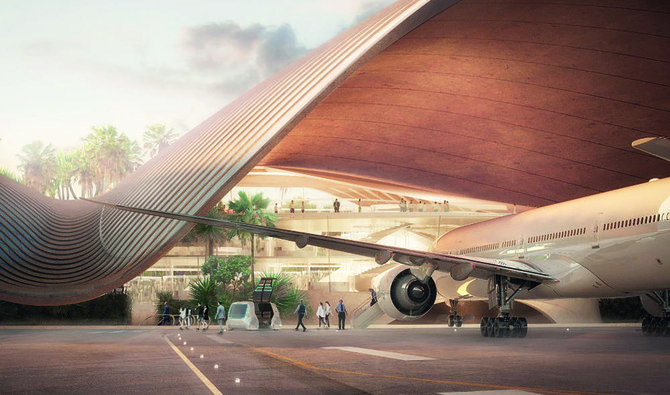

Flight testing held on July 20-21 at the Red Sea International Airport, which is under construction at The Red Sea Project, marks the beginning of a new era of tourism and travel in the Kingdom.

With over five hours’ drive from the nearest existing major international airports of Jeddah or Madinah and over two hours from the nearest regional international airports of Yanbu or AlUla, RSI airport will bring domestic and international guests to the doorstep of this new global tourism destination.

Deliberately located some 20km from the sensitive coastal lagoons and islands, home to precious mangroves and reefs, the airport is tucked away on an open plain between the coastal dunes and the mountains.

The first phase of this Saudi Vision 2030 project will welcome the first guests early next year, and the airport’s developers are determined to make the travelers’ experience unique.

TRSP in itself is a unique regenerative development with the vast majority of land and marine area remaining untouched and the carefully selected development intervention set to achieve an environmental net-positive benefit by 2040. In addition, the supporting infrastructure, such as the new airport, has been sensitively approached to stay true to the vision and values of the project's developer The Red Sea Development Co.

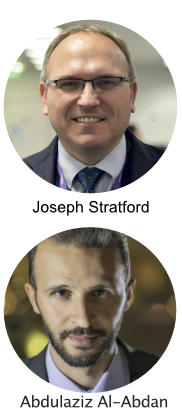

TRSDC Airport Project Executive Director Joseph Stratford, a civil and environmental engineer who has spent most of his career in airport infrastructure delivery in the Middle East, is spearheading the project.

He left for his homeland for five years to apply his international airport delivery experience to the expansion of the London Heathrow Airport. He has since returned to the Kingdom to lead on next-generation aviation delivery.

“Red Sea International Airport is one of the smaller airports I have led, but without doubt the most iconic, progressive and special. The architectural concept, mode of operation and guest experience are truly unique,” Stratford told Arab News in an exclusive interview.

Red Sea International Airport is the most iconic, progressive and special. The architectural concept, mode of operation and guest experience are truly unique.

Joseph Stratford

Unmatched operating procedures

Unlike current standards, the entire operational plans for travel processes at RSI ensure top-notch customer services and create an environment that offers a seamless, unmatched and hassle-free experience.

For instance, the aviation team is working toward implementing a unique concept of operations for baggage handling. Passengers at RSI will not have to worry about stopping by a baggage claim area to pick up their bags.

“Instead, the passengers will be escorted to the welcome center in the arrival area. The bags will be processed in a dedicated facility through a state-of-the-art baggage handling system that can track each piece until it is delivered to the owner at their selected destination,” said Abdulaziz Al-Abdan, aviation operations director, RSI airport.

Additionally, the airport will apply discreet and non-intrusive security arrangements and procedures, enhancing the overall customer experience without infringing any regulatory requirements governing such operations.

Furthermore, RSI will be the first and only airport in the Middle East and North Africa that serves amphibious seaplanes and is linked to water aerodromes.

The airport features a dedicated runway for seaplanes and small general aviation aircraft operations, allowing direct air access to the Red Sea destinations.

“Our aviation team worked closely with the General Authority of Civil Aviation to establish the regulatory framework for water aerodromes, seaplanes and water runways,” said Al-Abdan.

The regulatory framework resulted in the introduction and enforcement of a new set of safety regulations that govern the establishment and operations of water aerodromes GACA Regulations Part 137, as well as agreeing on the certifications for Red Sea Air Services Co. to operate seaplanes and water runways.

Ammar Ghaith, associate airport infrastructure director, RSI, said the airport will be the

first and last impression of all their distinguished guests.

