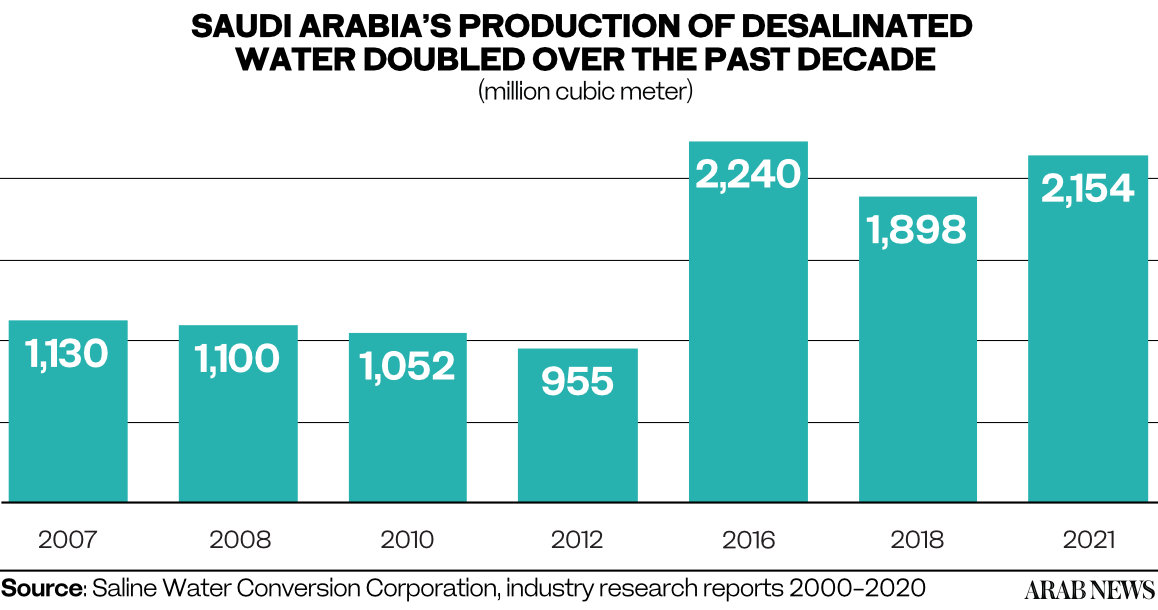

RIYADH: Water desalination in Saudi Arabia has doubled over the past decade to reach 2.2 billion cubic meters in 2021, up from 1.1 billion cubic meters per year in 2010, thanks to a major overhaul of some existing plants and the introduction of new technologies.

For instance, Jubail 2, one of the Kingdom’s largest water desalination plants that serve Riyadh and Jubail, increased its annual production capacity by roughly 30 percent to 380 million cubic meters in 2021 from under 300 million cubic meters in 2014.

However, to meet the growing domestic demand for water, the desalination industry in the Kingdom is all poised to consider making another breakthrough.

A brief history outlined below shows water desalination plays a vital role in the Kingdom’s economy.

The process of water desalination in the Kingdom dates back to the early 1900s, when Jeddah became the first city to install two privately-owned distillation condensers to meet the city’s rising demand.

Yanbu and Jazan, the other coastal cities of the Kingdom, followed the same approach of developing their private seawater distillation condensers until the entire industry was nationalized and regulated under the Ministry of Environment, Water and Agriculture in 1965.

As the method started gaining popularity in the region, the Saline Water Conversion Corp. was founded as an independent government entity in 1974 to promote and regulate water distillation operations in the Kingdom.

Although it started as costly and inefficient, it was crucial for the Kingdom’s increasing population needs.

Further, its geographic location puts it at a disadvantage in accessing different types of water resources like, for example, rainfall.

Therefore, its options were limited to shallow and deep groundwater and desalinated water.

The rise in population to 33.5 million in 2018 from just 25.2 million in 2007 brought about a 70 percent increase in potable water demand, according to a research report published in the Journal of Water Process Engineering back in 2019.

The report added that it would be impossible for groundwater to last 50 years at this consumption rate, highlighting the option of water desalination, which has been strategically considered and implemented by the government.

