RIYADH: Last April, top strategy and consulting firm Accenture estimated that the global gaming industry exceeded $300 billion, much more than the combined market of music and movies. The industry added 500 million new gamers between 2019 and 2021. And that was just the beginning.

Driven by the surge in mobile gaming and the urge for social interaction during the pandemic, the industry has engulfed scores of startups and multinational corporations into its fold. Besides the demandside traction, the potent technology mix of blockchain and non-fungible tokens, or NFTs, has also allowed game developers to leverage these tools and create virtual worlds.

In fact, some of the developers are smiling all the way to the bank by effortlessly tapping into unexplored cultural niches. One of them is Jordan-based mobile game publisher Tamatem, which smartly publishes games targeted at Arab users and builds brilliant narratives around Arab culture.

“Arabic is the fourth most spoken language globally, yet only one percent of the overall content is in Arabic. That’s a huge gap to fill, especially in the Middle East and North Africa gaming industry,” Hussam Hammo, founder and CEO of Tamatem, told Arab News.

Flavored with local tastes

A few of his earliest games include the Awad the Delivery King, a mobile game featuring a food delivery guy racing around the pothole-riddled streets of Amman. Despite being a cartoon character based in Jordan, the game was the No. 1 app in the app stores of Saudi Arabia and Jordan, reported US-based online publishing platform Medium.

Its current chartbusters include VIP Baloot and Clash of Empires.

Launched in 2013, the game developer collaborates with international players and converts their content into Arabic. For instance, another sought-after game, Escape the Past, was a partnership with French studio 3DDuo, where Tamatem customized the content to suit the local tastes and culture, the Medium reported.

Such has been the buzz around Tamatem that, according to a company press release issued last December, it raised $11 million in Series B funding led by PUBG developer Krafton. But reaching this crucial milestone wasn’t easy. Set up in 2009, Hammo’s first gaming venture, Wizard, shut down because the industry in the region was in its infancy.

“It resulted in a negative perception among the investors’ community. It also put a huge question mark on my leadership and in the industry,” recollected Hammo. He barely had a bank balance of $200 when he planned to launch Tamatem. In the nick of time, he found 500 Startups, a Silicon Valley-based investor that infused $50,000 in exchange for a 5 percent share, valuing the gaming company at $1 million in 2013. The rest, as they say, is history.

“Tamatem currently ranks as the No. 1 game publisher in the MENA region in user engagement. It has one million active users across its games, three million users playing monthly, and 150 million downloads,” said Hammo, while adding that he is constantly looking for ideas to sustain the numbers.

Last February, Tamatem roped in Saudi poet and social media influencer Ziyad bin Nahit to launch the Baloot League, an extension of its popular app-based card game VIP Baloot that led to over 700 people participating in the fete.

Harnessing the game plan

The hunger to compete and excel is palpable across the region. According to Saudi Social Development Bank, the Kingdom’s video games market has a value of $1 billion and expects to grow to $2.5 billion by 2030. Boston Consulting Group’s outlook is more optimistic. It projects that Saudi Arabia’s revenue from gaming will reach $6.7 billion by 2030.

Interestingly, much of this growth is being led shoulder to shoulder by a public-private partnership. In January this year, Amazon Saudi Arabia and the UAE announced a collaboration with MENATech, a GGTech Entertainment Group company, to launch Amazon University Esports, the first educational esports league for each country. In the same month, Riyadh-based Savvy Gaming Group, backed by the Saudi Public Investment Fund, or PIF, purchased ESL, formerly known as Electronic Sports League, for $1 billion.

In November 2020, the Mohammed bin Salman Foundation, or Misk, announced a strategic investment of around SR813 million ($217 million) to acquire a 33.3 percent stake in Japanese gaming Company SNK Corporation. Two months ago, the foundation increased its share to 96 percent, reported Verge, a technology news platform.

The industry is already buzzing with activity. Last February, the PIF disclosed stakes of more than 5 percent in two Japan-listed gaming firms, namely Capcom Co. and Nexon Co., with combined holdings worth around $1.2 billion, Bloomberg reported.

The public fund also purchased a 5.02 percent stake of $883 million in Nexon, the company behind role-playing games like MapleStory and Dungeon&Fighter, Bloomberg added.

According to US-Saudi Business Council, the Ministry of Communications and Information Technology, or MCIT, is also adding fillip to the private-public partnerships and infrastructure investments. The ministry has been deeply involved in developing the Kingdom’s telecommunications and IT infrastructure, including broadband, fiber optics, and 5G.

“With MCIT’s assistance, US-based Activision Blizzard announced a partnership with Saudi Telecom Company to host the regional servers for one of their most popular titles, Call of Duty, in Saudi Arabia,” said the industry body in its recent paper on Gaming and E-sports in Saudi Arabia.

Going nifty with NFTs

What’s more? Many gaming publishers in Saudi Arabia are boarding the NFT bandwagon. What does that mean? NFT is a certificate of ownership of a digital asset that’s scarce. You own a certified token for it on a digital ledger or blockchain. Simply put, you get a link that proves your connection to that asset.

For instance, a game developer like Activision’s Call of Duty could introduce its popular emblems as NFTs, which could be used as your profile picture for your social media accounts. The company could sell weapon camouflage, operator outfits, and other in-game paraphernalia, a massive draw in Call of Duty fandom.

