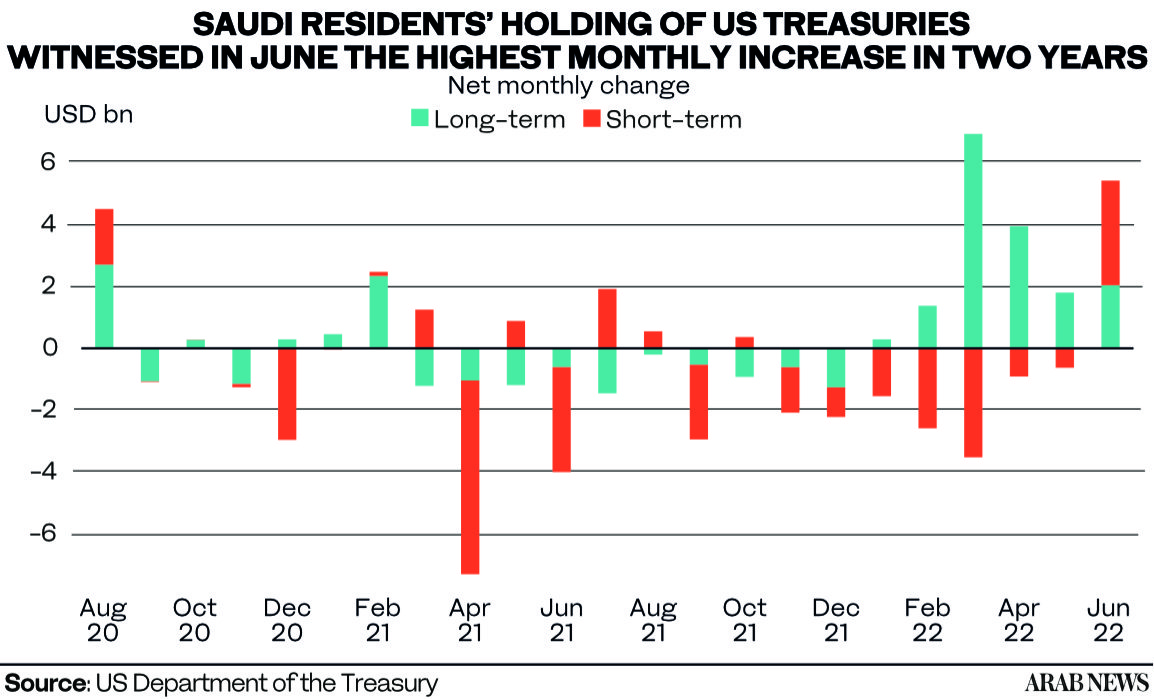

CAIRO: The total value of US Treasuries held by Saudi residents in June increased to $119.2 billion from $114.7 billion in May, according to data from the US Department of the Treasury.

The data showed that the month-on-month rise in US Treasuries had been the highest since August 2020, contrary to the trend seen in the year’s first half.

In January, the US Treasuries holdings totaled $119.4 billion and have seen a general downward trend in the months leading up to June.

It fell to $116.7 billion in February and $115.5 billion in March. It slightly rose to $115.7 billion in April yet dipped to $114.7 billion in May.

Saudi-held long-term Treasuries that have maturities of more than one year rose from $99.3 billion in May to $102 billion in June.

Short-term Treasuries with maturities less than one year, also known as US Treasury bills, grew from $15.3 billion in May to $17.1 billion in June.

While the rate of the Kingdom’s public debt has slowed, the government still spends around $2 billion a quarter to service them, around a third of which is external debt.

The level of debt financing expenses that the Kingdom should pay to service its public debt totaled $2 billion between April and June, up from $1.8 trillion between January and March, reported the Ministry of Finance.

In 2021, these expenses amounted to $1.5 billion in the first quarter, increased to $2 billion in the second, went down to $1.7 billion in the third and concluded the year with $2 billion.

On the other hand, the country’s quickly rising revenue over the past two quarters aided the government in boosting reserves. As a result, it could more than cover the additional government spending in the second quarter of 2022.

According to the Ministry of Finance, the Kingdom’s total revenue amounted to over $98.7 billion in the second quarter of 2022, while total expenditures totaled $78 billion.

The Saudi Central Bank’s recent data pointed out that deposits of government and government-supported institutions rose by $9.8 billion in June to $181.9 billion.

The figure rose further in July to over $186 billion.

These deposits were the highest amount recorded since September 2019.

“The key indicator is the trajectory for more US interest rate rises, especially in the medium-term,” London-based consultant and former professor Mohamed Ramady told Arab News while explaining the outlook for Saudi holding of US Treasuries.

He added: “The US government could try and borrow more in the short- and medium-term at albeit higher interest rates, rather than assume higher priced long-term debt.”

The largest foreign owner of US debt is China, even though its US Treasuries holdings fell for the seventh month in a row in June.

China’s US government debt fell to $967.8 billion in June while remaining on top of the list of US debt owners.

“The role of Saudi Arabia in the US Treasuries market appears to be one of counterbalance and stability,” according to a release by the Euro-Gulf Information Center.

“Buying chunks of US debt means reducing the power of China and possibly the influence of other hostile actors,” continued the release.