KARACHI: Traders and market analysts described 2022 as a tough year for Pakistan’s stock market on Thursday, as many of them warned the trend could persist in the coming year amid a worsening economic situation and enduring political uncertainty in the country.

According to the Pakistan Stock Exchange (PSX) data, the benchmark KSE100 index lost over 6,000 points since the beginning of the year and the market capitalization of listed companies fell by 18 percent to Rs6.3 trillion until December 28.

Given the exchange rate volatility, the loss in the US dollar terms amounted to 36 percent and brought the market value down to $28 billion.

“For the Pakistan stock market, 2022 was not a good year,” Muhammad Sohail, chief executive officer of Topline Securities, told Arab News. “The share prices came down sharply in 2022 along with the volume. There were also very few initial public offerings and other right issues.”

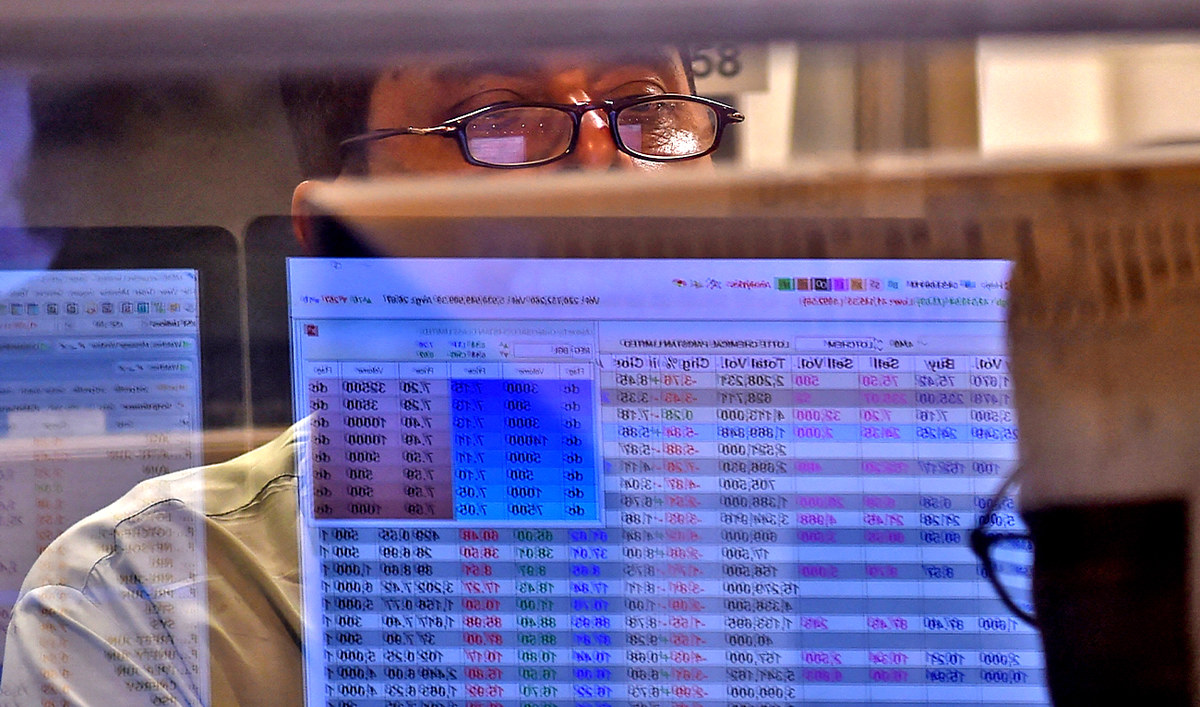

A stockbroker monitors the share prices during a trading session at the Pakistan Stock Exchange (PSX) in Karachi on June 3, 2022. (AFP)

Pakistan’s stock market only recorded three new listings in the outgoing year that generated a total amount Rs1.3 billion, the lowest in the last nine years.

Sohail believed the tight monetary policy regime and political situation played a critical role in keeping the market performance subdued.

“The tightening of monetary policy, which led to an interest rate hike from 10 to 16 percent, did not prove good along with the overall pollical situation of the country,” he continued. “Together the two things kept the equity market situation bad.”

Pakistan’s central bank raised the key policy rate by 625 basis points in 2022 to contain rising inflation which hovered around the record high of 25 percent.

Ahsan Mehanti, the top official at the Arif Habib Corporation, added “growing cost of doing business” to his list of negative factors that slowed down the stock market.

He noted the national currency of the South Asian country “devalued over 21 percent during the year from Rs177 to more than Rs226” against the US dollar due to the economic uncertainty over Pakistan’s debt repaying ability and huge imports coupled with the dollar rate hike in the global market.

Small traders also complained about higher interest rate regime which, they said, took its toll on the profitability of companies and increased the cost of doing business.

“The interest rates are almost at an all-time high,” Jibran Sarfraz, a trader and broker at PSX, complained. “At such levels, it has become difficult to do business due to the substantial increase in the borrowing cost.”

He maintained the higher interest rate made finished goods more expensive, impacting sales and profit margins of various organizations.

Despite the adverse business environment prevailing at country’s stock market, however, a number of sectors performed well while other posted huge declines.

Real Estate Investment Trust (REIT), Synthetic & Rayon, and Sugar were the top performing sectors in 2022 and their market capitalization increased by 12, six and five percent, respectively.

Engineering, automobile parts, and miscellaneous sectors, on the other hand, declined by 45, 41 and 34 percent, respectively.

During the outgoing year, the government and the IMF continued to discuss a $7 billion bailout program, though Pakistani officials remained visibly reluctant to implement harsh conditions imposed by the global lender which caused delays in the completion of performance reviews under the financial facility.

Currently, the country is working with the IMF over the ninth review, though the two sides have made very little progress which has left the stock exchange in a prolonged state of economic uncertainty.

A participant stands near a logo of IMF at the International Monetary Fund - World Bank Annual Meeting 2018 in Nusa Dua, Bali, Indonesia, on October 12, 2018. (REUTERS/File)

Meanwhile, Pakistan’s forex reserves stand at $6.1 billion which are barely enough to provide an import cover of one month to the country.

The dire situation of the economy has prompted international credit rating agencies like Standard and Poor, Fitch and Moody’s to downgrade Pakistan. The foreign firms have bracketed the South Asian state with countries like Angola, Congo, Tunisia and Nigeria who were previously thought to be perilously close to default.

While Pakistan’s finance minister has tried to dispel such economic fears, he has simultaneously conceded that the country is in a tight spot.

The country’s equity traders and analysts fear the market performance in 2023 may also remain dull due to the external debt repayment crisis and increased political noise ahead of the general elections.