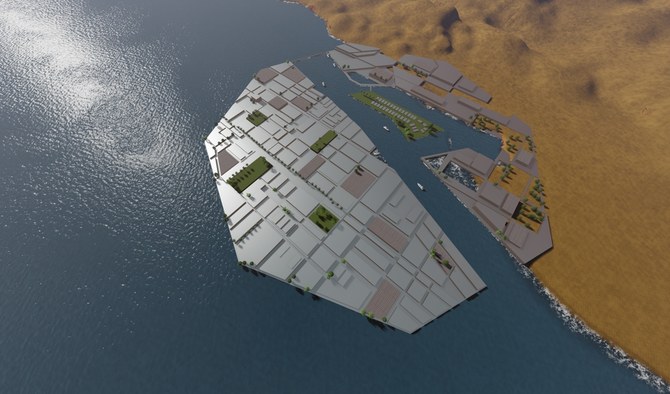

RIYADH: Saudi Arabia’s $500-billion megaproject NEOM is negotiating with entities to invest $20 billion to develop its planned brine chemicals complex in the industrial city OXAGON, according to a report.

Citing a close source familiar with the matter, MEED reported that the development will be built in phases and require somewhere between $15 billion to $20 billion in investments.

According to the report, the chemicals complex aims to build industries and plants that convert brine, the main waste output of desalination, into industrial materials that can be used locally or exported internationally.

NEOM’s water and energy subsidiary ENOWA said the brine generated from the desalination plant will be treated to feed industries utilizing high-purity industrial salt, bromine, boron, potassium, gypsum, magnesium and rare metal feedstocks, the report added.

In September, ENOWA’s CEO Peter Terium, during an exclusive interview with Arab News on the sidelines of the Future Desalination International Conference held in Riyadh, said that NEOM will build a water desalination plant by 2024 to combat water scarcity.

“If you want to build a future land like NEOM, and you want to have liveability, green parks and food production, then you need water, and of all the beautiful things it has, water is not one of them,” he said.

Terium added that the desalination project will be a benchmark in sustainability as it will be powered by 100 percent renewable energy.

In June, ENOWA signed a memorandum of understanding with Japan-based Itochu and French firm Veolia to develop a desalination plant powered by renewable energy in OXAGON.

According to ENOWA, the desalination plant will have a design capacity of 500,000 cubic meters a day and is expected to become operational by 2024.

NEOM is Saudi Arabia’s most ambitious project, as the Kingdom eyes diversifying its economy in alignment with the goals outlined in Vision 2030. The construction of the project is progressing steadily in the Tabuk Province in north-western Saudi Arabia, and upon completion, it is expected to become one of the most popular tourist destinations in the Kingdom.