RIYADH: Bitcoin, the leading cryptocurrency internationally, traded lower on Wednesday, down 4.42 percent to $38,816 as of 10.45 a.m. Riyadh time.

Ether, the second most traded cryptocurrency, was priced at $2,879, down 4.26 percent, according to data from Coindesk.

Mining report shows Bitcoin's electricity consumption decreased by 25% in Q1 2022

Mining for bitcoin is energy-intensive (File/Shutterstock)

The bitcoin mining industry continues to improve its sustainable energy use and technological efficiency, according to the latest Bitcoin Mining Council, or BMC, report.

At the end of May last year, Elon Musk, founder and CEO of SpaceX and Tesla, convinced Bitcoin industry leaders to form a BMC and in mid-July, it launched its public services and website.

The BMC survey for the first quarter of 2022 presents three metrics which include: “electricity consumption, technological efficiency, and sustainable power mix.”

BMC researchers were able to survey nearly 50 percent of the network's hashpower on March 31, 2022.

The survey indicated that 64.6 percent of all respondents benefit from electricity with a sustainable power mix, Bitcoin.com reported.

“Based on this data it is estimated that the global bitcoin mining industry’s sustainable electricity mix is now 58.4 percent or had increased approximately 59 percent year-on-year, from the first quarter of 2021 to the first quarter of 2022, making it one of the most sustainable industries globally,” the BMC said in the report.

Michael Saylor, CEO of Microstrategy — an American company that provides business intelligence, mobile software and cloud-based services — also made a statement in BMC's fourth quarterly report.

“In the first quarter of 2022, the hashrate and related security of the Bitcoin network improved by 23 percent year-on-year, while energy usage decreased 25 percent,” Saylor said.

He added: “We observed a 63 percent year-on-year increase in efficiency due to advances in semiconductor technology, the rapid expansion of North American mining, the China Exodus, and the worldwide adoption of sustainable energy and modern bitcoin mining techniques.”

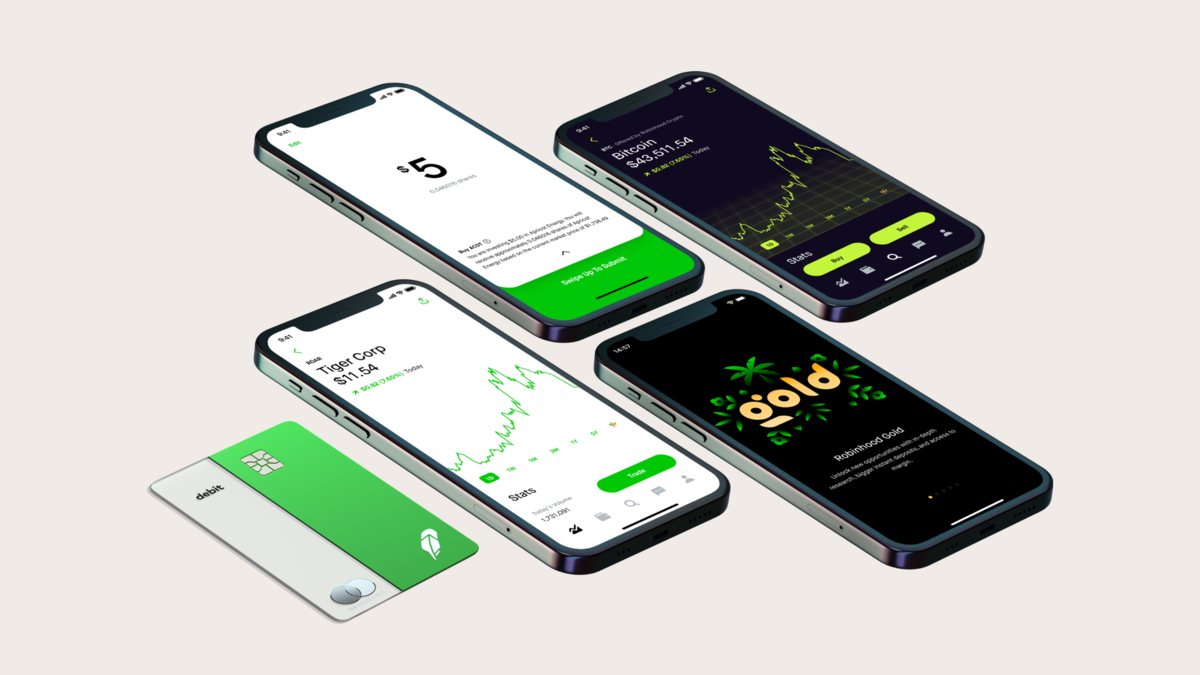

Robinhood to cut its workforce

(Robinhood Markets)

Retail trading platform Robinhood Markets Inc., said on Tuesday it is laying off about 9 percent of its full-time employees, sending its shares down 5 percent in extended trade.

The company, which is reporting its quarterly results later this week, said the rapid headcount growth has led to some duplicate roles and job functions.

As of Dec. 31, the company’s total headcount was 3,800.

Robinhood’s easy-to-use interface has made it a hit among young investors trading from home on cryptocurrencies and stocks such as GameStop Corp. during the COVID-19 pandemic.

“We will continue to accelerate our product momentum through 2022 and will introduce key new products across brokerage, crypto and spending/saving,” CEO Vlad Tenev wrote in a blog post.

Revolut eyes expansion into crypto wallets, mortgages

(Revolut)

Digital banking platform Revolut is working on expanding into decentralized cryptocurrency wallets and is also looking at the mortgage sector, its CEO said, as the London-based company pushes ahead with its strategy to become a so-called “super-app.”

Revolut, which currently offers payments services, crypto trading, savings accounts and stock trading, is focused in the short-term on expanding its remittance offerings and launching a buy now, pay later product.

But the financial technology company has more work to do to become a one-stop-shop for financial services, said CEO Nik Storonsky.

“For example… decentralized wallets, and enabling deposits, withdrawals of crypto [and] staking, lending — that’s another piece that we’re missing and we’re working on,” he told Reuters.

He added that it’s also important for the company to consider expanding into mortgages since home loans “are quite an important part of consumer financial life.”

Fidelity to allow retirement savings allocation to Bitcoin in 401(k) accounts

Fidelity Investments said on Tuesday it will allow individuals to allocate part of their retirement savings in Bitcoin through their 401(k) investment plans, becoming the first major retirement plan provider to do so.

The family-controlled asset manager said MicroStrategy Inc., a major Bitcoin corporate backer, will be the first employer to use the new product, which will be made available to other employers by the middle of the year.

Through the new offering, employees will be able to invest in Bitcoin through a Digital Assets Account within the core lineup of their 401(k) plans, Fidelity said.

Fidelity also said that Newfront, a retirement consulting services provider, has indicated that the DAA will help address a growing need among their client base.

Plan sponsors will be able to decide on employee contributions in the DAA and set limits on exchanging such contributions to Bitcoin, Fidelity said, adding that additional updates on the new offering will be made available in the coming months.

(With inputs from Reuters)