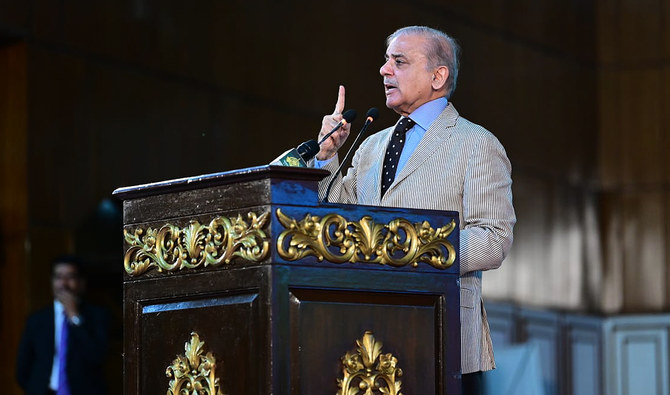

ISLAMABAD: Prime Minister Shehbaz Sharif on Sunday said his government saved Pakistan from a sovereign default, as he delivered his farewell address to the nation as its chief executive.

Sharif’s address followed a day after President Dr. Arif Alvi ratified Senator Anwaar-ul-Haq Kakar as the caretaker prime minister of the country. Haq was announced as the candidate for the post by the prime minister and the leader of the opposition in the National Assembly, Raja Riaz, on Saturday.

Sharif was elected prime minister on April 10, 2022, after ex-PM Imran Khan was dismissed from office via a parliamentary vote. During the course of its 16-month stint, Sharif’s government was racked by a worsening economic crisis and political instability. Pakistan breathed a sigh of relief after it managed to clinch a last-gasp $3 billion bailout program with the International Monetary Fund (IMF).

“My fellow countrymen, with the favor of the Almighty, we had the courage and capability to pull Pakistan out of its most serious economic and political crises,” Sharif said in his televised address to the nation.

“Time and the records will prove witness to the fact that we saved Pakistan from default and as a result, saved the nation from massive destruction in the times to come, and ensured Pakistan’s national interest did not suffer,” he added.

Sharif blamed the government of former prime minister Imran Khan for planting “landmines” that led to Pakistan’s economic meltdown, adding that due to the previous government’s mishandling of the economy, his administration could not arrest inflation.

“We can’t even fathom the destruction that would have taken place if Pakistan, God forbid, had defaulted,” the prime minister said. “We would experience shortages of food, medicines, electricity, gas, and petrol,” Sharif said.

Sharif said his government had adopted the constitutional path to come into power, adding that it was relinquishing it the same way. He spoke highly of Kakar, expressing confidence in his ability to hold free, fair, and transparent elections.

“He belongs to our great province Balochistan, and I am sure that he will ensure that free and fair elections are held in the country,” Sharif said.

Kakar will oversee elections in Pakistan, which were scheduled to be held in November. However, after the outgoing administration of Sharif approved the results of the latest census, the Election Commission now has to draw new boundaries for hundreds of federal and provincial constituencies and will be able to give an election date only after that exercise is complete.

The vote is thus widely expected to be delayed to as far as February.