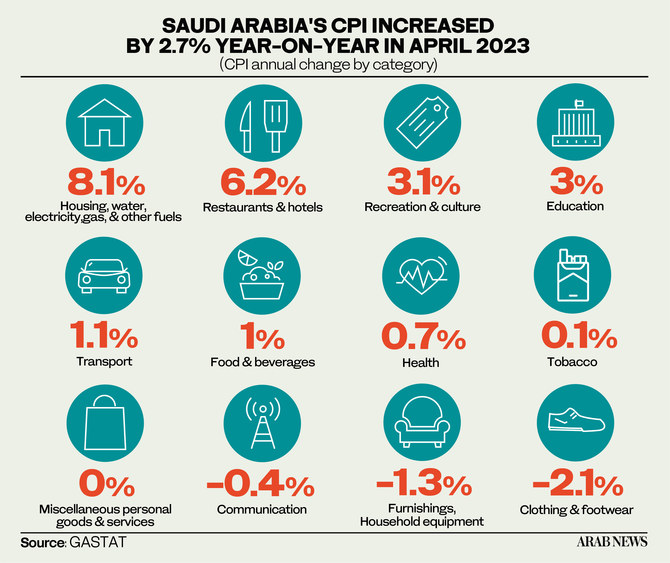

RIYADH: Saudi Arabia’s inflation rate remained unchanged at 2.7 percent in April compared to March 2023, according to the latest report released by the General Authority for Statistics.

However, on a year-on-year basis, the Kingdom’s inflation rate continues to rise in line with the global trend, which stood at 2.3 percent in April 2022.

The Kingdom’s Consumer Price Index in April was driven by higher prices of housing, water, electricity, gas, and other fuels, which rose by 8.1 percent in April, compared to the same month of 2022, the report noted.

“Actual rents for housing increased by 9.6 percent in April 2023, reflecting the increase in rents for apartments by 22.2 percent. Prices for rents were the main driver of the inflation rate in April 2023 due to their high relative importance in the Saudi consumer basket with a weight of 21.0 percent,” said GASTAT in the report.

The food and beverage sector — the leading driver for inflation during most months of last year — rose by 1 percent annually in April, and within the food sector, milk, milk products and eggs rose by 10.9 percent.

In March 2023, Saudi Arabia’s inflation rate had softened to 2.7 percent from 3 percent recorded in February.

The inflation rate was at 3.4 percent and 3.3 percent in January 2023 and December 2022, respectively.

Meanwhile, the growth rate of wholesale prices continues to decelerate in Saudi Arabia, with the Kingdom’s wholesale price index rising by 0.2 percent in April 2023, compared 1.1 percent rise recorded in March.

Saudi Arabia’s WPI rose by 2.7 percent in February, down from the 3.6 percent increase seen in January this year.

The GASTAT report revealed that the annual increase in the WPI index was primarily driven by higher prices of food products, beverages, tobacco, and textiles which went up by 3.4 percent in April.

Prices of agriculture and fishery products increased by 1.4 percent year-on-year, while other transportable goods went up by 0.8 percent.