CAIRO: In a post-pandemic era, people have never been more aware of their wellness, including physical well-being and prevalent health issues.

COVID-19, on the other hand, had a significant effect on technology.

When quarantines and social distancing became a daily norm, people used digital technologies to interact with the world, especially in healthcare.

The result: The healthcare industry became one of the fastest growing sectors in the world and gave rise to newer business models such as telehealth and next-gen managed care. Arab News compiled a list of the top 10 most funded health-tech startups in the Middle East and North Africa region.

Vezeeta

Total funding: $73 million

Founders: Amir Barsoum and Ahmed Badr

Investors: BECO Capital, Silicon Badia, Vostok New Ventures, Crescent Enterprises’ CE-Ventures, Endeavour Catalyst and STV

Headquarters: Egypt

Founded in 2012, Vezeeta offers appointment management software for doctors and healthcare providers to manage their operations better.

The company also provides patients with a free platform to book their appointments, as doctors can opt for the platform using a subscription model.

In 2020, Vezeeta managed to secure $40 million in a series D funding round to roll out new products and introduce its telehealth services.

Altibbi

Total funding: $52.5 million

Founders: Jalil Labadi and Abdel Aziz Labadi

Investors: Foundation Holdings, Hikma Ventures, Global Ventures and DASH Ventures

Headquarters: UAE

Founded in 2008, Atlibbi is a digital platform that allows users to receive remote medical consultations and connect with professionals via calls and text chats.

The company has over 10,000 doctors on its platform and won the World Summit Award for the Best Digital Health Content Award and the Schwab Foundation for Social Entrepreneurship.

In its latest funding round, Altibbi raised $44 million in a series B funding round in March 2022 to enhance its technology and e-pharmacy services.

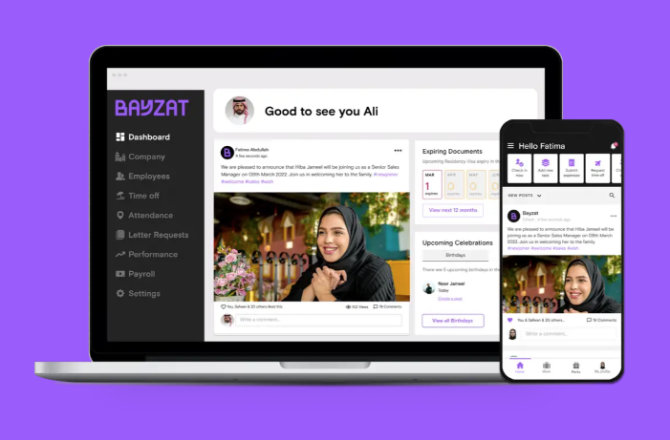

Bayzat

Total funding: $31 million

Founders: Talal Bayaa, Tarek Bayaa and Brian Habibi

Investors: Mohammed Bin Rashid Innovation Fund, Point72 Ventures, Mubadala, Beco Capital, Silicon Badia and Hamed Kanoo Co.

Headquarters: UAE

Founded in 2013, Bayzat is a web and mobile application that allows clients to buy and sell health insurance.

The company’s health tech platform compares health insurance and offers them the best options. Raising $16 million in a series B funding round in 2019, the company used its funding to empower its technology to serve its clients better.

It also provides HR solutions for companies.

GluCare Health

Total funding: $20 million

Founders: Ali Hashemi and Ihsan Almarzooqi

Investors: Polymath Ventures

Headquarters: UAE

Founded in 2020, GluCare offers diabetic care in the clinic and virtually for its patients using its data monitoring and artificial intelligence.

With the company’s application, patients can connect with a care team to monitor glucose, insulin, diet intake and more.

Selfologi

Total funding: $18 million

Founder: Tamer Wali

Investors: Xenel

Headquarters: UAE

Founded in 2020, Selfologi is an online platform for aesthetic medical treatments that allows users to book appointments with doctors in fields like botox, hair removal, acne scarring and more.

The company raised its $18 million investment in a round led by its founder and angel investor, Tamer Wali, with participation from Xenel international group.

Tamer Wali, founder of Selfologi.

Okadoc

Total funding: $12 million

Founders: Fodhil Benturquia

Investors: Abu Dhabi Investment Office, Ithmar Capital and iGan Partners

Headquarters: UAE

Founded in 2018, Okadoc is an appointment booking platform provider that allows people to search for the nearest clinic, practitioners and hospitals.

In 2020, the company closed its $10 million series A funding, expanded its operations and promoted its telehealth offering and virtual consultations.

Yodawy

Total funding: $8.5 million

Founders: Karim Khashaba, Yasser AbdelGawad and Sherief El-Feky

Investors: Global Ventures, MEVP, Algebra Ventures, CVentures, P1 Ventures and Athaal Angel Investors Group

Headquarters: Egypt

Founded in 2018, Yodawy is a virtual pharmacy providing a marketplace for people who want access to medication with over 3,000 pharmacies.

In mid-2021, the company secured $7.5 million in a series B funding round to build its digital marketplace to serve its wide range of customers.

Aumet

Total funding: $8.5 million

Founders: Yahya Aqel and Shahed Altawafsheh

Investors: 500 Startups, Right side capital, TechStars, Shorooq Partners and Plug and Play

Headquarters: Saudi Arabia and Jordan

Established in 2020, Aumet is a B2B marketplace for healthcare providers to buy supplies from retailers. In 2020, the company raised $1.25 million in a seed funding round and had not disclosed its later investments.

Webteb

Total funding: $5.1 million

Founders: Majed Abukhater and Mahmoud Kayal

Investors: Sadara Ventures and Siraj Palestine Fund

Headquarters: Jordan

Founded in 2011, Webteb is an online platform that provides health news, medical information, and lifestyle-related topics.

The company raised $3.2 million in its series C investment round to fuel regional expansion.

Health at Hand

Total funding: $4 million

Founder: Charlie Barlow

Investors: Simon Charlton and Rockfirst Capital

Headquarters: UAE

Born in 2015, Health at Hand is a mobile application that facilitates virtual consultations for patients with nonemergency conditions like colds, coughs and others.

The company raised its total funding in a seed round in 2017 to develop its technology further and introduce its subscription-based model.