No major decisions were reached at the end of a meeting of ministers from the Organization of the Petroleum Exporting Countries on Wednesday, according to Reuters.

The news agency reported unnamed delegates as saying that administrative issues were discussed during the first of two-days of meetings.

On Thursday, ministers from the joint ministerial monitoring committee of OPEC+ — which is OPEC and its allies including Russia, will begin discussions from 1100 GMT and then hold a full online OPEC+ meeting.

Sources are saying a big policy change is unlikely this month, according Reuters.

At its last gathering in early June, OPEC+ decided to raise output each month by 648,000 barrels per day (bpd) in July and August, compared with a previous plan to add 432,000 bpd over three months.

Washington welcomed the producers’ decision in June that followed months of pressure from the West on OPEC+ to raise production to help lower oil prices.

International prices hit their highest since the record levels of 2008 after the West imposed sanctions on Russia over its invasion of Ukraine begun on Feb. 24, which Moscow calls “a special military operation.”

They have eased since this year’s March peaks, but rose for a fourth day on Wednesday to approach $120 a barrel because of tight supply and concern OPEC has little ability to raise output.

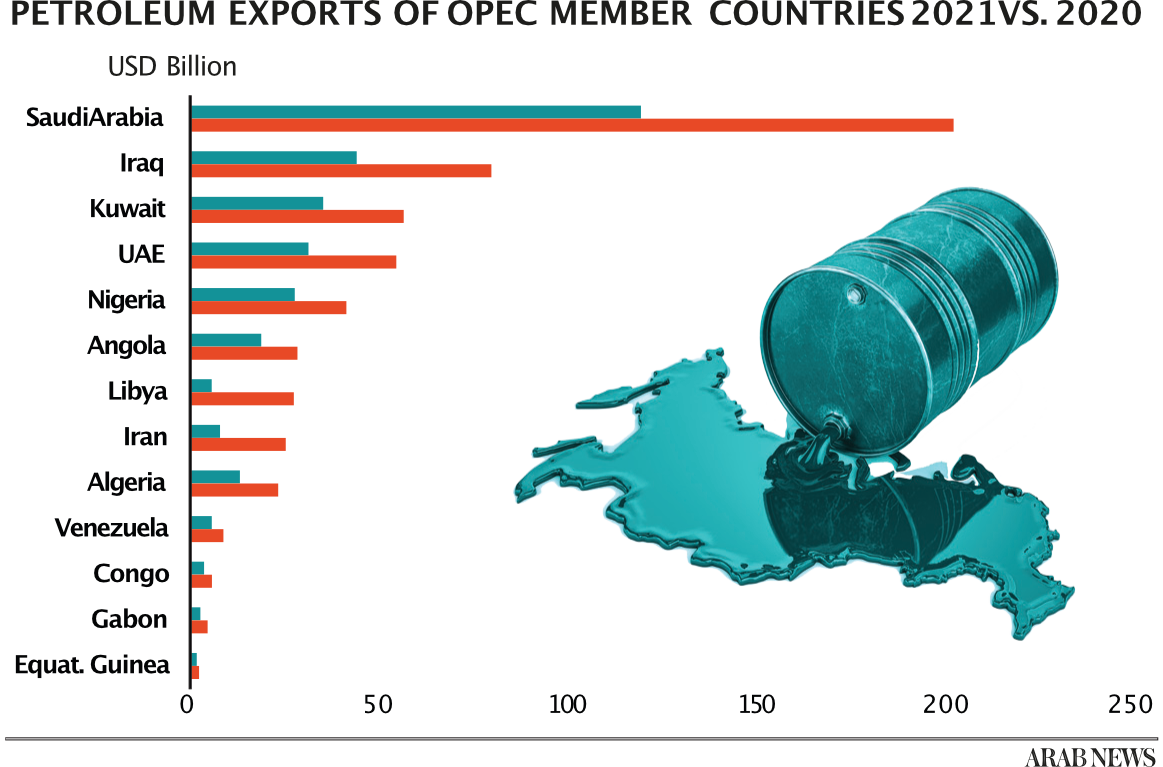

French President Emmanuel Macron told US President Joe Biden this week he had been told that Saudi Arabia and the United Arab Emirates, considered the only OPEC members with significant spare capacity, can barely increase oil production.

Biden will travel to the Middle East, including Saudi Arabia next month, and is widely expected to press Riyadh to raise production.

At least five OPEC+ delegates said this week’s meeting will focus on confirming August output policies and would not discuss September.

Two other delegates said the issue of production after August could emerge but it was unclear what steps could be taken.

Oil prices

Oil prices gained for a fourth straight session on Wednesday with tight supply worries offset- ting concerns about a weaker global economy.

Brent crude futures for August were up 87 cents to $118.85 a barrel by 1132 GMT. The August contract will expire on Thursday and the more-active September contract was at $114.79, up 99 cents, or 0.87 percent.

US West Texas Intermediate crude futures were up $1.20, or 1.1 percent, to $112.96 a barrel.

Both contracts rose more than 2 percent on Tuesday as concerns over tight supplies due to Western sanctions on Russia outweighed fears that demand may slow in a potential future recession.

With input from Reuters