KARACHI: The Saudi Tourism Authority launched the travel planning and booking app Nusuk in Pakistan on Tuesday, a day after Islamabad and Riyadh signed an agreement to increase the number of flights and boost tourism.

Nusuk is Saudi Arabia's first-ever official planning, booking, and experience platform to create Hajj or Umrah itineraries to Makkah, Madinah, and beyond. With Nusuk, travelers from all over the world can easily organize their entire visit to the Kingdom, from applying for an eVisa to booking hotels and flights.

The platform was launched in Karachi by the Saudi Minister of Hajj and Umrah Dr. Tawfiq Al-Rabiah who arrived in Pakistan on a four-day visit on Sunday with a delegation comprising the deputy ministers of Hajj and Umrah, tourism and international cooperation, the president of Saudi Airlines, the general authority of civil aviation, and representatives from Saudi Aviation.

Representatives of Pakistan's business community and Hajj and Umrah tour operators attended the launch event.

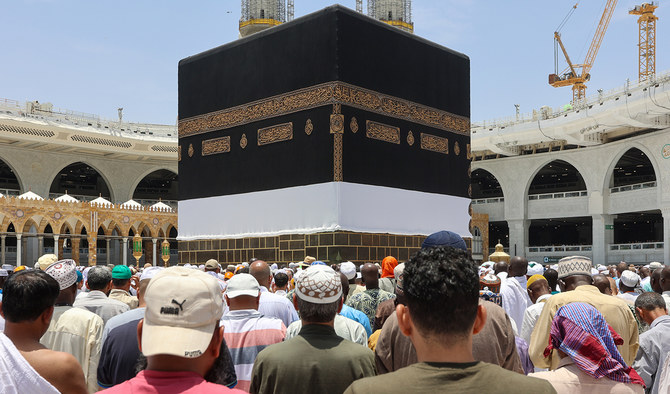

A screen grab taken from Nusuk's website shows the app's logo and the Holy Kaaba in the background. (Photo courtesy: nusuk.sa)

“This platform is part of Saudi Vision 2030 that aims at opening Saudi Arabia to the world through increasing tourism,” Furqan Abdul Kadir, convener of the Central Standing Committee on Hajj and Umrah at the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) which is organizing the launch event, told Arab News.

Kadir said the platform's launch would allow tourists direct access to many Saudi cities, making it easier for Pakistanis to travel to the Kingdom.

“Apart from the ease of having access to the Saudi visa, this would also increase interaction between the people of Pakistan and Saudi Arabia, resulting in a further strengthened relationship,” Kadir added.

According to the Saudi Tourism Authority, tourism development is an important driver of growth for the Kingdom's future and one of the key pillars at the heart of the Vision 2030 plan to help diversify the country's economy and reduce its reliance on oil.

The Ministry of Tourism, the Saudi Tourism Authority and the Tourism Development Fund were established in line with best international practices to support the growth of the tourism sector.

The launch of the Nusuk app comes on the heels of Pakistan and Saudi Arabia signing an agreement on Monday to increase the number of flights between the two countries, with Al-Rabiah saying the deal would also help bring down the cost of travel.