NIIGATA, Japan: Finance leaders of the Group of Seven (G7) rich nations are expected to warn of more global economic uncertainty as they wrap up a three-day meet on Saturday overshadowed by a US debt ceiling stalemate and fallout from Russia’s invasion of Ukraine.

The gathering in the Japanese city of Niigata came as worries over a US default fueled uncertainty over the global outlook, already clouded by stubbornly high inflation and US bank failures.

“The global economy has shown resilience against multiple shocks, including the COVID-19 pandemic, Russia’s war of aggression against Ukraine, and associated inflationary pressures,” the leaders will say in a final draft of a communique seen by Reuters.

“We need to remain vigilant and stay agile and flexible in our macroeconomic policy amid heightened uncertainty about the global economic outlook.”

The communique is unlikely to mention the US debt ceiling stalemate, which hits markets at a time when borrowing costs are rising because of aggressive monetary tightening by US and European central banks.

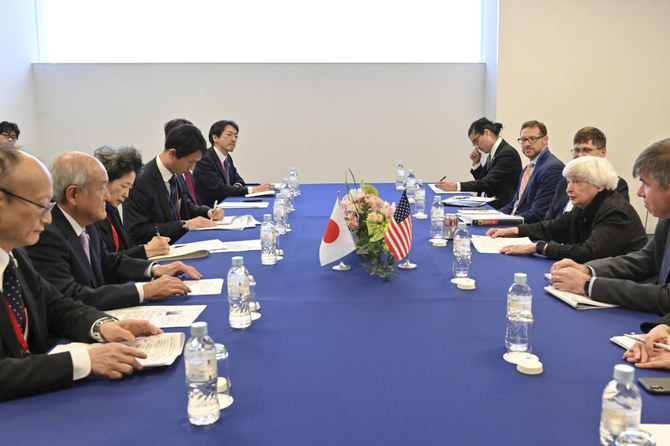

US Treasury Secretary Janet Yellen said on Friday she would meet senior Wall Street bankers next week about the possibility that Washington could default on its debt for the first time since 1789.

“Clearly, distress in the world’s biggest economy would be negative for everyone,” World Bank President David Malpass told Reuters on the sidelines of the G7 meeting the same day. “The repercussions would be bad to not get it done.”

On the banking troubles, the draft communique said policymakers would tackle “data, supervisory, and regulatory gaps in the banking system.”

The grouping is expected to reiterate its condemnation of Russia’s invasion of Ukraine and pledge to strengthen monitoring of cross-border transactions between Russia and other countries.

China has also been much on the leaders’ minds, with this year’s chair, Japan, spearheading efforts to diversify supply chains and reduce their heavy reliance on the world’s second-biggest economy.

The G7 finance leaders are expected to set a year-end deadline for launching a new scheme to diversify global supply chains, the draft showed.

The new scheme envisages the G7 offering aid to low- and middle-income countries so that they can play a bigger role in supply chains for energy-related products, such as by refining minerals and processing manufacturing parts.