KARACHI: Overseas investors said on Tuesday they were faced with a growing challenge and threat to the continuity of their businesses in the South Asian country as the government remains unable to devise a plan to clear an estimated $1.5 billion outbound remittances.

Top officials of a representative body of multinational companies operating in Pakistan told journalists in Karachi the country's current economic situation was affecting the confidence of foreign investors.

“Besides shrinking economy, the high inflation and interest rates, weakening currency, the uncertain environment and lack of ownership is affecting business confidence,” said Amir Paracha, president of the Overseas Investors Chamber of Commerce and Industry (OICCI).

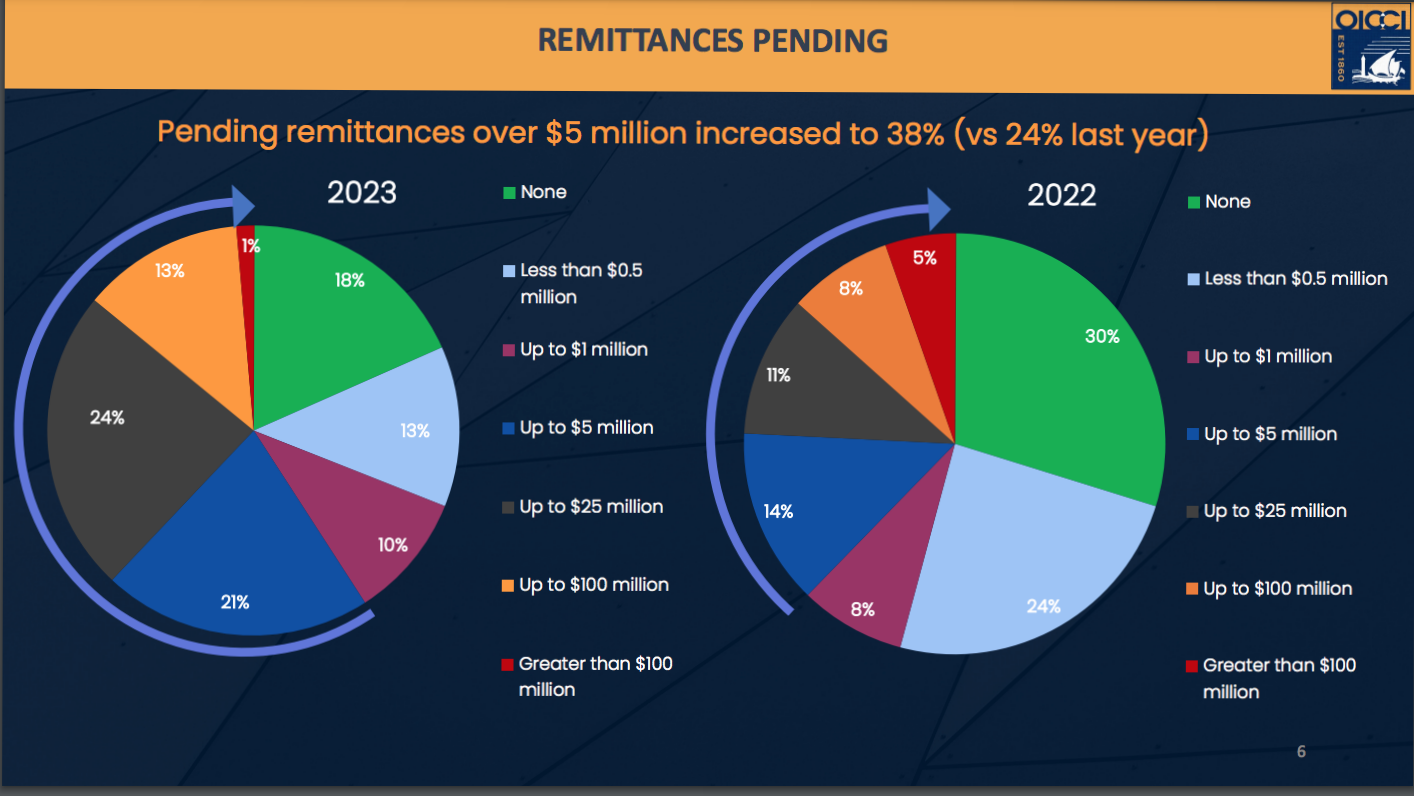

The OICCI chief said the major concern prevails about the remittance of dividends pending for the last one year besides remittances for services, including directors’ fees that need to be repatriated.

Pakistani Finance Minister Ishaq Dar did not respond to Arab News' request for a comment on the matter.

Infographics by OICCI

Paracha estimated that around $1.5 billion were stuck up in Pakistan that multinational companies wanted to be repatriated to their parent companies, but were unable to have the payments processed due to the current economic meltdown in the South Asian country.

“All multinational companies (MNCs) are faced with serious foreign exchange remittance issue,” Paracha said. “We fully understand the economic constraints but at least the government should sit with us to chalk out a plan to deal with the situation for the satisfaction of companies’ headquarters.”

The South Asian nation has been facing a severe dollar liquidity crunch that has either slowed or blocked the process of dollar outflow to avoid complete dry up of its meagre $4.2 billion foreign exchange reserves.

The current reserve position continues to exert pressure on the national currency that has seen a massive decline in its value against US dollar. The greenback further rose to Rs288.43 on Tuesday.

Abdul Aleem, the OICCI general secretary, said the primary challenge being faced by most companies was the “threat to business continuity” under the current situation.

“An active forum for the government and the private sector is vital to interact and collectively drive actionable reforms,” he said.

Multinational companies face difficulties in repatriation of dividends, royalty, technical fee and service payments to their parent companies and the government’s indifferent attitude is further compounding the situation, Aleem informed.

