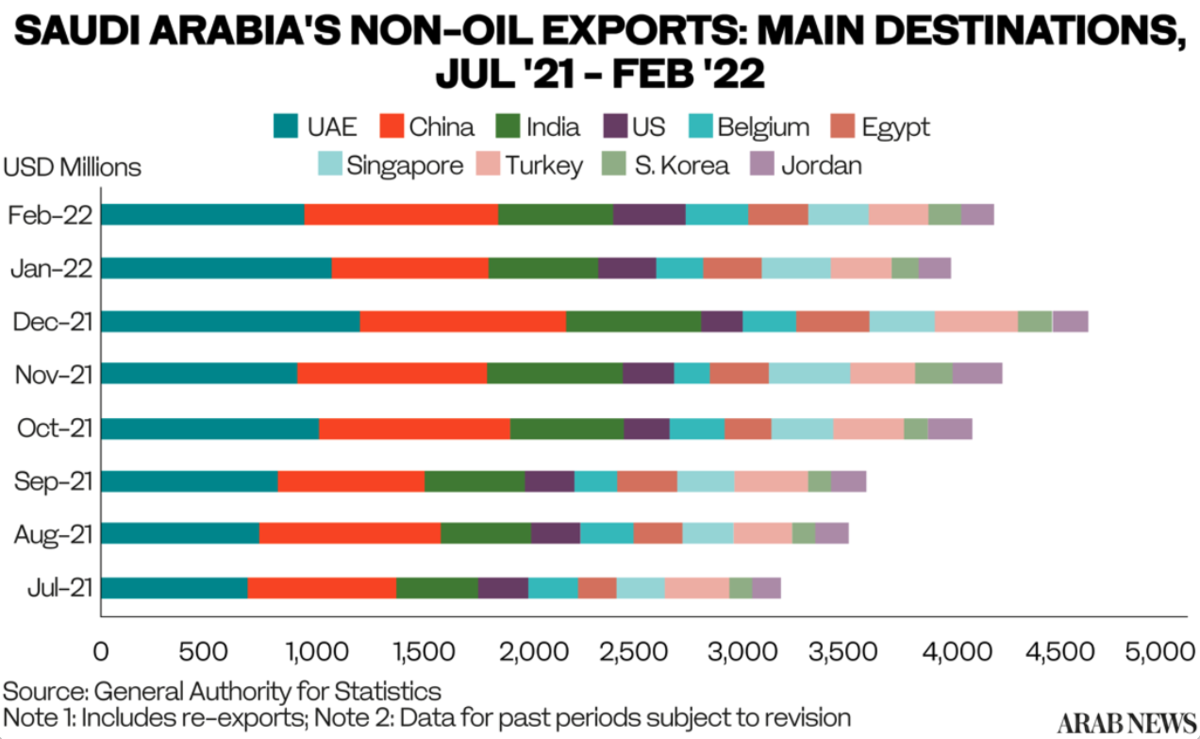

RIYADH: The UAE’s share of Saudi non-oil exports dropped to 14.8 percent in February, down from 17 percent the previous month, according to initial data by the General Authority for Statistics.

Despite the fall, it is still the leading destination for the Kingdom’s non-oil exports.

The drop is partly due to a decline in transport equipment exports.

The equipment, which made up 30.7 percent of UAE’s share of exports in February, fell to SR1.11 billion ($0.3 billion), from 1.42 billion in January.

Machinery and electrical equipment fell to SR687 million, from SR752 million respectively.

The Kingdom’s total exports of plastic and rubber products also fell by SR307.7 million this month, a quarter of which is attributed to the UAE.

Chemical product exports increased by SR1.212 billion in February. The country’s largest export category amounted to SR8.73 billion, making up 35.7 percent of total non-oil exports.

China, coming in second, attained 13.9 percent of Saudi exports, with the chemical industry and the plastics and rubber industry leading the way, at 54.6 percent and 31.1 percent of Chinese non-oil exports, respectively.

The subsequent non-oil exporters in February are India, USA and Belgium, making up 8.6 percent, 5.0 percent and 4.6 percent of the total , which all saw a rise in chemical product exports this month compared to January.