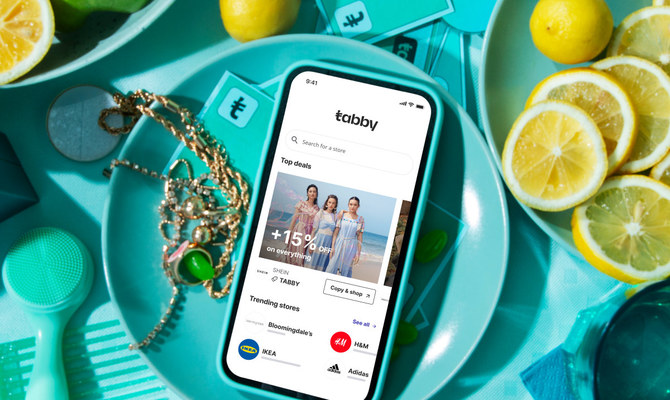

CAIRO: Tabby, the UAE-based buy now, pay later fintech company, will soon be widening its scope in Saudi Arabia with the introduction of its virtual card in the Kingdom.

The Tabby virtual card is a Visa card that allows shoppers to split their purchases into four payments at select in-store locations.

Fresh off securing $150 million in debt financing in early August, the company wants to provide easy payment options in the Arab world’s largest economy, where less than 20 percent of the population has a credit card, said a senior company official.

“Saudi Arabia has a penetration rate of around 0.3 credit cards per person, so there is a real need for easy consumer credit, especially for day-to-day payments,” Abdulaziz Saja, general manager of Tabby Saudi Arabia, told Arab News exclusively.

Tabby is aiming to empower in-store users using the virtual card in addition to a huge focus of the company’s operations going into providing payment solutions for all users, not just online.

Abdulaziz Saja, general manager of Tabby Saudi Arabia

Users can activate the card using the Tabby app, add it to their preferred digital wallets and tap the payment terminal at checkout to divide their payments into installments.

“After the successful launch of the Tabby Virtual Card in UAE, we want to bring it to Saudi Arabia,” said Saja.

He added that Tabby is aiming to empower in-store users using the virtual card in addition to a huge focus of the company’s operations going into providing payment solutions for all users, not just online.

The company will also use its recently raised funding to sustain its balance sheet as BNPL requires very high capital.

“Some of that funding will also invest in young Saudi talent. Because as we grow the company, we’ll also be looking into hiring locally for product managers and software engineers,” Saja added.

Tabby currently operates in the UAE, Saudi Arabia, Kuwait and Egypt, with 85 percent of its sales volume happening in the Kingdom, Saja stated.

He attributed the company’s growth in the Kingdom primarily to the rise in the adoption of e-commerce during the COVID-19 pandemic.

“An additional factor is the effect of a 15 percent value-added tax that has also put a bit of stress on customer disposable incomes here,” he added.

Saja also said that the Saudi market has a huge population compared to the UAE, in addition to the booming last-mile delivery services in the Kingdom.

The Saudi Central Bank’s Sandbox program also nurtured the company, closely monitoring its challenges and performance.

“We’ve also given back to the community by mentoring young companies participating in the Saudi fintech accelerated program,” Saja said.

“Our main stakeholder in Saudi Arabia is the central bank, but we’ve also engaged with several other entities that have helped us either source talent or connect with investors,” he added.

Tabby has raised $275 million since its launch in the UAE in late 2019. Its latest $150 million round was from US-based venture capital firms Atalaya Capital Management and Partners for Growth.

Tabby currently has over 4,000 global brands and small businesses, with over 2 million active users on its platform.

The company also experienced 10 times growth in revenue, eight times in active users, and three times in active retailer partners in just the first half of 2022 compared to the same period last year.