Game developers in Saudi Arabia want to capitalize on this fandom. Tamatem’s Hammo will soon be announcing its NFT project, and so will others, including Riyadh-based UMX Studio.

“In the future, players can make revenues based on reselling those items using the blockchain,” said Ali Al-Harbi, founder and CEO of UMX Studio, a game developer who has already started auctions at his games where players can trade stuff. It is a precursor to the outbreak of new opportunities on the blockchain.

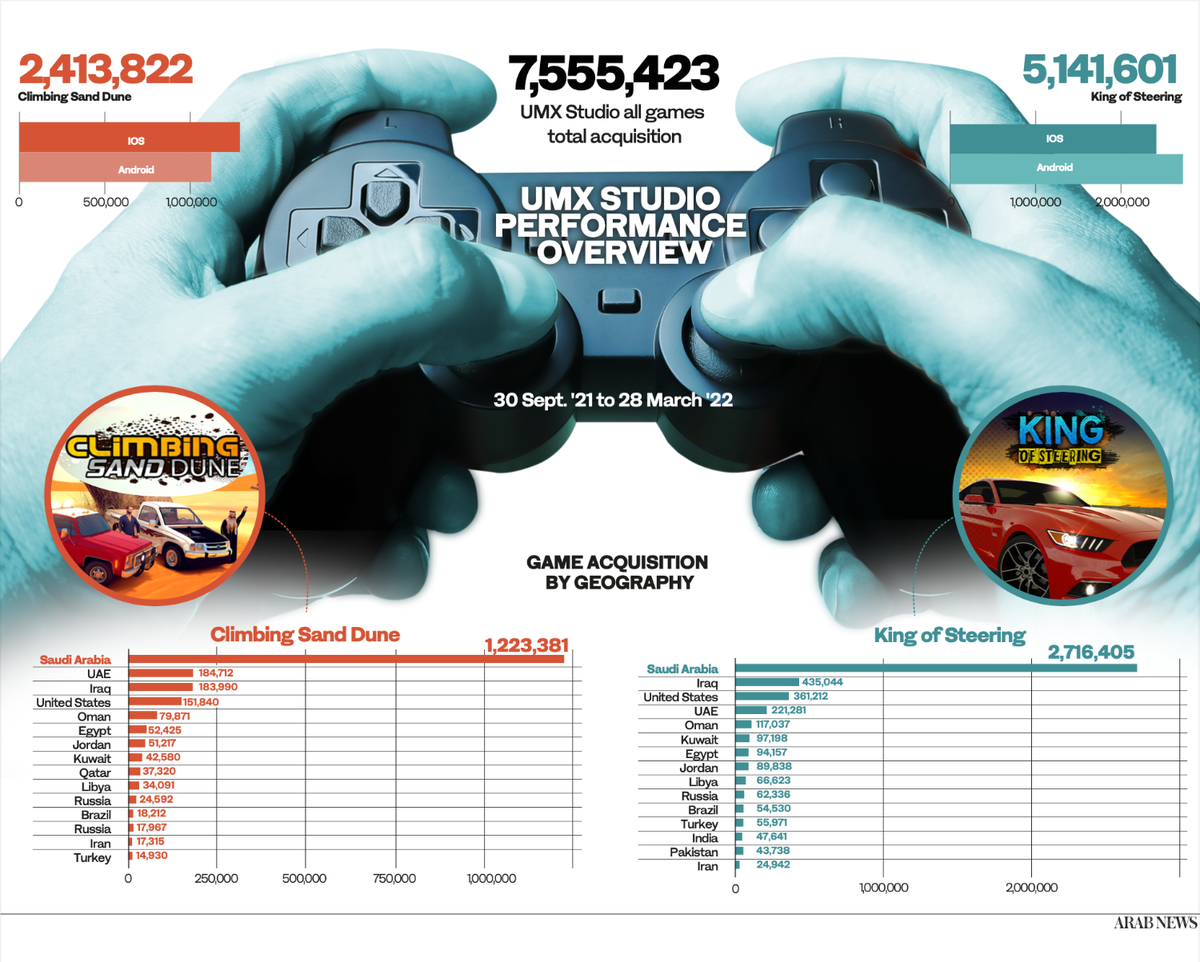

Publishers of the popular drag-race game Climbing Sand Dune and police-chase game King of The Steering, the studio has 200,000 daily active users and has clocked 50 million downloads. Starting in 2014 with around $4,000 in the kitty, Al-Harbi made headway pretty much on his terms. His first game fetched him $200,000 in the first few years of its inception.

Al-Harbi has never felt the need for external investors or funding. He makes his money from in-app services, online subscriptions and advertisements. His mantra of success: He listens to his players. “We continue to grow to the next level only because we listen to our audience. We will soon be releasing a lighter version of the game on their demand.”

The opportunity for gaming developers to grow is endless, thanks to the toys at their disposal and the state support. But what will make the Saudi gaming industry tower over the rest in the room is when it listens to the customer and builds a unified narrative celebrating the Arab culture. After all, success in the gaming business isn’t about making money; it’s about building visibility and soft power.