RIYADH: After leading an ascent that began in 2018, Saudi banks’ real estate lending has slowed down over the past year caused by a decline in growth in the retail sector, according to the Saudi Central Bank, also known as SAMA.

In the second quarter of 2021, the real estate lending growth rate halved to 5.4 percent from 10.8 percent in the first quarter of 2021.

Although real estate loans by banks increased by SR28.2 billion ($7.5 billion) between January and March 2021 to SR502.7 billion between April and June 2021, their growth rate decelerated compared to the past six quarters.

Moreover, this decrease in the growth trend has continued throughout the second quarter, where the total value of real estate loans stood at SR638.7 billion.

This dip came after a reduction in real estate bank loans to individuals who suffered the same fate since the quarter ending June 2021.

As a result, the bank loan growth rate stumbled from 13.6 percent to 5.7 percent in this quarter.

However, this was not the case during the coronavirus pandemic.

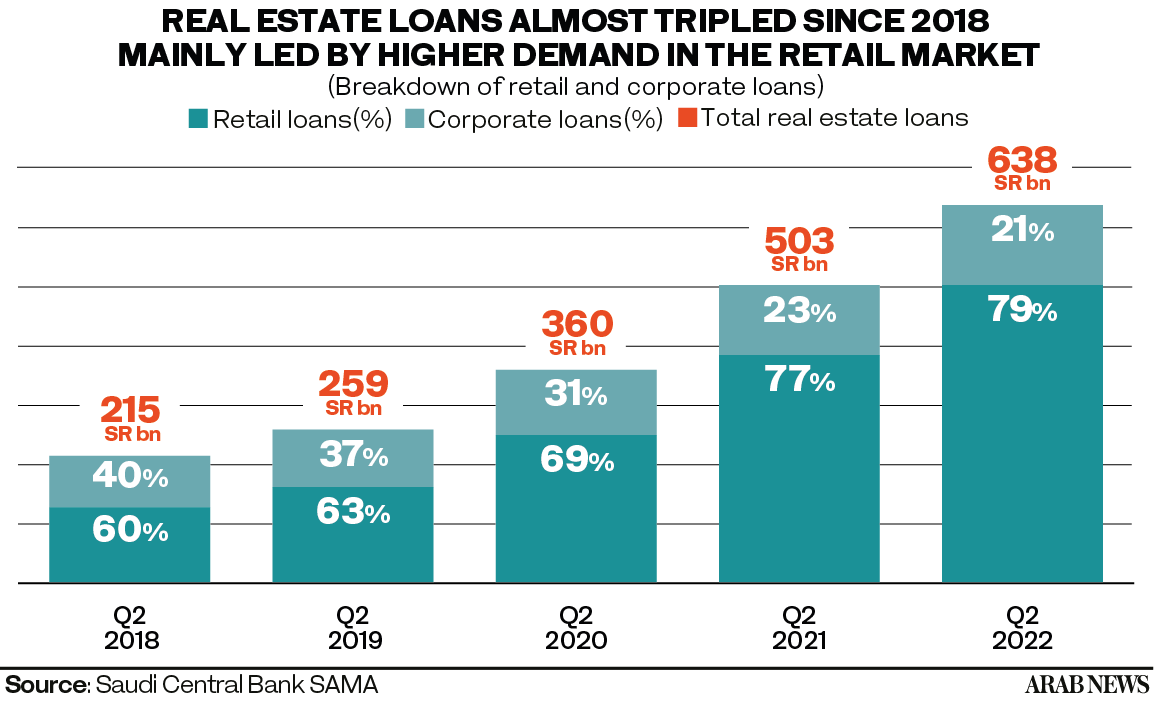

Saudi banks’ real estate lending surged 133 percent from SR215.6 billion in the second quarter of 2018 to SR502 billion in the second quarter of 2021, according to the data compiled by Arab News. The period was considered the peak of coronavirus restrictions.

The retail sector has driven this staggering increase, knowing that individual loans grew 180 percent, from SR128.3 billion to SR358.0 billion over this period.

As a result, the share of retail loans in Saudi banks’ total real estate lending portfolio went up to 79 percent at the end of the second quarter of 2022.

On the other hand, corporate loans kept decreasing their share of real estate bank loans.

Until 2019, corporate loans comprised approximately 40 percent of total credit banks’ loans. However, this number kept diminishing until it reached a mere 25 percent in the past year.

So, what could have been a possible cause for this change in trend? During the coronavirus outbreak, the Saudi government took it upon itself to aid citizens in their search for an affordable mortgage plan.

The government achieved it by removing the 15 percent value added tax from property deals and instead levied a lower 5 percent real estate transaction tax.

In fact, first-time Saudi homebuyers were exempted for transactions of up to SR1 million, according to a 2021 report by Bloominvest titled “Saudi Arabia Residential Market and its impact on the banking sector.”

The banks later increased their mortgage loans to align with the government’s plans to boost home ownership. This trend was evident through new residential mortgage finance for individuals provided by banks’ impeccable growth, hitting its all-time high record of 245 percent year on year in the third quarter of 2019 at SR19.5 billion in comparison to SR5.7 billion in the third quarter of 2018.

According to the SAMA data, this led to a 91 percent rise in the total value of new mortgage loans by banks to individuals.

However — like real estate loans — new mortgage finance loans to individuals plummeted over the past year. The number of new mortgage finance contracts declined 35 percent from 65,667 in the first quarter of 2021 to 42,693 in the second quarter of 2021. The value of new mortgage finance loans decreased 33 percent, from SR49.0 billion to SR32.8 billion during the same period. It fell further to SR31.2 billion in the second quarter of 2022.

Both contract and value mortgage loans performed slightly better in their year-on-year performances in the second quarter of 2022, which could have signified a possible recovery; however, this was countered by another drastic decrease in quarterly values of mortgage loans and contracts.

Therefore, it seems like the future of real estate loans to individuals will continue on a downward spiral.