In 2010, SWCC produced some 1.1 billion cubic meters of water at its 30 desalination plants located on the east and west coasts of the Kingdom, which met approximately 50 percent of the domestic water demand in the Kingdom.

The company further improved its capacity to 5.2 million cubic meters per day of water or 1.9 billion cubic meters a year, in 2018.

In 2021, SWCC produced 2.2 billion cubic meters of water and operated 32 production plants. As a byproduct of water distillation, it generated 47 million megawatts per hour of electricity.

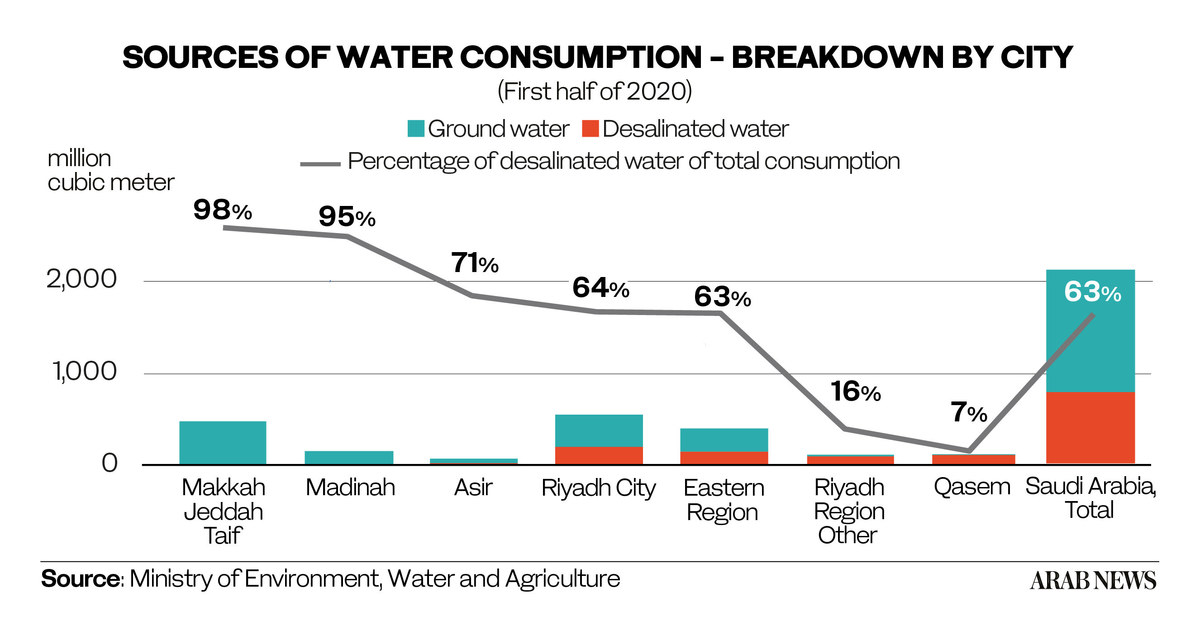

In major cities, the desalinated share in total water consumption is pretty high, especially in the cities like Makkah, Jeddah and Taif where almost all of their drinking water comes from nearby desalination plants.

The share for Riyadh and the Kingdom stood at 63-64 percent in 2020.

Thermal distillation and reverse osmosis are the two most popular methods used to convert seawater into potable water.

The former uses heat to vaporize seawater, separating the salt from the water, and then the vaporized gas is cooled down into the water through condensation.

The latter passes seawater through a semipermeable membrane that separates salt from water, wasting less energy in the process.

Moreover, SWCC has partaken in two renewable energy projects being developed in alignment with the Vision 2030 blueprint.

The future of water desalination in Saudi Arabia looks promising and challenging simultaneously. Therefore, SWCC aims to take on more renewable sources for its water desalination projects, to reduce the conversion cost, thereby improving conversion efficiency and cutting carbon emissions simultaneously.

Assuming the current population growth rates hold through the next 10-15 years, the Kingdom may require a desalinated water capacity of up to 4.5 billion cubic meters per year in 2040, a profound research report released in 2014 suggested. In effect, the output will be required to double again from the 2021 production level.

No matter how efficient or productive methods of water desalination get, at this rate, Saudi Arabia will have to resort to methods of decreasing demand, whether it is through awareness campaigns or imposing taxes on high water usage.