“We have approached the prime minister, the finance ministry and the board of investment but no one has responded to date,” he lamented.

The OICCI officials said they had offered four options for the situation, including repatriation of 10 percent of pending dividends within the next two months and the rest in quarterly installments over the next two years.

The other options included all pending dividends be hedged at the current exchange rate and remitted in two years, pending dividends be allowed to be invested into a profit-generating bank account, and pending dividends be allowed to be re-invested in the expansion of local subsidiaries and treated as additional foreign direct investment (FDI) from the parent company, they detailed.

Pakistan attracted $784 million FDI during the first eight months of the current fiscal year (July 2022-June 2023) which is 40 percent less than the foreign investment last year, bearing no comparison with FDI inflow in other countries in the region.

“For a developing country like Pakistan, FDI is expected to be over 3 percent of the GDP against the current level of less than 0.5 percent,” Aleem said. "The potential of FDI is around $9 billion."

Due to the current economic state, the OICCI officials said, many members had decided to partially or completely shut down their operations like other businesses in Pakistan.

“We may see a serious downfall in revenue collection from organized businesses,” Paracha said. "Therefore, we have recommended that the government should simplify the tax regime, broaden the tax base, remove the one-time burden of Super Tax from the organized sector."

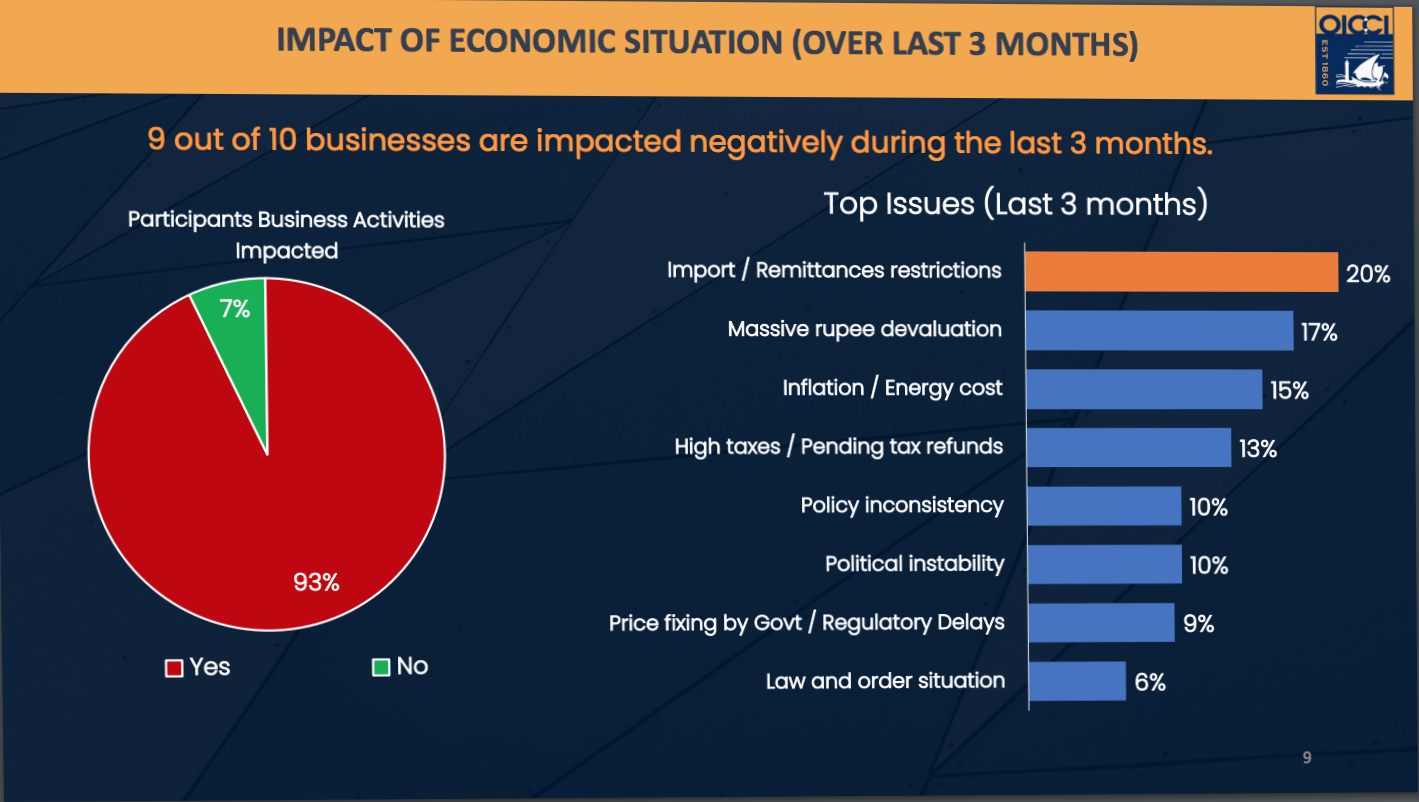

Infographics by OICCI

Sharing the findings of a recent survey, the OICCI officials said 20 percent of the businesses had been negatively impacted during the last three months due to the economic situation.

“Seventeen percent said they were impacted by rupee devaluation while 15 percent businesses have been negatively impacted by inflation or the energy price hike,” Aleem informed.

The officials said they had recommended the government to increase tax-free income to Rs1.2 million from the current Rs0.6 million annually.

Considering the recent World Bank forecast of 0.4 percent GDP growth this fiscal year, the OICCI estimates that most of the businesses in Pakistan, including foreign investors, will be affected and will show subdued fiscal results and thereby lower tax contribution.