Magnificent by design

What makes RSI different is it is a high-end tourist destination airport and not a regular civil airport. The scope of its operations includes mobility and hospitality services that begin when guests arrive at the airport until they finally check in to their hotels.

“The airport is an extension to the exclusive resorts at the Red Sea and will be the first and last impression of all our distinguished guests,” said Ammar Ghaith, associate airport infrastructure director, RSI.

It has a unique design with efficient space planning that allows for fewer steps to complete the arrival or departure process, besides minimum human intervention and shortest processing times.

The airport has partnered with key stakeholders to facilitate its flight procedures and airspace networks.

The stakeholders include GACA, Saudi Air Navigation Services, airport aviation consultant United ATS, FlyNas, FlyAdeal, TRSDC Operations, Red Sea Air Services Co., airside contractor Nesma Almabani Joint Venture, water runway consultant Jacobs and airport operator DAA International.

Mobility like never before

Ground and sea-based local mobility to resorts will be by more-sustainable electric vehicles chosen over petrol or diesel engine vehicles.

In the case of air taxis, although initially planned to be by conventional amphibious seaplanes, the airport has a dedicated secondary runway, which will be an early adopter of hydrogen-powered seaplane variants and eVTOL and eSTOL aircraft technology.

While eVTOL is the acronym for electric vertical takeoff and landing technology, eSTOL is electric short takeoff and landing type aircraft.

This approach will enable guests and their baggage to travel quickly, quietly and sustainably to and from resorts with style and pure spectacle.

The air taxi terminal is scheduled to open next year, initially to be used for a combination of air taxi, domestic and general aviation for guest access to the first tranche of hotels. The iconic main terminal building will provide international commercial aviation capability and capacity for successive hotel delivery and operation tranches.

The flight testing initiated recently is a necessary step for all new airports where a purpose-built aircraft laden with specialist equipment maneuvers new runways to test the visual and instrument aids and systems. In addition, it enables pilots to conduct safe and efficient takeoffs and landings in diverse weather and other operating conditions.

Shoring up responsibly

“There has been a quantum leap in recent years in sensitive delivery in this region, in terms of how we approach, plan, deliver and operate facilities like these,” Stratford explained.

“This is, across the board, from the culture of caring for the workforce, environmental protection, processes, quality of product, respect of time and cost. The wider team and I are passionate about ensuring that projects like this are delivered responsibly,” he added.

Stratford earlier lived in TRSP Construction Village Housing accommodation alongside many of the 1,800 contractors’ staff for the airport. He relocated this year to the Coastal Village Residences, where the TRDSC offices, management hotels, apartments, villas and townhouses have accepted staff, suppliers and visitors in the final construction stages of TRSP ahead of the phased opening of the resorts to tourists next year.

“Striving for high standards has been key to the timeliness and quality of delivery of the airport facilities so far,” Stratford said. “Indeed, the airport project has passed nine million safe man-hours worked without a lost time injury.”

TRSDC’s approach aligns with the national and industry leadership mandate that aviation development is a critical enabler of economic growth and should focus on environmental and sustainability implications and challenges.

Stratford added: “Besides providing iconic and progressive facilities in form and function, we have considered sustainability and the environment from the outset.

“For the airfield construction, the contractors have met the highest standards and expectations that I have seen in my career — impact assessments, permitting, monitoring and reporting are taken seriously. The team’s culture, pride, passion, professionalism and care play their part.”

Construction is underway on the passenger terminal facilities, with building structural and envelope packages awarded and commenced. TRSP will be entirely off-grid, including the airport, powered by a solar farm and the world’s largest battery storage facility.

Going high on ratings

Additionally, the airport passenger terminal facilities have followed industry-leading LEED or Leadership in Energy and Environmental Design, the rating system used by the US Green Building Council to measure a building’s sustainability and resource efficiency.

“We have aimed high for a Platinum Rating,” emphasized Stratford. “The detailed design-stage preliminary rating suggests we are on track for a Gold Rating or better, to be confirmed through construction and operation.”

He added: “We have been driven toward requirements, selection of materials, methods, equipment, energy and resources reduction and reuse.”

In theory, some 15 percent of the aviation industry’s carbon challenge is associated with the ground-based airport infrastructure, and the other 85 percent is associated with jet aircraft and flight.

“We’re mindful of our part of the aviation sustainability and carbon challenge, and what we can do with practices and technology of the day, but also looking to what we can do to facilitate emergent technologies and practices,” Stratford informed.

For example, RSI is planning infrastructure for sustainable aviation fuels, ground power and preconditioned air, use of resources and energy-efficient operational practices.