ST. PETERSBURG: Russian firms are keen to develop further ties with the UAE, the country’s deputy prime minister has insisted in a speech lauding economic links between the two nations.

Speaking at the St. Petersburg International Economic Forum, Denis Manturov — also Russia’s industry and trade minister — noted the special nature of Russian-Emirati relations, which includes strong ties of friendship and a rich history of cooperation based on the principles of mutual respect and trust.

His comments came after the ruler of the emirate of Ras Al-Khaimah, Sheikh Saud Al-Qasimi, took part in the opening of the UAE’s pavilion at the forum, marking the country’s role as a guest at the event.

Trade turnover between the two countries has doubled over the past year and now amounts to $10 billion, and Manturov said: “We are constantly expanding the range of areas in which we build joint work.

“We are implementing a number of industrial cooperation projects, initiatives in the field of transport and services, energy and food security.

“We have started an active negotiation process on a free trade agreement between the UAE and the states of the Eurasian Economic Union.

“This will give an additional impetus to the comprehensive development of our multilateral trade and economic ties.”

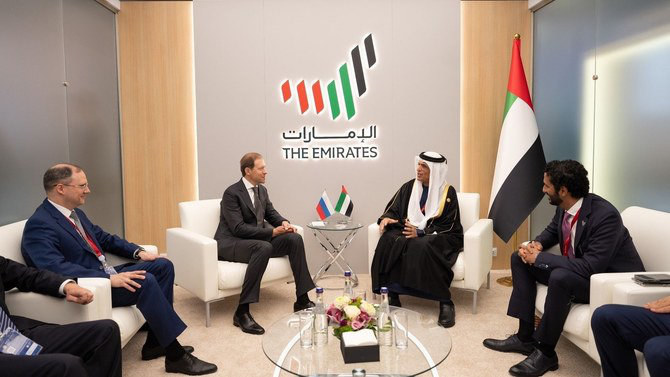

After the opening ceremony for the pavilion, Manturov and the Minister of Economy of the UAE Abdullah bin Touq Al-Marri joined the Russia-UAE business dialogue, during which priority areas for the development of further cooperation were considered.

“I would like to note that our companies from both sides are interested in continuing work on different vectors of cooperation,” Manturov said, adding: “Russian business is showing great interest in locating production and logistics facilities in the UAE.”

He went on: “We also expect continued investment cooperation with the UAE. In recent years, Emirati companies have invested in various sectors of the Russian economy, and these investments have paid off — this is reflected in the figures of foreign trade turnover.

“I would like to emphasize that industrial cooperation is the basis for increasing investment and trade turnover.

“Today, opportunities for cooperation, projects in the aviation and automotive industries, metallurgy, mechanical engineering, and pharmaceuticals are being successfully implemented and worked out with our colleagues from the UAE.”

In a speech, Al-Marri marked the strong participation of his country in the forum, which includes 18 companies in various sectors of the economy.

Speaking about the trade turnover between Abu Dhabi and Moscow, Al-Marri noted its growth has doubled over the past year.

The minister said: “On the aspect of engagement, we really built a strong and significant approach in areas that we are looking forward to engage with, more specifically on the aspects of science, AI (artificial intelligence), green energy, and technology.

“The UAE and Russia have a very strategic partnership and we are engaged in this partnership in a very robust way and our trade has grown since then.”

The participation of the UAE as a guest country at the St. Petersburg International Economic Forum is an important step in strengthening trade, economic and investment cooperation between the two countries.

The pavilion’s motto — “Impossible is Possible” — is seen as perfectly corresponding to the spirit of Russian- Emirati relations.