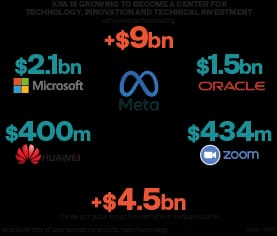

CAIRO: Saudi Arabia witnessed the signing of $9 billion worth of investment contracts on the first day of the global tech event LEAP23 that began on Feb. 6 in Riyadh.

Aimed at supporting future technology, digital entrepreneurship and tech startups, the deals were announced by Saudi Arabia’s Minister of Communications and Information Technology, Abdullah Al-Sawaha, during his opening speech at the event that will run till Feb. 9.

These deals include Microsoft’s $2.1 billion investment that the tech giant is putting in to develop a super-wide cloud in the Kingdom, while Oracle’s agreed to invest $1.5 billion to establish a new cloud region in the country.

Chinese tech firm Huawei also pumped in $400 million to offer cloud services in the Kingdom, while state oil firm Aramco formed a partnership with Zoom worth $434 million to establish a cloud area. In addition, the event saw the signing of $4.5 billion worth of other deals with a wide range of global and local firms for various sectors.

These investments aim to strengthen the Kingdom’s position as the largest digital economy in the Middle East and North Africa region aligned with Crown Prince Mohammed bin Salman’s goal to empower the technology sector.

Al-Sawaha stated that hosting the LEAP23 conference is a global affirmation of the great support directed by the Kingdom to transform the economy into a digital landscape that promises rapid developments in line with Vision 2030.

The conference also witnessed some major announcements including Meta launching the opening of the first Metaverse Academy in MENA, headquartered in Saudi Arabia; WEO Technology and Camel Lab launching Hektar, a multi-content social media app. In addition, MENA Communication and STC announced the launching of Beem – a new application for instant messaging, high-quality voice and video calls, and business features.

Al-Sawaha stressed that the technology sector holds unprecedented opportunities supported by the Crown Prince in sub-sectors including digital economics, Internet of Things, health tech, quantitative sciences, space and satellites, fintech and open sources.

In his opening speech, the minister stated that the event is set to host more than 250,000 attendees, as opposed to 100,000 last year, and will continue to see more investments as the Kingdom holds a $42 billion opportunity platform and stands as the largest technology market in the region.

He added that Saudi Arabia continues to lead the human technical workforce with more than 340,000 workers in the market and female participation in the technical sector reaching 32.5 percent, higher than the average of the EU and Silicon Valley.

Taking place at the Riyadh Front Center for Exhibitions and Conventions, the conference was launched under the title “Towards New Horizons” with more than 400 global and local technology companies.