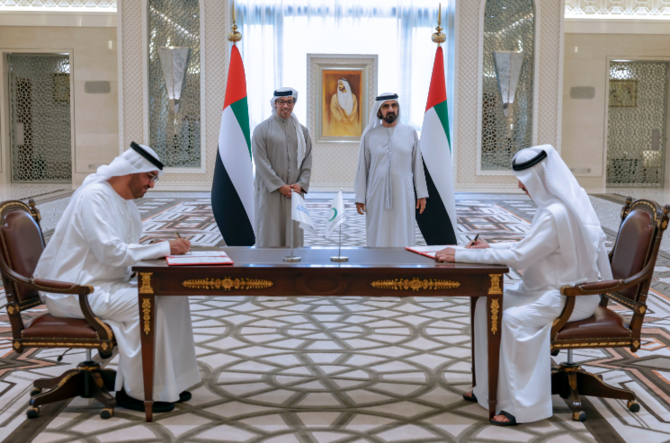

The agreement was signed by Ahmed bin Ahmed Al-Jaber, UAE’s minister of industry and advanced technology, and Saeed Mohammed Al-Tayer, managing director and CEO of DEWA.

“Being awarded this landmark renewable energy project on the world’s largest single-site solar park is another significant milestone for Masdar. It is a testament to Masdar’s track record in pioneering clean energy projects as we continue to support the UAE’s net zero by 2050 strategic initiative,” said Al-Jaber, who is also the chairman of Masdar.

He added: “Ahead of our nation hosting COP28 later this year, it is vital that the world triples global renewable energy capacity by 2030 to keep the ambition of 1.5 degrees within reach. This landmark project demonstrates definitive action in our shared journey toward a cleaner, greener future.”

Upon completion, the sixth phase of the project is expected to provide clean energy to approximately 540,000 residences and reduce 2.36 million tons of carbon emissions annually.

“This latest award once again shows that Masdar is a global leader in clean energy as we move forward from 20 GW (gigawatts) capacity today to reach 100 GW of clean energy capacity by 2030 driving decarbonization at home and abroad,” said Mohammed Jameel Al-Ramahi, CEO of Masdar.

The sixth phase will become operational in stages starting from the fourth quarter of 2024, the statement added.

“We are committed to achieving a balance between development and environmental sustainability across social, economic and environmental plans. This underscores the UAE’s prominent status as one of the world’s largest investors in clean and renewable energy projects,” added Al-Tayer.